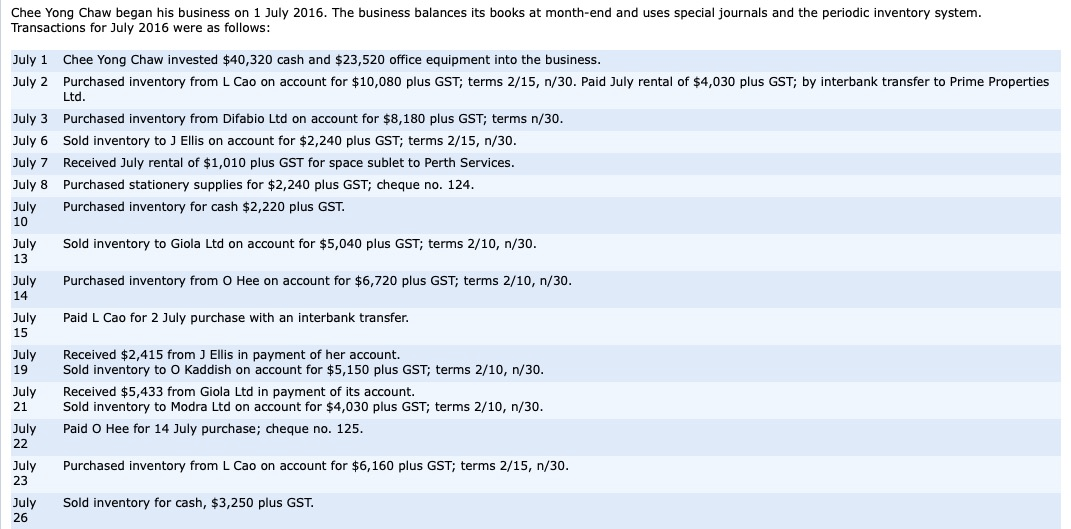

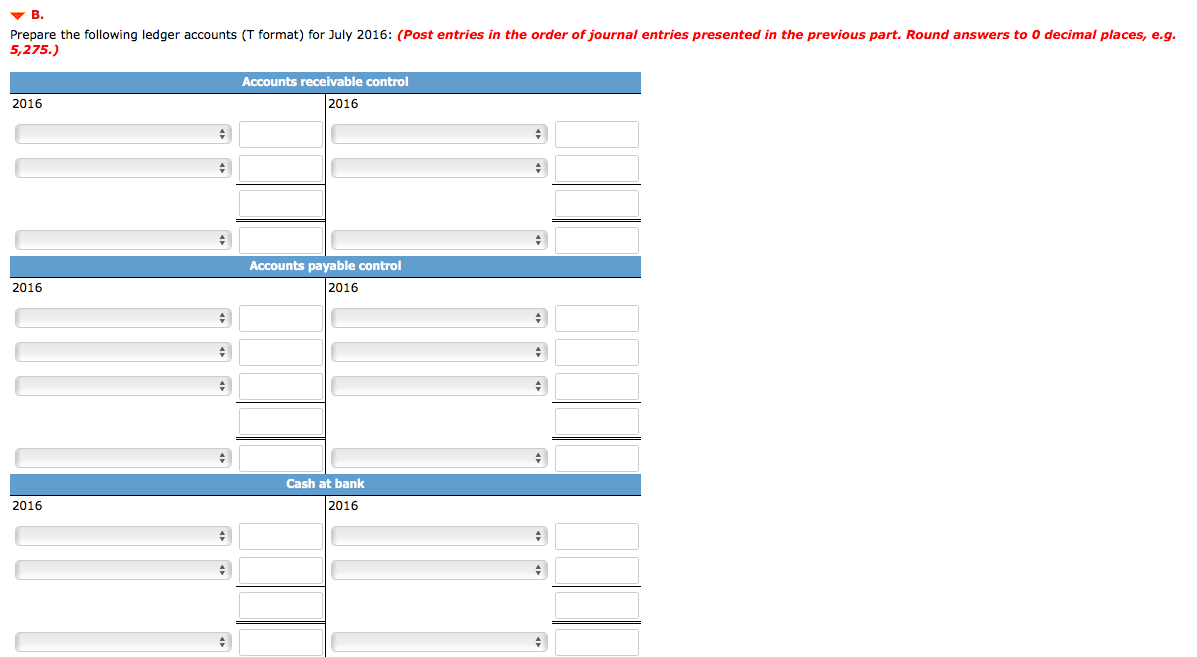

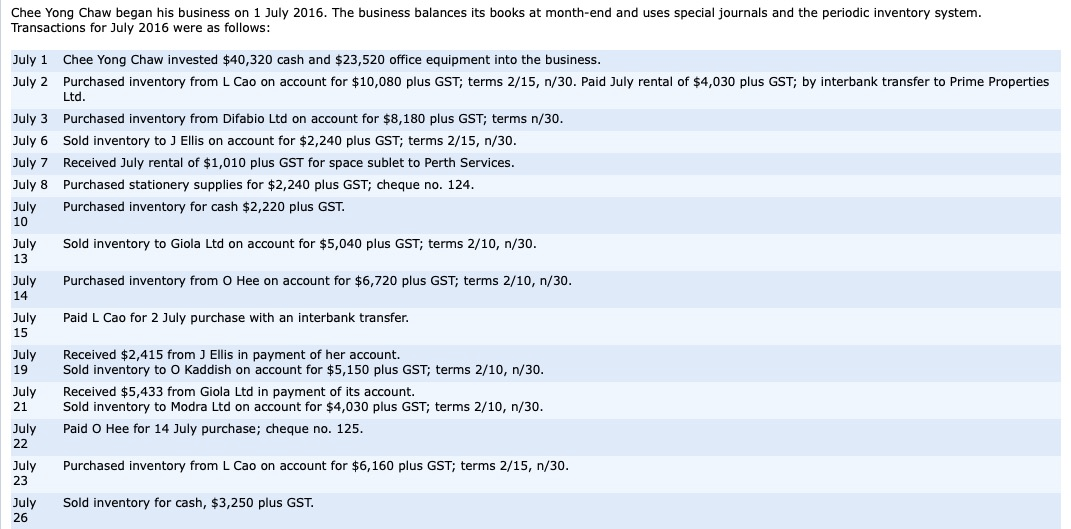

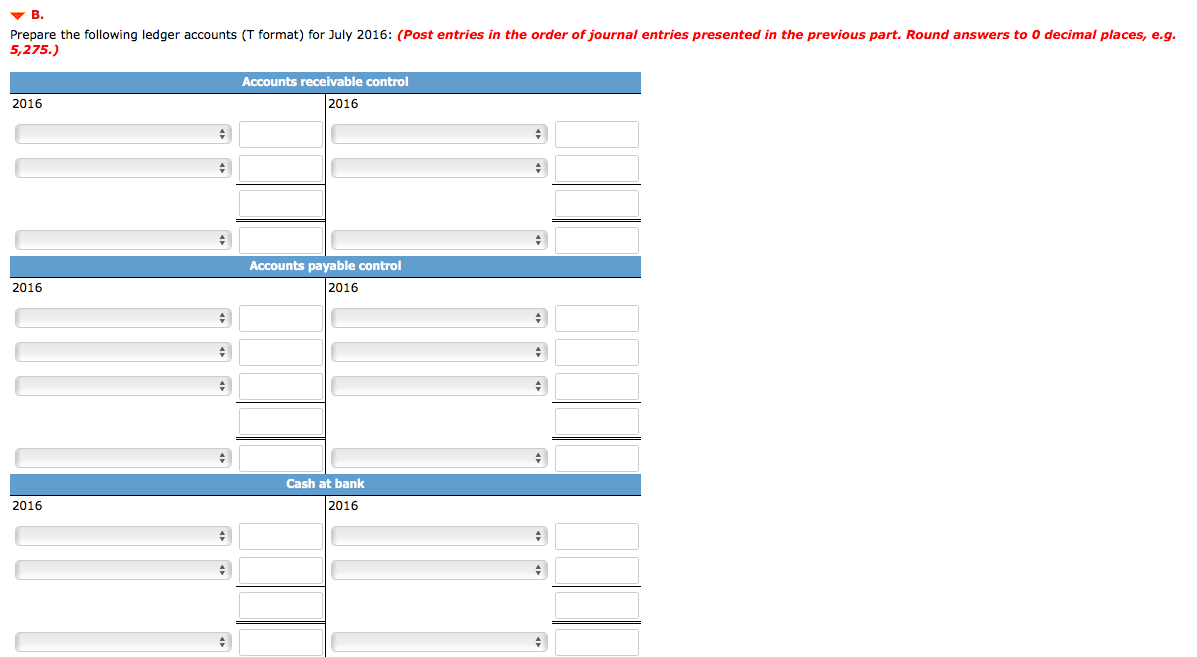

Chee Yong Chaw began his business on 1 July 2016. The business balances its books at month-end and uses special journals and the periodic inventory system. Transactions for July 2016 were as follows: July 1 July 2 July 3 July 6 July 7 July 8 July 10 July 13 July Chee Yong Chaw invested $40,320 cash and $23,520 office equipment into the business. Purchased inventory from L Cao on account for $10,080 plus GST; terms 2/15, n/30. Paid July rental of $4,030 plus GST; by interbank transfer to Prime Properties Ltd. Purchased inventory from Difabio Ltd on account for $8,180 plus GST; terms n/30. Sold inventory to ] Ellis on account for $2,240 plus GST; terms 2/15, n/30. Received July rental of $1,010 plus GST for space sublet to Perth Services. Purchased stationery supplies for $2,240 plus GST; cheque no. 124. Purchased inventory for cash $2,220 plus GST. Sold inventory to Giola Ltd on account for $5,040 plus GST; terms 2/10, n/30. Purchased inventory from O Hee on account for $6,720 plus GST; terms 2/10, n/30. 14 Paid L Cao for 2 July purchase with an interbank transfer. July 15 July 19 July 21 Received $2,415 from ) Ellis in payment of her account. Sold inventory to O Kaddish on account for $5,150 plus GST; terms 2/10, n/30. Received $5,433 from Giola Ltd in payment of its account. Sold inventory to Modra Ltd on account for $4,030 plus GST; terms 2/10, n/30. Paid O Hee for 14 July purchase; cheque no. 125. July Purchased inventory from L Cao on account for $6,160 plus GST; terms 2/15, n/30. July 23 July Sold inventory for cash, $3,250 plus GST. 26 Prepare the following ledger accounts (T format) for July 2016: (Post entries in the order of journal entries presented in the previous part. Round answers to 0 decimal places, e.g. 5,275.) Accounts receivable control 2016 2016 Accounts payable control 2016 2016 Cash at bank 2016 2016 Chee Yong Chaw began his business on 1 July 2016. The business balances its books at month-end and uses special journals and the periodic inventory system. Transactions for July 2016 were as follows: July 1 July 2 July 3 July 6 July 7 July 8 July 10 July 13 July Chee Yong Chaw invested $40,320 cash and $23,520 office equipment into the business. Purchased inventory from L Cao on account for $10,080 plus GST; terms 2/15, n/30. Paid July rental of $4,030 plus GST; by interbank transfer to Prime Properties Ltd. Purchased inventory from Difabio Ltd on account for $8,180 plus GST; terms n/30. Sold inventory to ] Ellis on account for $2,240 plus GST; terms 2/15, n/30. Received July rental of $1,010 plus GST for space sublet to Perth Services. Purchased stationery supplies for $2,240 plus GST; cheque no. 124. Purchased inventory for cash $2,220 plus GST. Sold inventory to Giola Ltd on account for $5,040 plus GST; terms 2/10, n/30. Purchased inventory from O Hee on account for $6,720 plus GST; terms 2/10, n/30. 14 Paid L Cao for 2 July purchase with an interbank transfer. July 15 July 19 July 21 Received $2,415 from ) Ellis in payment of her account. Sold inventory to O Kaddish on account for $5,150 plus GST; terms 2/10, n/30. Received $5,433 from Giola Ltd in payment of its account. Sold inventory to Modra Ltd on account for $4,030 plus GST; terms 2/10, n/30. Paid O Hee for 14 July purchase; cheque no. 125. July Purchased inventory from L Cao on account for $6,160 plus GST; terms 2/15, n/30. July 23 July Sold inventory for cash, $3,250 plus GST. 26 Prepare the following ledger accounts (T format) for July 2016: (Post entries in the order of journal entries presented in the previous part. Round answers to 0 decimal places, e.g. 5,275.) Accounts receivable control 2016 2016 Accounts payable control 2016 2016 Cash at bank 2016 2016