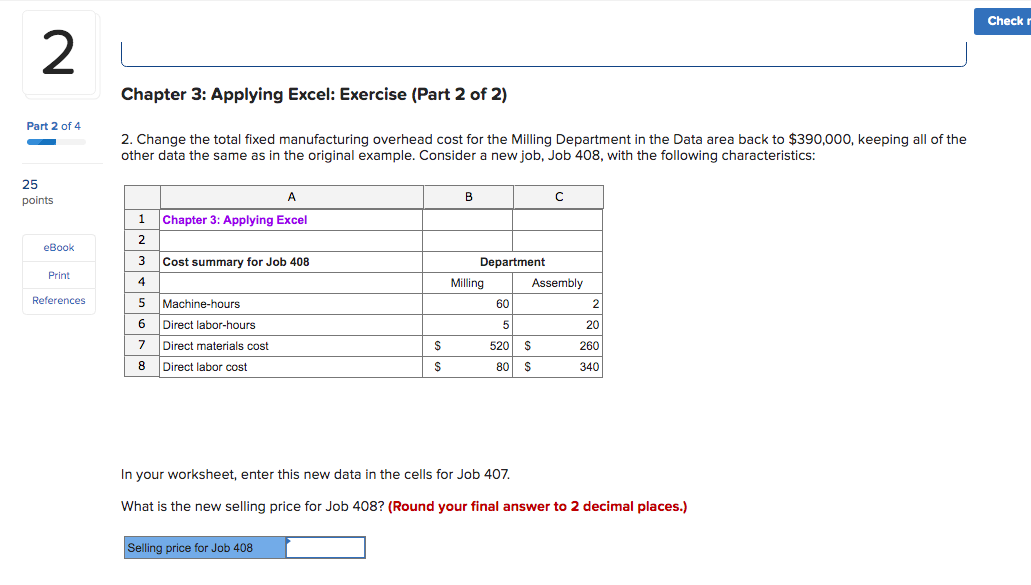

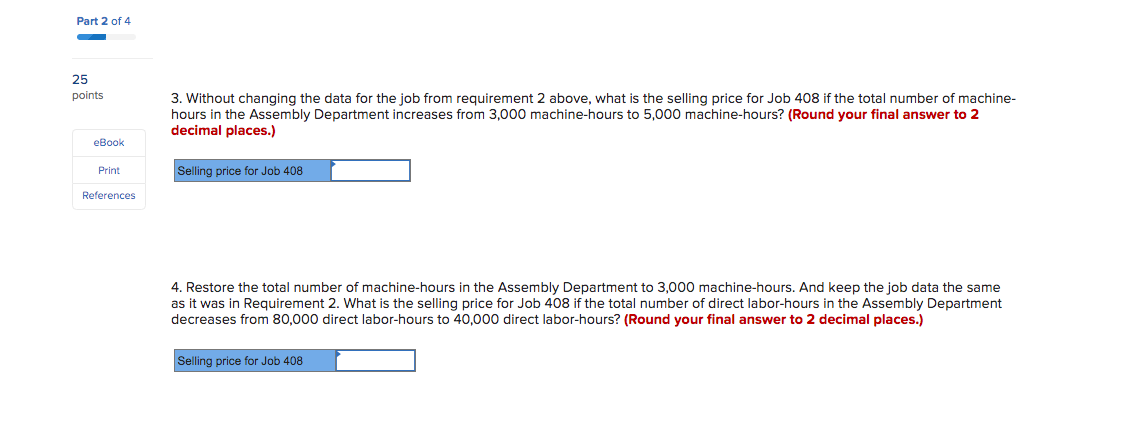

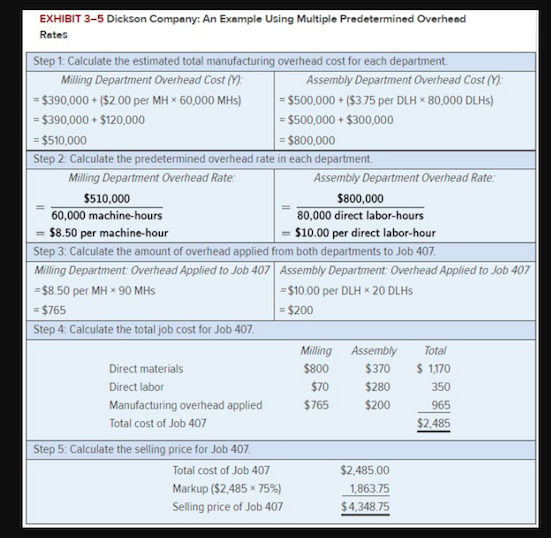

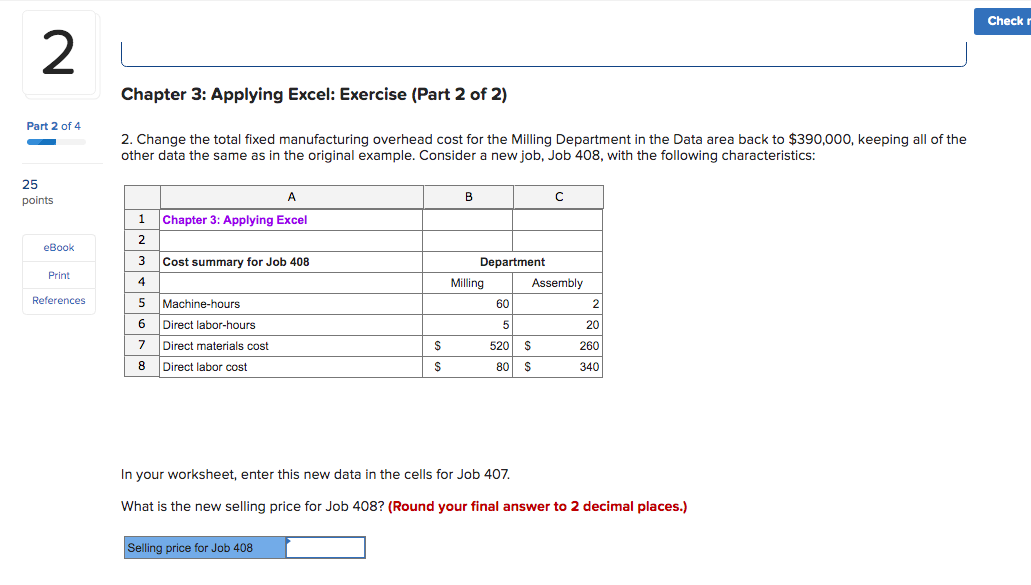

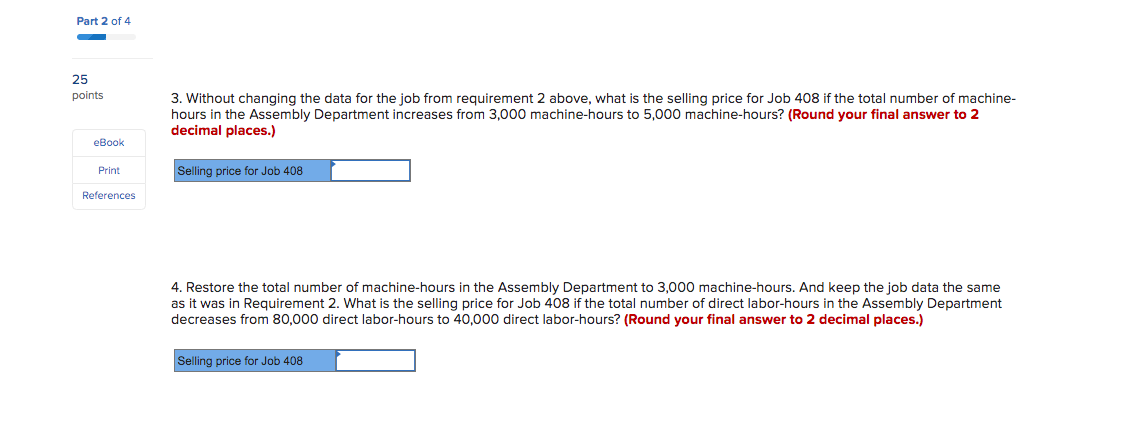

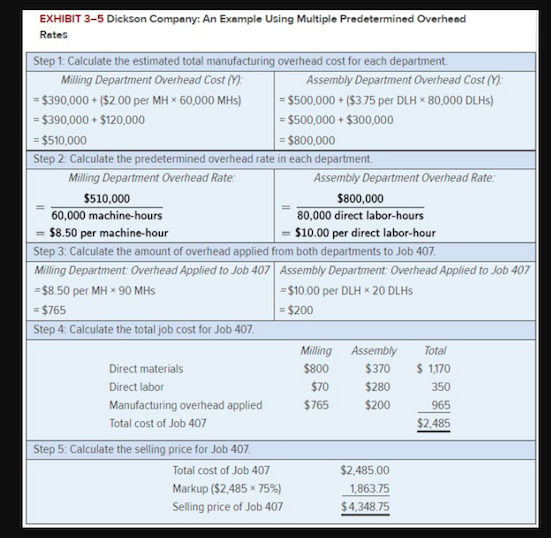

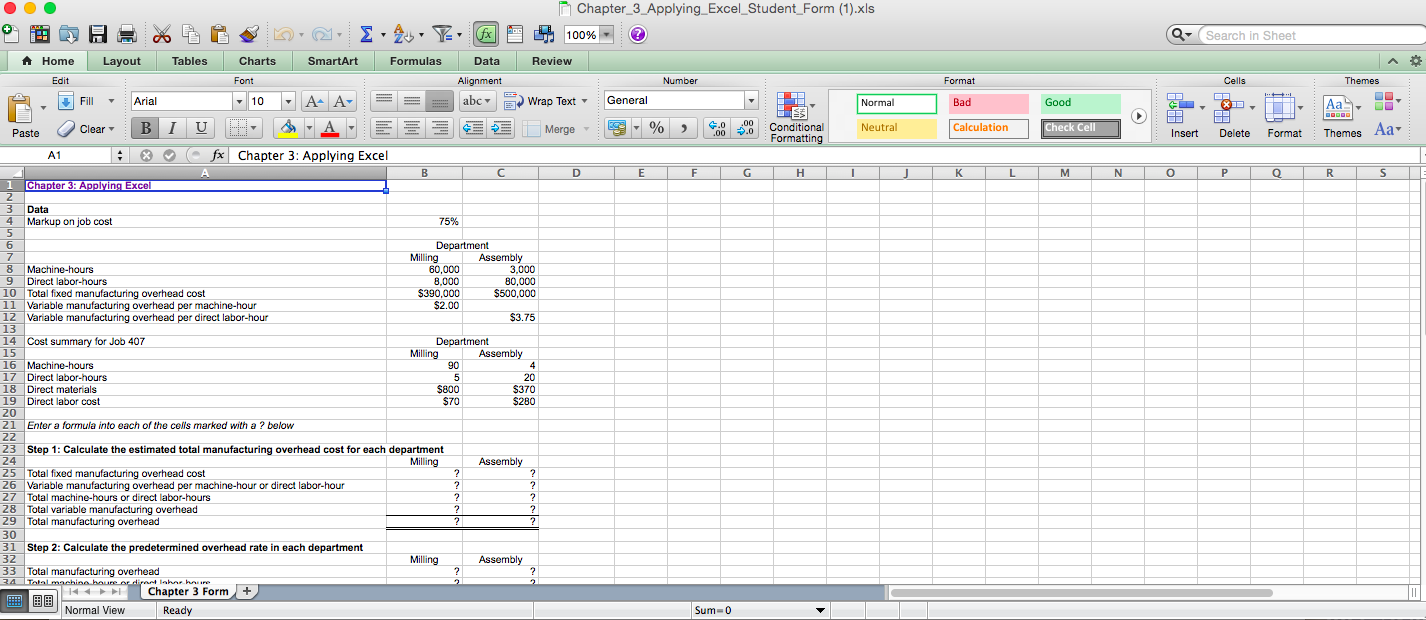

Checkr 2 Chapter 3: Applying Excel: Exercise (Part 2 of 2) Part 2 of 4 2. Change the total fixed manufacturing overhead cost for the Milling Department in the Data area back to $390,000, keeping all of the other data the same as in the original example. Consider a new job, Job 408, with the following characteristics: 25 points A B 1 Chapter 3: Applying Excel 2 eBook 3 Cost summary for Job 408 Print Department Milling Assembly 4 References 5 60 2 6 5 20 Machine-hours Direct labor-hours Direct materials cost Direct labor cost 7 $ 520 S 260 340 8 S 80 S In your worksheet, enter this new data in the cells for Job 407. What is the new selling price for Job 408? (Round your final answer to 2 decimal places.) Selling price for Job 408 Part 2 of 4 - 25 points 3. Without changing the data for the job from requirement 2 above, what is the selling price for Job 408 if the total number of machine- hours in the Assembly Department increases from 3,000 machine-hours to 5,000 machine-hours? (Round your final answer to 2 decimal places.) eBook Print Selling price for Job 408 References 4. Restore the total number of machine-hours in the Assembly Department to 3,000 machine-hours. And keep the job data the same as it was in Requirement 2. What is the selling price for Job 408 if the total number of direct labor-hours in the Assembly Department decreases from 80,000 direct labor-hours to 40,000 direct labor-hours? (Round your final answer to 2 decimal places.) Selling price for Job 408 EXHIBIT 3-5 Dickson Company: An Example Using Multiple Predetermined Overhead Rates Step 1: Calculate the estimated total manufacturing overhead cost for each department. Milling Department Overhead Cost M: Assembly Department Overhead Cost (Y): = $390,000 + ($2.00 per MH * 60,000 MHs) = $500,000 + ($3.75 per DLH * 80,000 DLHS) $390,000 + $120,000 = $500,000 + $300,000 = $510,000 = $800,000 Step 2: Calculate the predetermined overhead rate in each department. Milling Department Overhead Rate: Assembly Department Overhead Rate: $510,000 $800,000 60,000 machine-hours 80,000 direct labor-hours = $8.50 per machine-hour = $10.00 per direct labor-hour Step 3: Calculate the amount of overhead applied from both departments to Job 407. Milling Department Overhead Applied to Job 407 Assembly Department: Overhead Applied to Job 407 =$8.50 per MH * 90 MHS = $10.00 per DLH * 20 DLHS = $765 = $200 Step 4: Calculate the total job cost for Job 407. Milling Assembly Total Direct materials $800 $370 $ 1,170 Direct labor $280 350 Manufacturing overhead applied $765 $200 965 Total cost of Job 407 $2,485 Step 5: Calculate the selling price for Job 407. Total cost of Job 407 $2,485.00 Markup ($2,485 x 75%) 1.863.75 Selling price of Job 407 $4,348.75 $70 Chapter_3_Applying_Excel_Student_Form (1).xls co 2 - 45 Y= (fx 100% - ? Q- Search in Sheet A Home Layout Tables Charts SmartArt Formulas Data Review . Edit Font Number Format Cells Themes Alignment abc Fill Arial - 10 A+ A- Wrap Text General Normal Bad Good ! B I U Clear CES % ) Merge 4.0 9.00 .00 .0 Neutral Conditional Formatting Paste Calculation Check Cell HH Delete Insert Format Themes Aa- D E F G J K L M N o P Q R S A1 + X fx Chapter 3: Applying Excel A B 1 Chapter 3: Applying Excel 2 3 Data 4 Markup on job cost 75% 5 6 Department 7 Milling Assembly 8 Machine-hours 60,000 3,000 9 Direct labor-hours 8,000 80,000 10 Total fixed manufacturing overhead cost $390,000 $500,000 11 Variable manufacturing overhead per machine-hour $2.00 12 Variable manufacturing overhead per direct labor-hour $3.75 13 14 Cost summary for Job 407 Department 15 Milling Assembly 16 Machine-hours 90 4 17 Direct labor-hours 5 20 18 Direct materials $800 $370 19 Direct labor cost $70 $280 20 21 Enter a formula into each of the cells marked with a ? below 22 23 Step 1: Calculate the estimated total manufacturing overhead cost for each department 24 Milling Assembly 25 Total fixed manufacturing overhead cost ? ? 26 Variable manufacturing overhead per machine-hour or direct labor-hour ? ? 27 Total machine-hours or direct labor-hours ? ? 28 Total variable manufacturing overhead ? ? 29 Total manufacturing overhead ? ? 30 31 Step 2: Calculate the predetermined overhead rate in each department 32 Milling Assembly 33 Total manufacturing overhead ? ? 24 Talal machine boure or direct labar harire Chapter 3 Form + Normal View Ready !!! Sum-0