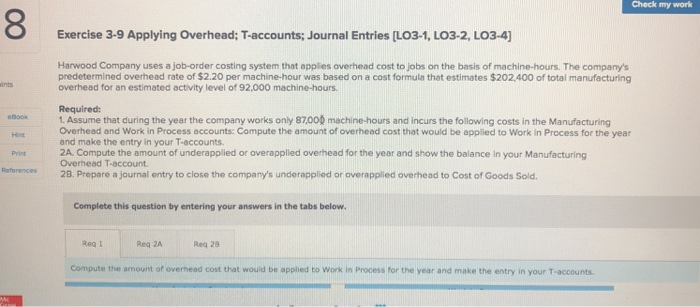

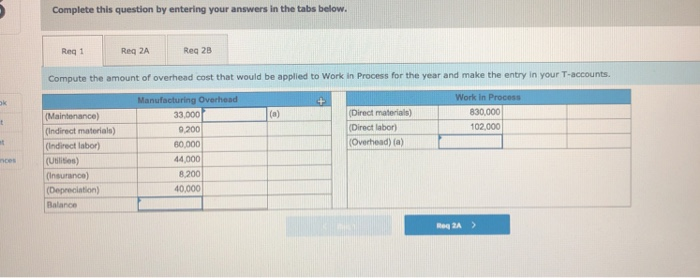

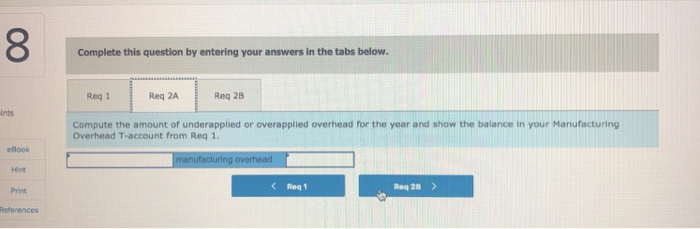

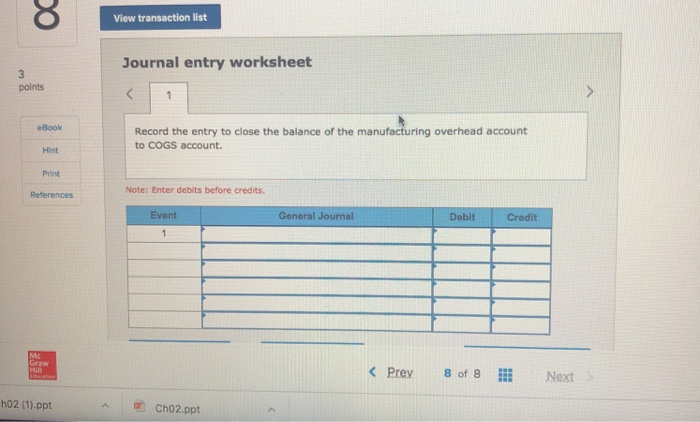

Check my work Exercise 3-9 Applying Overhead; T-accounts; Journal Entries [LO3-1, LO3-2, LO3-4) Harwood Company uses a job-order costing system that applies overhead cost to jobs on the basis of machine-hours. The company's predetermined overhead rate of $2.20 per machine-hour was based on a cost formula that estimates $202.400 of total manufacturing overhead for an estimated activity level of 92,000 machine-hours eBoox Required 1. Assume that during the year the company works only 8700p machine-hours and incurs the following costs in the Manufacturing Overhead and Work in Process accounts: Compute the amount of overhead cost that would be applied to Work in Process for the year and make the entry in your T-accounts. Hint Prit 2A Compute the amount of underapplied or overapplied overhead for the year and show the balance in your Manufacturing Rerorences 28. Prepare a journal entry to close the company's underapplied or overapplied overhead to Cost of Goods Sold. Overhead T-account. Complete this question by entering your answers in the tabs below Req I Req 2A Req 28 Compute the amount of overhead cost that would be applied to Work in Process for the year and make the entry in your T-accounts Complete this question by entering your answers in the tabs belovw Req 1 Req 2A Req 2B Compute the amount of overhead cost that would be applied to Work in Process for the year and make the entry in your T-accounts. ok Direct materials) 830,000 102,000 Maintenance) (Indirect materials) Indirect labor) 3,000 9.200 60,000 44,000 8,200 40,000 (Direct labor) (Overhead) (a) ncesuBlison) (Depreciation) Balance Req ZA > Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Ints Compute the amount of underapplied or overapplied overhead for the year and show the balance in your Manufacturing Overhead T-account from Req 1 eBook Req 1 Req 28> Print References View transaction list Journal entry worksheet polnts eBook Hint Print References Record the entry to close the balance of the manufacturing overhead account to COGS account. Note: Enter debits before credits. Event General Journal Dobit Crodit Graw