Answered step by step

Verified Expert Solution

Question

1 Approved Answer

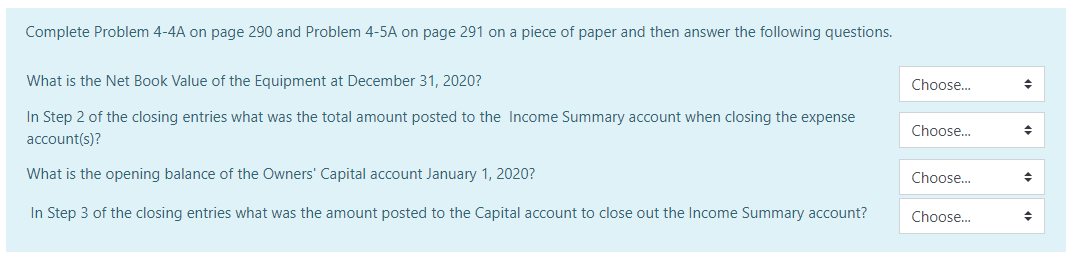

Only need to complete first picture. Complete Problem 4-4A on page 290 and Problem 4-5A on page 291 on a piece of paper and then

Only need to complete first picture.

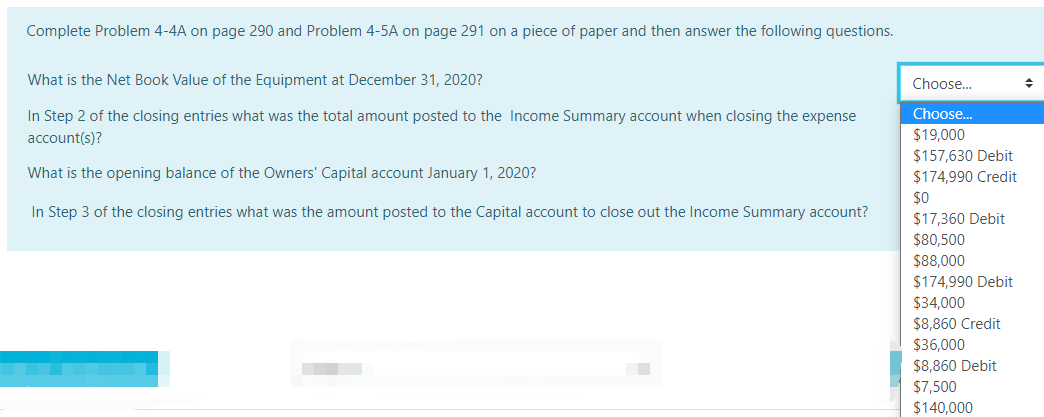

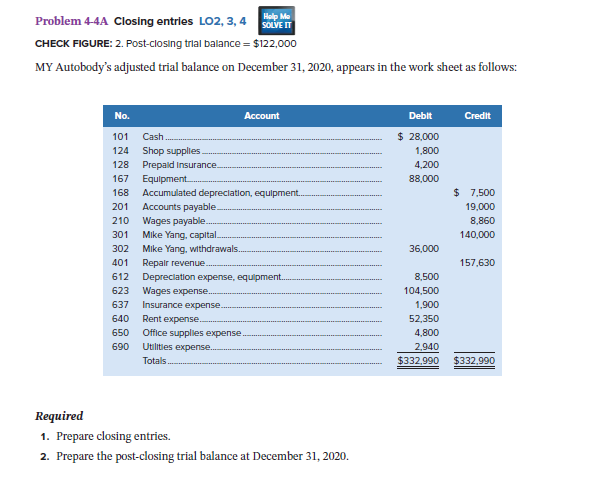

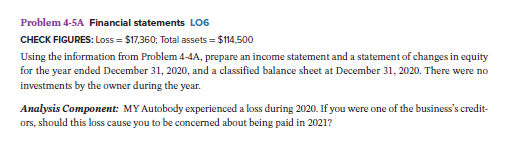

Complete Problem 4-4A on page 290 and Problem 4-5A on page 291 on a piece of paper and then answer the following questions. What is the Net Book Value of the Equipment at December 31, 2020? Choose... In Step 2 of the closing entries what was the total amount posted to the Income Summary account when closing the expense account(s)? Choose... What is the opening balance of the Owners' Capital account January 1, 2020? Choose... In Step 3 of the closing entries what was the amount posted to the Capital account to close out the Income Summary account? Choose... Complete Problem 4-4A on page 290 and Problem 4-5A on page 291 on a piece of paper and then answer the following questions. What is the Net Book Value of the Equipment at December 31, 2020? Choose... In Step 2 of the closing entries what was the total amount posted to the Income Summary account when closing the expense account(s)? What is the opening balance of the Owners' Capital account January 1, 2020? In Step 3 of the closing entries what was the amount posted to the Capital account to close out the Income Summary account? Choose... $19,000 $157,630 Debit $174,990 Credit $0 $17,360 Debit $80,500 $88,000 $174,990 Debit $34,000 $8,860 Credit $36,000 $8,860 Debit $7,500 $140,000 Help Me SOLVE IT Problem 4-4A Closing entries LO2, 3, 4 CHECK FIGURE: 2. Post-closing trial balance = $122,000 MY Autobody's adjusted trial balance on December 31, 2020, appears in the work sheet as follows: No. Account Debit Credit $ 28,000 1.800 4,200 88,000 $ 7,500 19.000 8.860 140,000 101 Cash 124 Shop supplies 128 Prepaid Insurance 167 Equipment 168 Accumulated depreciation, equipment 201 Accounts payable 210 Wages payable 301 Mike Yang, capital 302 Mike Yang, withdrawals. 401 Repair revenue 612 Depreciation expense, equipment.. 623 Wages expense. 637 Insurance expense. 640 Rent expense- 650 Office supplies expense 690 Utilities expense. Totals. 36,000 157.630 8,500 104,500 1.900 52,350 4.800 2,940 $332,990 $332.990 Required 1. Prepare closing entries. 2. Prepare the post-closing trial balance at December 31, 2020, Problem 4-5A Financial statements L06 CHECK FIGURES: Loss = $17,360, Total assets = $114,500 Using the information from Problem 4-4A, prepare an income statement and a statement of changes in equity for the year ended December 31, 2020, and a classified balance sheet at December 31, 2020. There were no investments by the owner during the year. Analysis Component: MY Autobody experienced a loss during 2020. If you were one of the business's credit- ors, should this loss cause you to be concerned about being paid in 2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started