Question

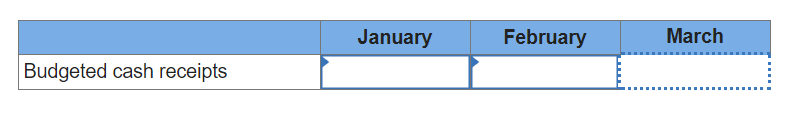

Crew Clothing (CC) sells womens resort casual clothing to high-end department stores and in its own retail boutiques. CC expects sales for January, February, and

- Crew Clothing (CC) sells womens resort casual clothing to high-end department stores and in its own retail boutiques. CC expects sales for January, February, and March to be $440,000, $500,000, and $520,000, respectively. Twenty percent of CCs sales are cash, with the remainder collected evenly over two months. During December, CCs total sales were $750,000. CC is beginning its budget process and has asked for your help in preparing the cash budget. Compute CCs expected cash receipts from customers for each month

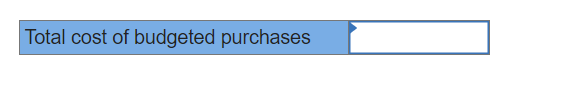

2. Garfield Corporation expects to sell 1,300 units of its pet beds in March and 600 units in April. Each unit sells for $150. Garfields ending inventory policy is 40 percent of the following months sales. Garfield pays its supplier $50 per unit. Compute Garfield's budgeted purchases of pet beds for March.

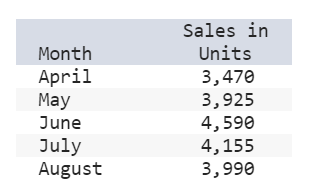

3. Croy Incorporated has the following projected sales for the next five months:

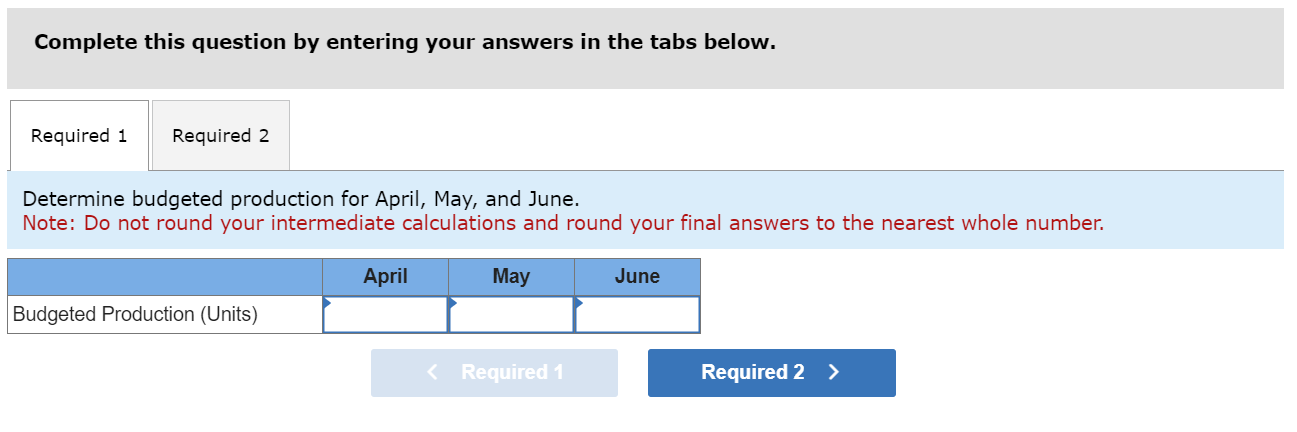

Croys finished goods inventory policy is to have 50 percent of the next months sales on hand at the end of each month. Direct materials cost $2.70 per pound, and each unit requires 2 pounds. Direct materials inventory policy is to have 50 percent of the next months production needs on hand at the end of each month. Direct materials on hand at March 31 totaled 3,698 pounds.

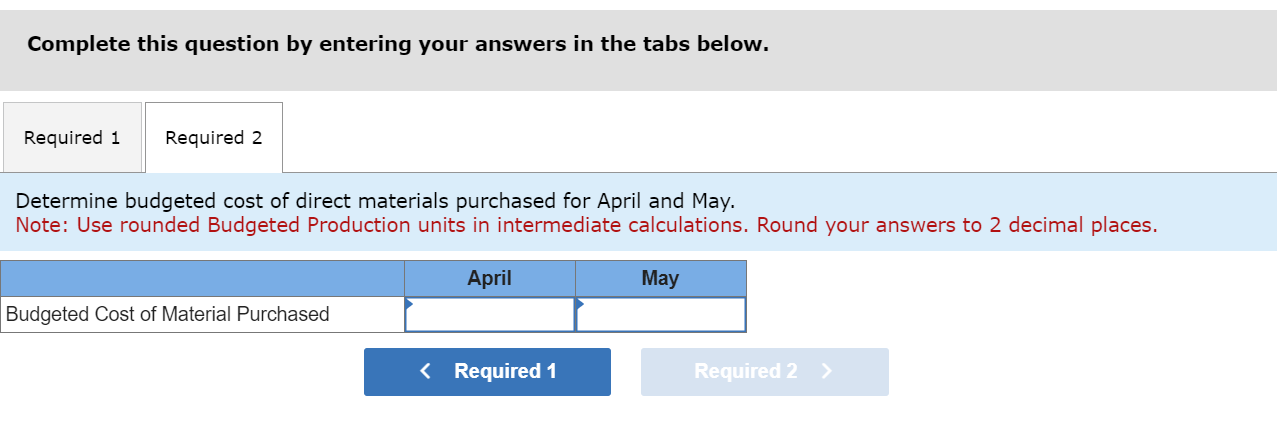

- Determine budgeted production for April, May, and June.

- Determine budgeted cost of direct materials purchased for April and May.

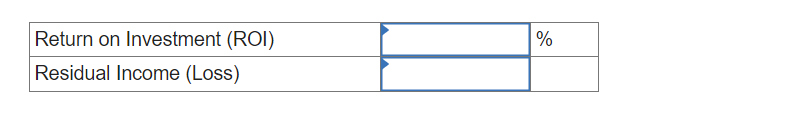

4. Violet Company has sales of $461,000, net operating income of $249,000, average invested assets of $806,000, and a hurdle rate of 11.00 percent.

Calculate Violets return on investment and its residual income.

Note: Enter your ROI answer as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%). Round your Residual Income (Loss) answer to the nearest whole dollar.

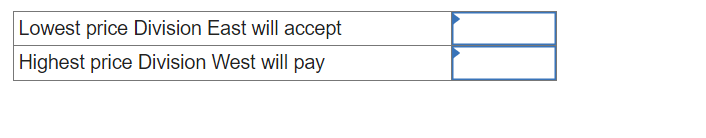

5. Peppertree Company has two divisions, East and West. Division East manufactures a component that Division West uses. The variable cost to produce this component is $1.58 per unit; full cost is $1.95. The component sells on the open market for $4.95.

5. Peppertree Company has two divisions, East and West. Division East manufactures a component that Division West uses. The variable cost to produce this component is $1.58 per unit; full cost is $1.95. The component sells on the open market for $4.95.

Assuming Division East has excess capacity, what is the lowest price Division East will accept for the component? What is the highest price that Division West will pay for it?

Note: Enter your answers in 2 decimal places.

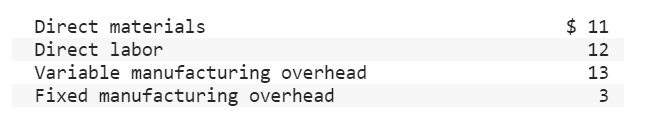

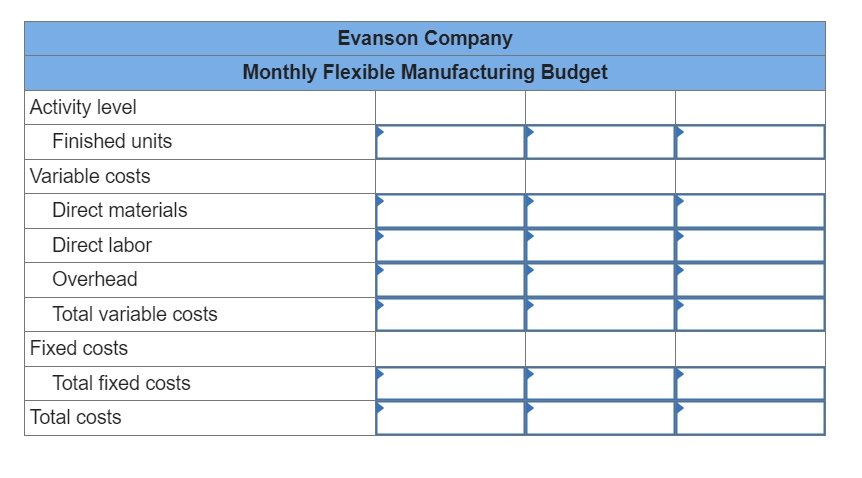

6. Evanson Company expects to produce 528,000 units during the year. Monthly production is expected to range from 40,000 to 80,000 units. The company has budgeted manufacturing costs per unit to be as follows:

Required:

Prepare a flexible manufacturing budget using 20,000 unit increments.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started