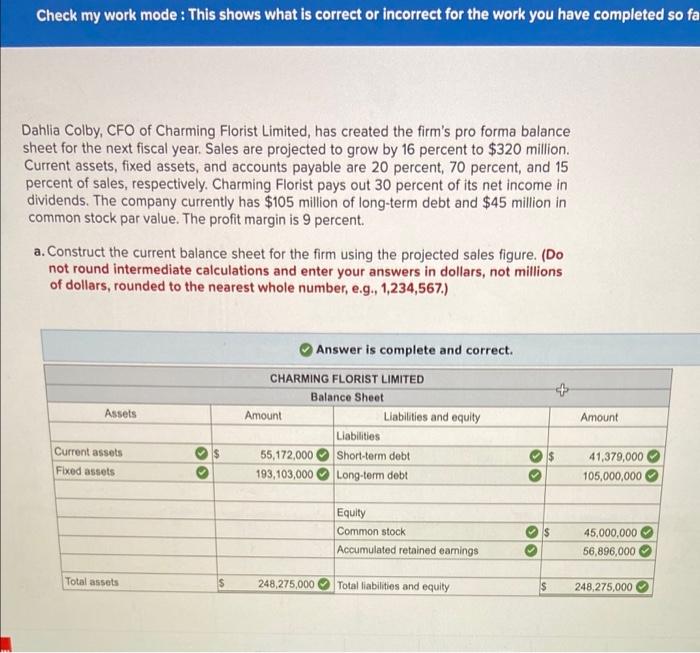

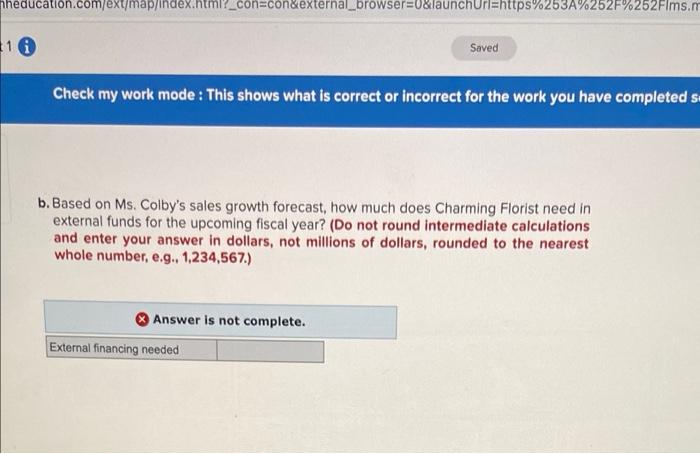

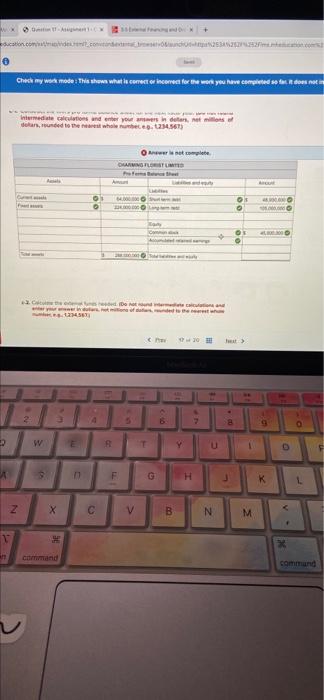

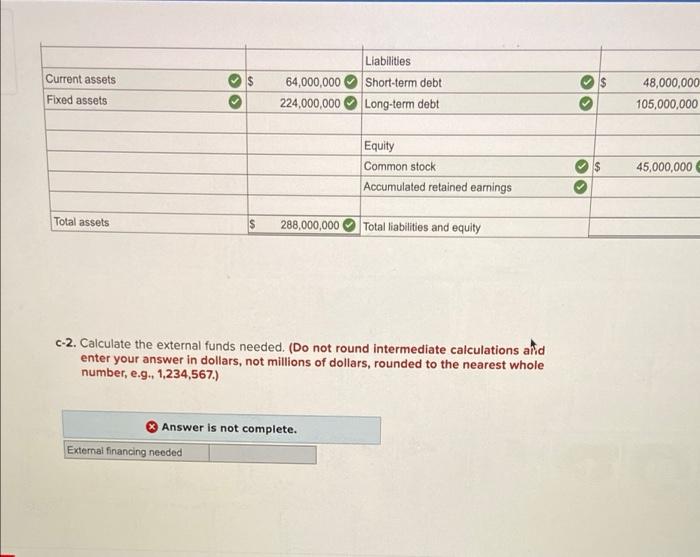

Check my work mode : This shows what is correct or incorrect for the work you have completed so fa Dahlia Colby, CFO of Charming Florist Limited, has created the firm's pro forma balance sheet for the next fiscal year. Sales are projected to grow by 16 percent to $320 million. Current assets, fixed assets, and accounts payable are 20 percent, 70 percent, and 15 percent of sales, respectively. Charming Florist pays out 30 percent of its net income in dividends. The company currently has $105 million of long-term debt and $45 million in common stock par value. The profit margin is 9 percent a. Construct the current balance sheet for the firm using the projected sales figure. (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) Assets Answer is complete and correct. CHARMING FLORIST LIMITED Balance Sheet Amount Liabilities and equity Liabilities 55,172,000 Short-term debt 193,103,000 Long-term debt Amount Current assets Fixed assets 41,379,000 105,000,000 Equity Common stock Accumulated retained earings 45,000,000 56,896,000 Total assets 248,275,000 Total liabilities and equity $ 248,275,000 nheducation.com/ext/map/index.html?_con=con&external_browser=0&launchurl=https%253A%252F%252Flms.m 110 Saved Check my work mode : This shows what is correct or incorrect for the work you have completed s b. Based on Ms. Colby's sales growth forecast, how much does Charming Florist need in external funds for the upcoming fiscal year? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g. 1,234,567.) Answer is not complete. External financing needed WAX education.com.co Check my work mote Ta shows what is correct or incorrect to the worst you have compidou do not Intermediate atins und enter your doors, mis olan, mund the whole. 24.567) On compte GESTUS ... UNE C 10 - 25 2 6 7 B 9 w R Y D 5 F G H K 1 N X V B N M + Command Liabilities Current assets $ Fixed assets 64,000,000 Short-term debt 224,000,000 Long-term debt 48,000,000 105,000,000 Equity Common stock Accumulated retained earnings $ 45,000,000 Total assets S 288,000,000 Total liabilities and equity c-2. Calculate the external funds needed. (Do not round Intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g. 1,234,567.) Answer is not complete. External financing needed