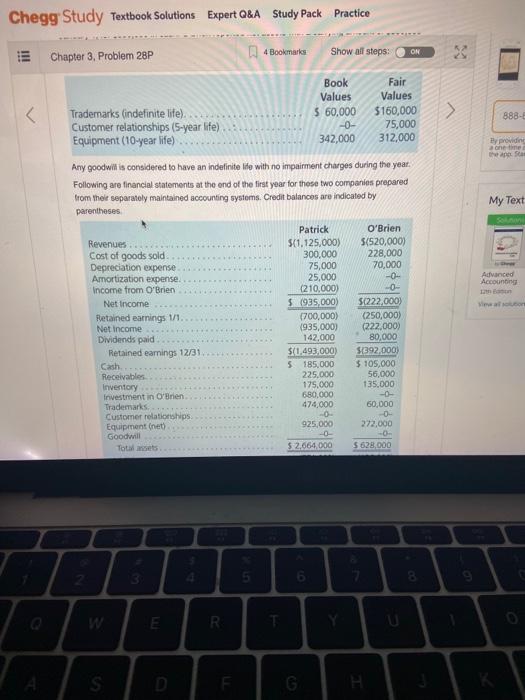

Chegg Study Textbook Solutions Expert Q&A Study Pack Practice E Chapter 3. Problem 28P 4 Bookmarks ON Show off steps: 888- By providing one the near My Text Book Fair Values Values Trademarks (indefinite life). 5 60,000 $160,000 Customer relationships (5-year life) -0- 75,000 Equipment (10-year life) 342,000 312,000 Any goodwill is considered to have an indefinite life with no impairment charges during the year. Following are financial statements at the end of the first year for these two companies prepared from their separately maintained accounting systems. Credit balances are indicated by parentheses Patrick O'Brien Revenues 5(1.125,000) 5(520,000) Cost of goods sold 300,000 228,000 Depreciation expense 75,000 70,000 Amortization expense. 25,000 -0- Income from O'Brien (210,000) -0. Net Income 51935,000 5(222,000 Retained earnings 11. 1700,000) (250,000) Net Income 1935,000) (222,000) Dividends paid 142.000 80,000 Retained earnings 12/31 $(1,493,000) $1892,000) Cash 5185.000 $ 105,000 Receivables 225.000 56,000 Inventory 175.000 135.000 Investment in O'Brien 680,000 -0- Trademarks 474,000 60,000 Customer relationships -0- Equipment (net) 925,000 272,000 Goodwill -0- -0- Totales 5 2,664,000 5628,000 Advanced Accounting aman ima 6. E R. S Chegg Study Textbook Solutions Expert Q&A Study Pack Practice E Chapter 3. Problem 28P 4 Bookmarks ON Show off steps: 888- By providing one the near My Text Book Fair Values Values Trademarks (indefinite life). 5 60,000 $160,000 Customer relationships (5-year life) -0- 75,000 Equipment (10-year life) 342,000 312,000 Any goodwill is considered to have an indefinite life with no impairment charges during the year. Following are financial statements at the end of the first year for these two companies prepared from their separately maintained accounting systems. Credit balances are indicated by parentheses Patrick O'Brien Revenues 5(1.125,000) 5(520,000) Cost of goods sold 300,000 228,000 Depreciation expense 75,000 70,000 Amortization expense. 25,000 -0- Income from O'Brien (210,000) -0. Net Income 51935,000 5(222,000 Retained earnings 11. 1700,000) (250,000) Net Income 1935,000) (222,000) Dividends paid 142.000 80,000 Retained earnings 12/31 $(1,493,000) $1892,000) Cash 5185.000 $ 105,000 Receivables 225.000 56,000 Inventory 175.000 135.000 Investment in O'Brien 680,000 -0- Trademarks 474,000 60,000 Customer relationships -0- Equipment (net) 925,000 272,000 Goodwill -0- -0- Totales 5 2,664,000 5628,000 Advanced Accounting aman ima 6. E R. S