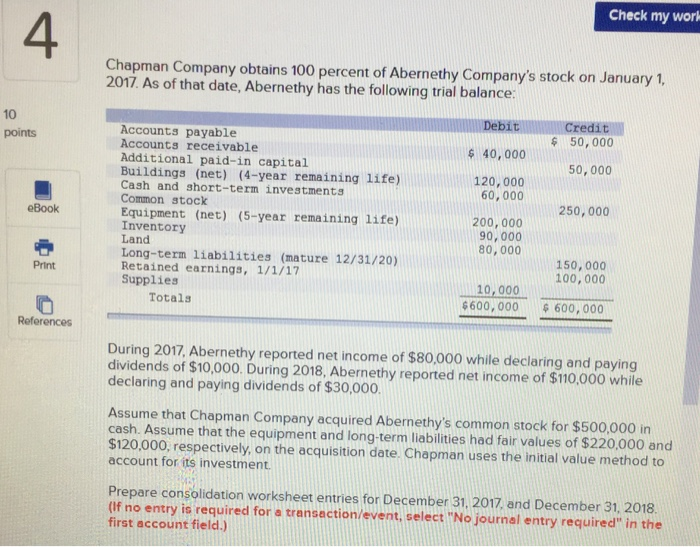

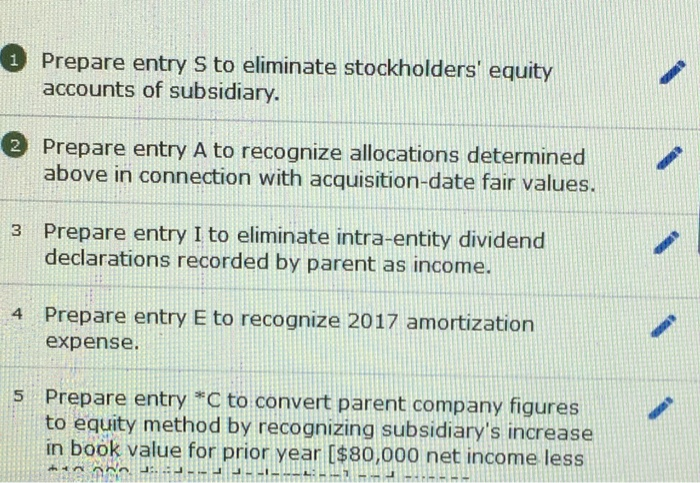

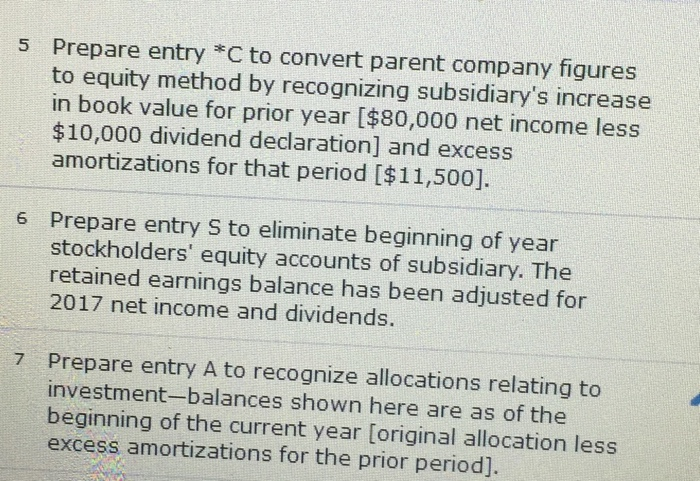

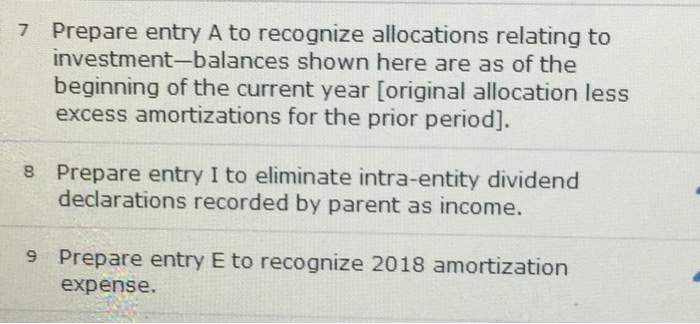

Check my world Chapman Company obtains 100 percent of Abernethy Company's stock on January 1, 2017. As of that date, Abernethy has the following trial balance: 40 Debit Credit $ 50,000 points $ 40,000 50,000 120,000 60,000 250,000 eBook Accounts payable Accounts receivable Additional paid-in capital Buildings (net) (4-year remaining life) Cash and short-term investments Common stock Equipment (net) (5-year remaining life) Inventory Land Long-term liabilities (mature 12/31/20) Retained earnings, 1/1/17 Supplies Totals 200,000 90,000 80,000 150,000 100,000 Print 10,000 $600,000 6600,000 References During 2017, Abernethy reported net income of $80,000 while declaring and paying dividends of $10,000. During 2018, Abernethy reported net income of $110,000 while declaring and paying dividends of $30,000. Assume that Chapman Company acquired Abernethy's common stock for $500,000 in cash. Assume that the equipment and long-term liabilities had fair values of $220,000 and $120,000, respectively, on the acquisition date. Chapman uses the initial value method to account for its investment Prepare consolidation worksheet entries for December 31, 2017, and December 31, 2018 (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) 1 Prepare entry S to eliminate stockholders' equity accounts of subsidiary. 2 Prepare entry A to recognize allocations determined above in connection with acquisition-date fair values. 3 Prepare entry I to eliminate intra-entity dividend declarations recorded by parent as income. 4 Prepare entry E to recognize 2017 amortization expense. 5 Prepare entry *C to convert parent company figures to equity method by recognizing subsidiary's increase in book value for prior year [$80,000 net income less ennnn .. .LLLLLLL 5 Prepare entry *C to convert parent company figures to equity method by recognizing subsidiary's increase in book value for prior year ($80,000 net income less $10,000 dividend declaration) and excess amortizations for that period ($11,500]. Prepare entry S to eliminate beginning of year stockholders' equity accounts of subsidiary. The retained earnings balance has been adjusted for 2017 net income and dividends. 7 Prepare entry A to recognize allocations relating to investment-balances shown here are as of the beginning of the current year (original allocation less excess amortizations for the prior period). 7 Prepare entry A to recognize allocations relating to investment-balances shown here are as of the beginning of the current year (original allocation less excess amortizations for the prior period). 8 Prepare entry I to eliminate intra-entity dividend declarations recorded by parent as income. 9 Prepare entry E to recognize 2018 amortization expense