Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chegg has stated that multipart questions are fine to submit, if you are not going to help me obtain the WHOLE answer, please do not

Chegg has stated that multipart questions are fine to submit, if you are not going to help me obtain the WHOLE answer, please do not comment.

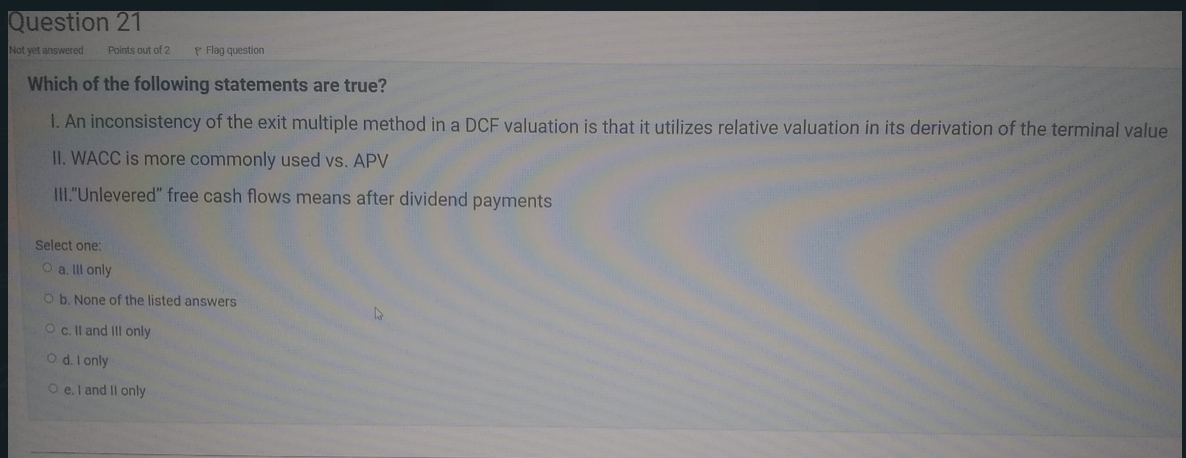

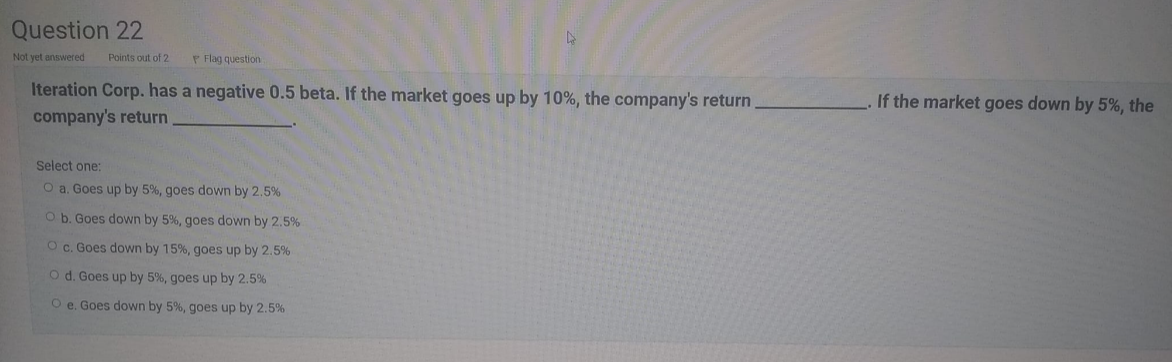

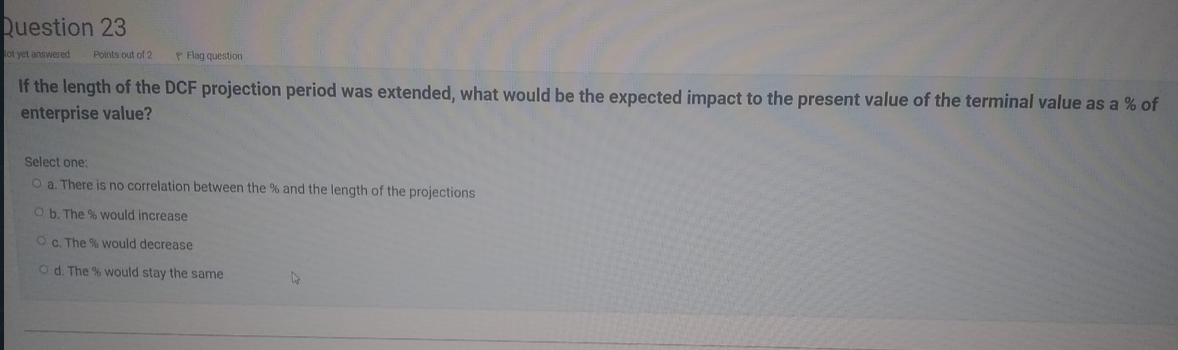

Question 21 Not yet answered Points out of 2 Flag question Which of the following statements are true? 1. An inconsistency of the exit multiple method in a DCF valuation is that it utilizes relative valuation in its derivation of the terminal value II. WACC is more commonly used vs. APV III."Unlevered" free cash flows means after dividend payments Select one: O a. lll only O b. None of the listed answers O c. ll and ill only O d. I only o e. I and II only Question 22 Not yet answered Points out of 2 P Flag question Iteration Corp. has a negative 0.5 beta. If the market goes up by 10%, the company's return company's return If the market goes down by 5%, the Select one: O a. Goes up by 5%, goes down by 2.5% O b. Goes down by 5%, goes down by 2.5% O c. Goes down by 15%, goes up by 2.5% O d. Goes up by 5%, goes up by 2.5% O e. Goes down by 5%, goes up by 2.5% lot yet answered Points out of 2 Question 23 P Flag question If the length of the DCF projection period was extended, what would be the expected impact to the present value of the terminal value as a % of enterprise value? Select one: O a. There is no correlation between the % and the length of the projections O b. The % would increase Oc. The % would decrease O d. The % would stay the sameStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started