Answered step by step

Verified Expert Solution

Question

1 Approved Answer

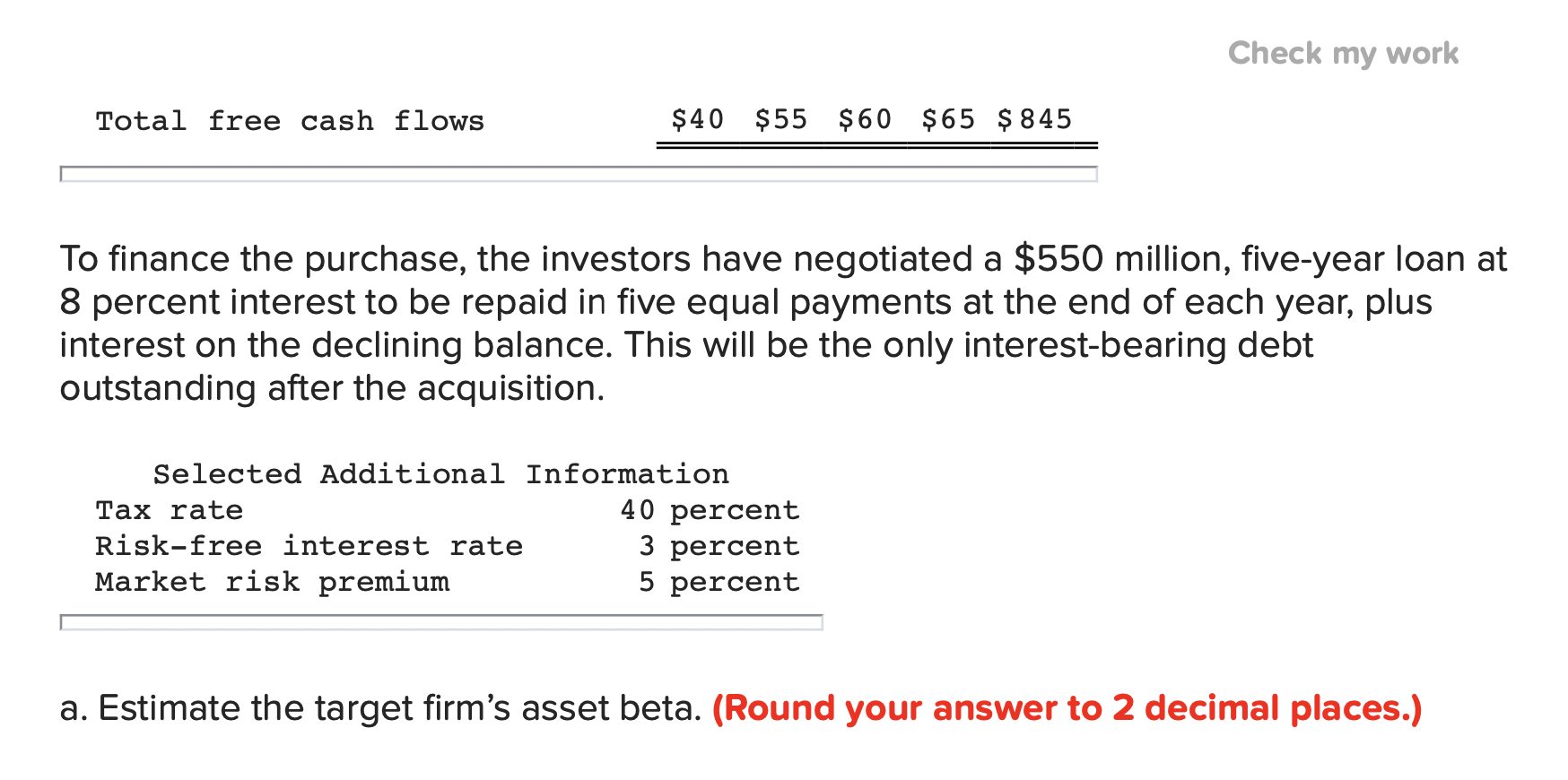

Check my work Total free cash flows $40 $55 $60 $65 $845 To finance the purchase, the investors have negotiated a $550 million, five-year

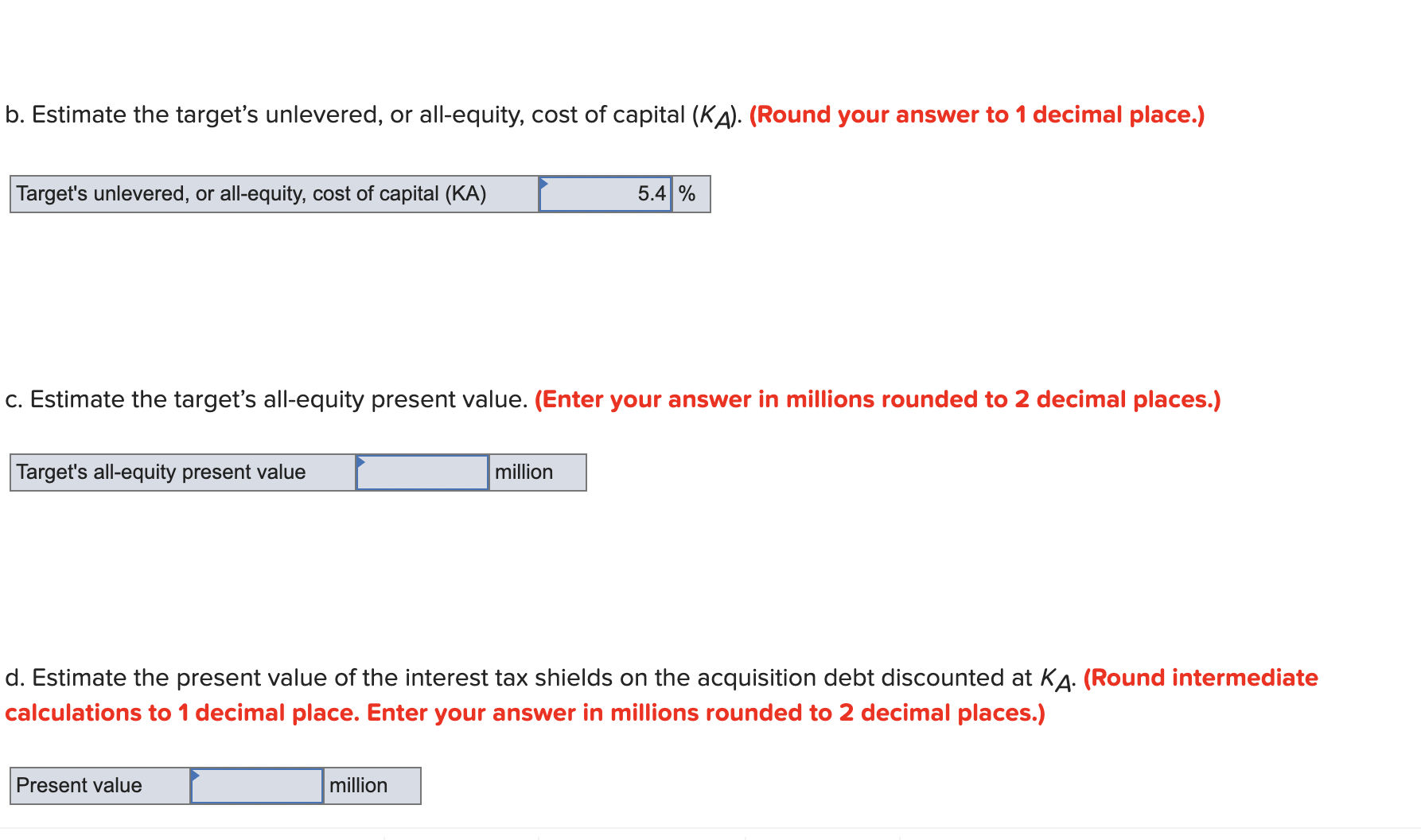

Check my work Total free cash flows $40 $55 $60 $65 $845 To finance the purchase, the investors have negotiated a $550 million, five-year loan at 8 percent interest to be repaid in five equal payments at the end of each year, plus interest on the declining balance. This will be the only interest-bearing debt outstanding after the acquisition. Selected Additional Information Tax rate 40 percent Risk-free interest rate 3 percent percent Market risk premium a. Estimate the target firm's asset beta. (Round your answer to 2 decimal places.) b. Estimate the target's unlevered, or all-equity, cost of capital (KA). (Round your answer to 1 decimal place.) Target's unlevered, or all-equity, cost of capital (KA) 5.4 % c. Estimate the target's all-equity present value. (Enter your answer in millions rounded to 2 decimal places.) Target's all-equity present value million d. Estimate the present value of the interest tax shields on the acquisition debt discounted at KA. (Round intermediate calculations to 1 decimal place. Enter your answer in millions rounded to 2 decimal places.) Present value million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started