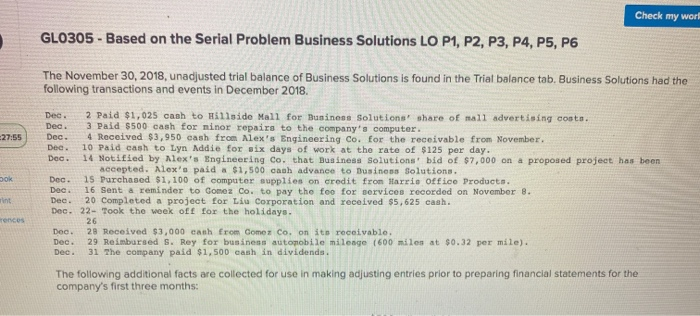

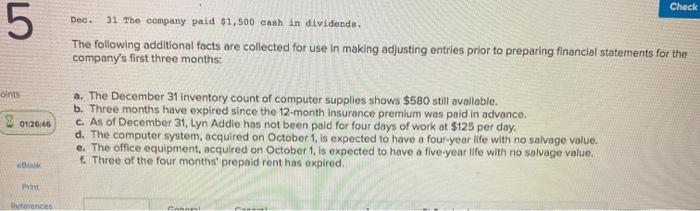

Check my work GLO305 - Based on the Serial Problem Business Solutions LO P1, P2, P3, P4, P5, P6 27:55 The November 30, 2018, unadjusted trial balance of Business Solutions is found in the Trial balance tab. Business Solutions had the following transactions and events in December 2018 Dec 2 Paid $1,025 cash to Hillside Mall for Business Solutions share of mall advertising costs. Dec. 3. Paid $500 cash for minor repairs to the company's computer. Dec. 4 Received $3,950 cash from Alex's Engineering Co. for the receivable from November. Dec. 10 Paid cash to Lyn Addie for six days of work at the rate of $125 per day. Dec. 14 Notified by Mex's Engineering Co. that Business Solutions bid of $7,000 on a proposed project has been accepted. Alex's paid a $1,500 cash advance to Business Solutions. Dec. 15 Purchased $1,100 of computer supplies on credit from larrie Office Products. Dec. 16 Sent a reminder to Gomez Co. to pay the foo for services recorded on November 8. Dee. 20 Completed a project for Liu Corporation and received $5,625 cash. Dec. 22- Took the week off for the holidays. 26 Dec. 28 Received $3,000 cash from Comer Co. on its receivable. Dec. 29 Reimbursed S. Rey for business automobile mileage (600 miles at $0.32 per mile). Dec. 31 The company paid $1,500 cash in dividends. Dok rint rences The following additional facts are collected for use in making adjusting entries prior to preparing financial statements for the company's first three months: Check 5 Dec. 31 The company paid $1,500 cash in dividends. The following additional facts are collected for use in making adjusting entries prior to preparing financial statements for the company's first three months oints 8012646 a. The December 31 inventory count of computer supplies shows $580 still available. b. Three months have expired since the 12-month insurance premium was paid in advance. c. As of December 31, Lyn Addie has not been paid for four days of work at $125 per day. d. The computer system, acquired on October 1, is expected to have a four-year life with no salvage value. e. The office equipment, acquired on October 1, is expected to have a five-year life with no salvage value. f. Three of the four months' prepaid rent has expired. Book Print References