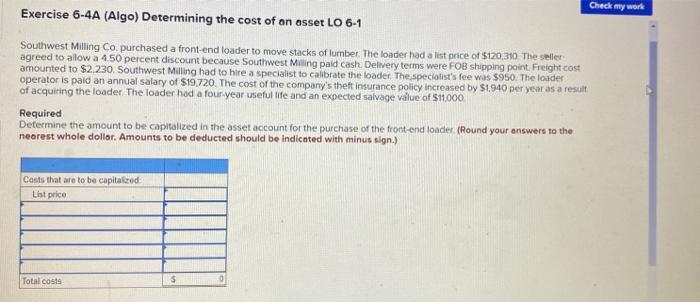

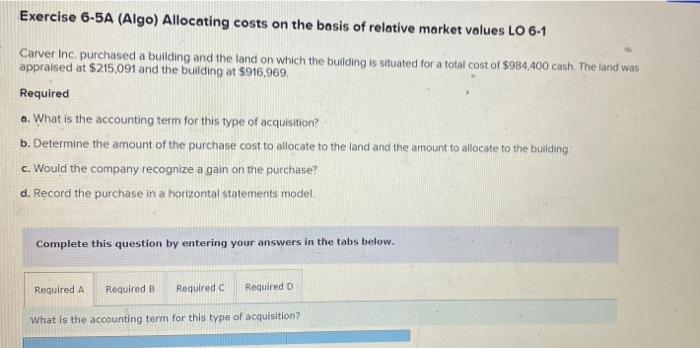

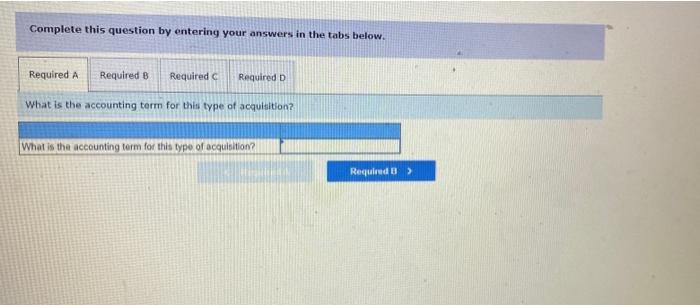

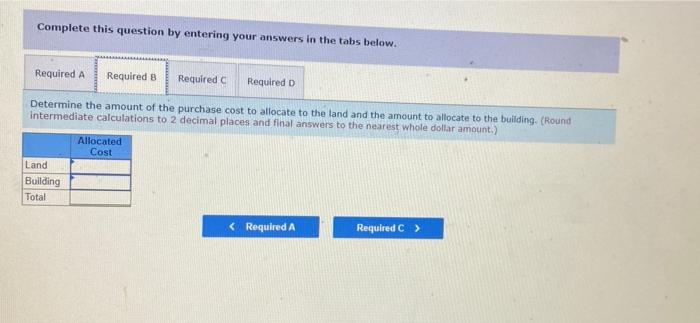

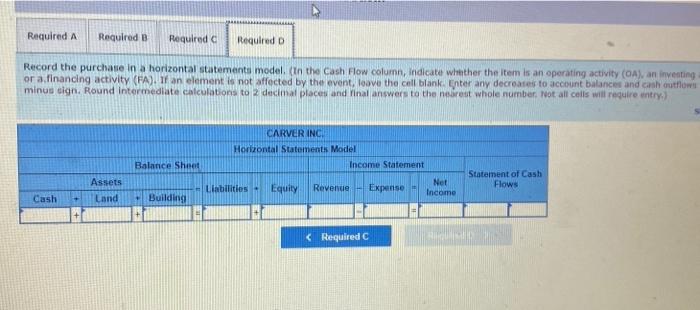

Check my work Exercise 6-4A (Algo) Determining the cost of an asset LO 6-1 Southwest Milling Co, purchased a front-end loader to move stacks of lumber The loader had a list price of $120,310 The seller agreed to allow a 4.50 percent discount because Southwest Miling paid cash Delivery terms were FOB shipping point Freight cost amounted to $2,230. Southwest Milling had to hire a specialist to calibrate the loader. The specialist's fee was $950. The loader operator is paid an annual salary of $19,720 The cost of the company's theft insurance policy increased by $1.940 per year as a result of acquiring the loader The loader had a four-year useful life and an expected salvage value of $11,000 Required Determine the amount to be capitalized in the asset account for the purchase of the front end loader (Round your answers to the nearest whole dollar. Amounts to be deducted should be indicated with minus sign.) Costs that are to be capitalized List price Total costs $ 0 Exercise 6-5A (Algo) Allocating costs on the basis of relative market values LO 6-1 Carver Inc purchased a building and the land on which the building is situated for a total cost of $984.400 cash. The land was appraised at $215,091 and the building at $916,969, Required a. What is the accounting term for this type of acquisition? b. Determine the amount of the purchase cost to allocate to the land and the amount to allocate to the building c. Would the company recognize a gain on the purchase? d. Record the purchase in a horizontal statements model Complete this question by entering your answers in the tabs below. Required A Required B Required Required What is the accounting term for this type of acquisition Complete this question by entering your answers in the tabs below. Required A Required B Required Required D What is the accounting term for this type of acquisition? What is the accounting term for this type of acquisition Required) Complete this question by entering your answers in the tabs below. Required A Required B Required Required D Determine the amount of the purchase cost to allocate to the land and the amount to allocate to the building. (Round Intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount.) Allocated Cost Land Building Total Complete this question by entering your answers in the tabs below. Required A Required B Required c Required D Would the company recognize a gain on the purchase Would the company recognize a gain on the purchase?