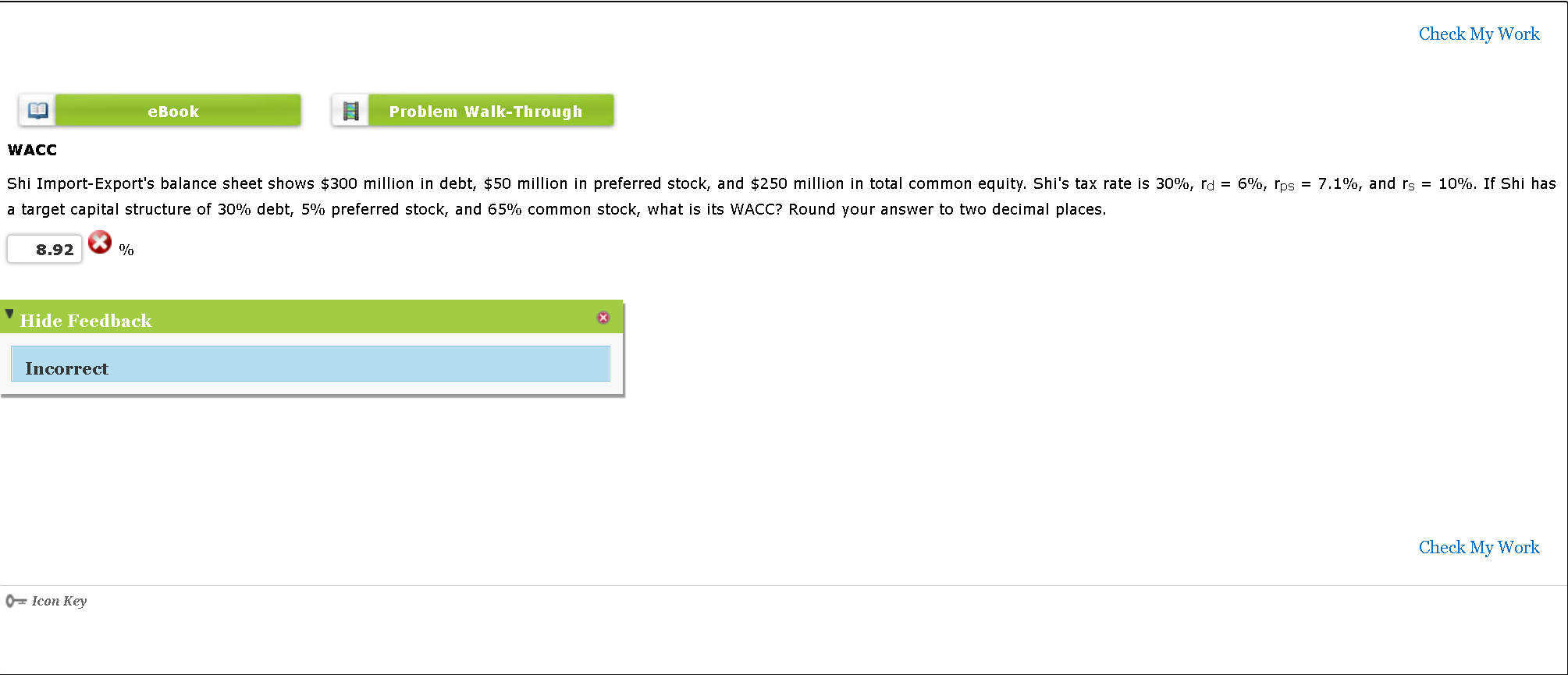

Question: Check My Work E eBook Problem Walk-Through WACC Shi Import-Export's balance sheet shows $300 million in debt, $50 million in preferred stock, and $250 million

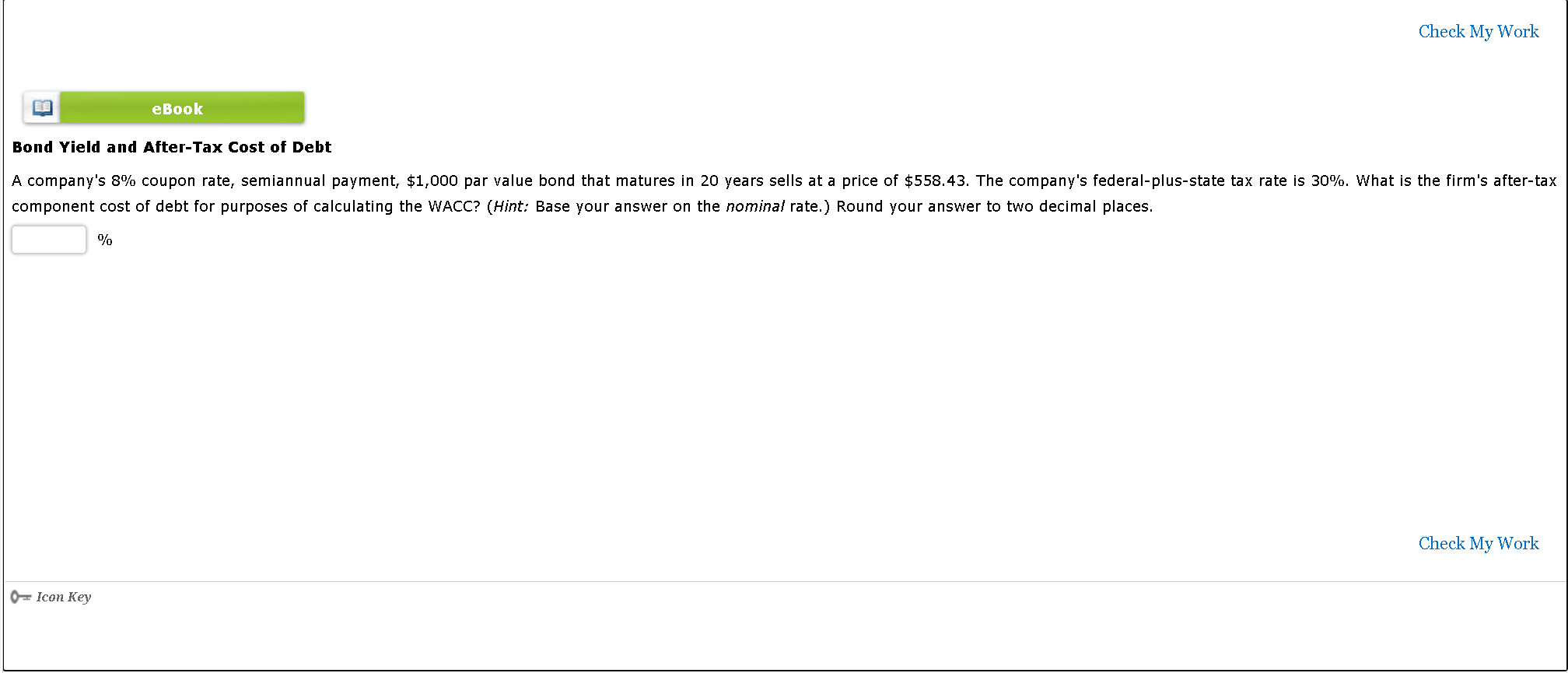

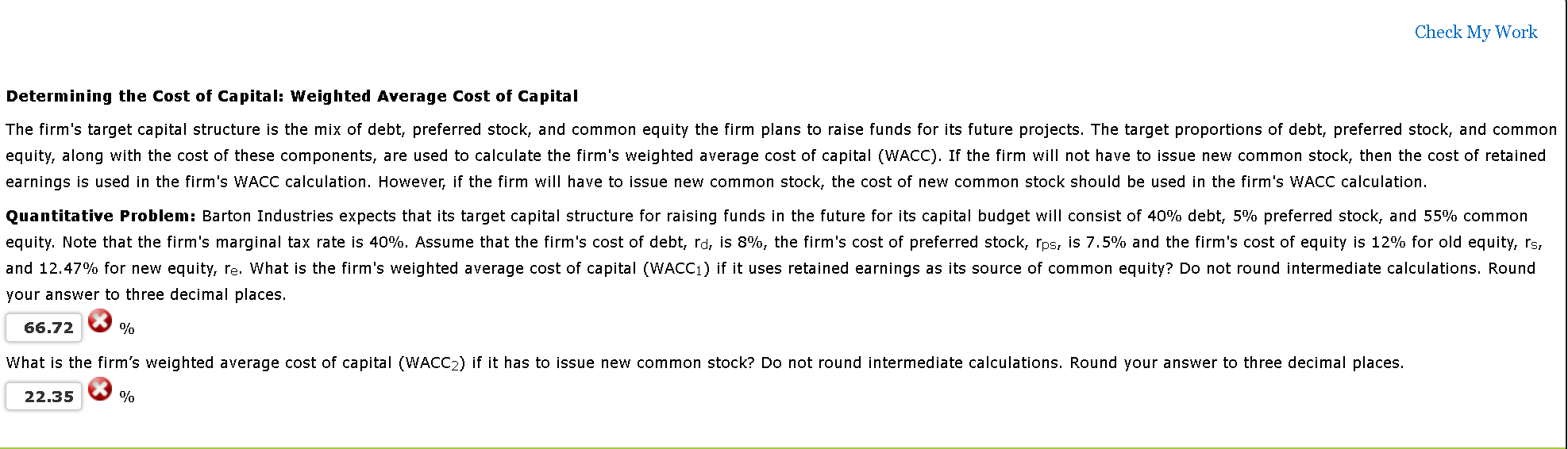

Check My Work E eBook Problem Walk-Through WACC Shi Import-Export's balance sheet shows $300 million in debt, $50 million in preferred stock, and $250 million in total common equity. Shi's tax rate is 30%, rd = 6%, lps = 7.1%, and rs = 10%. If Shi has a target capital structure of 30% debt, 5% preferred stock, and 65% common stock, what is its WACC? Round your answer to two decimal places. 8.92 % Hide Feedback Incorrect Check My Work 0=Icon Key Check My Work B eBook Bond Yield and After-Tax Cost of Debt A company's 8% coupon rate, semiannual payment, $1,000 par value bond that matures in 20 years sells at a price of $558.43. The company's federal-plus-state tax rate is 30%. What is the firm's after-tax component cost of debt for purposes of calculating the WACC? (Hint: Base your answer on the nominal rate.) Round your answer to two decimal places. % Check My Work 0Icon Key Check My Work Determining the Cost of Capital: Weighted Average Cost of Capital The firm's target capital structure is the mix of debt, preferred stock, and common equity the firm plans to raise funds for its future projects. The target proportions of debt, preferred stock, and common equity, along with the cost of these components, are used to calculate the firm's weighted average cost of capital (WACC). If the firm will not have to issue new common stock, then the cost of retained earnings is used in the firm's WACC calculation. However, if the firm will have to issue new common stock, the cost of new common stock should be used in the firm's WACC calculation. Quantitative Problem: Barton Industries expects that its target capital structure for raising funds in the future for its capital budget will consist of 40% debt, 5% preferred stock, and 55% common equity. Note that the firm's marginal tax rate is 40%. Assume that the firm's cost of debt, rd, is 8%, the firm's cost of preferred stock, rps, is 7.5% and the firm's cost of equity is 12% for old equity, rs, and 12.47% for new equity, re. What is the firm's weighted average cost of capital (WACC1) if it uses retained earnings as its source of common equity? Do not round intermediate calculations. Round your answer to three decimal places. 66.72 % What is the firm's weighted average cost of capital (WACC2) if it has to issue new common stock? Do not round intermediate calculations. Round your answer to three decimal places. 22.35 % Check My Work FE eBook The Cost of Equity and Flotation Costs Messman Manufacturing will issue common stock to the public for $45. The expected dividend and the growth in dividends are $2.00 per share and 6%, respectively. If the flotation cost is 12% of the issue's gross proceeds, what is the cost of external equity, re? Round your answer to two decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts