Question

CHENARD CORPORATION Statement of Cash Flows For the Year Ended December 31, 2017 Cash flows from operating activities Net income $269,100 Adjustments to reconcile net

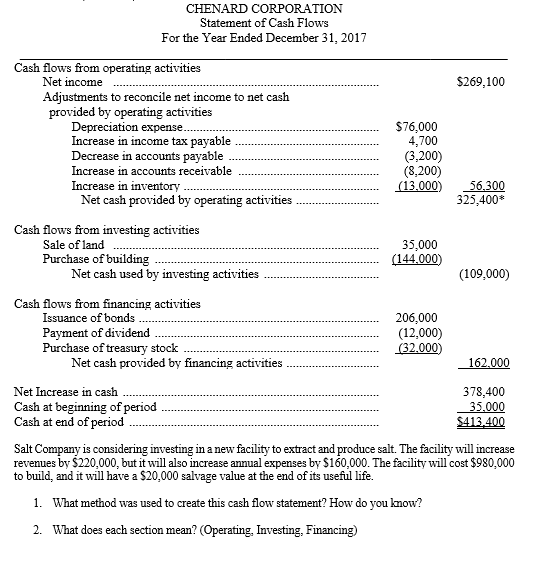

CHENARD CORPORATION

Statement of Cash Flows For the Year Ended December 31, 2017

Cash flows from operating activities Net income $269,100 Adjustments to reconcile net income to net cash provided by operating activities

Depreciation expense $76,000 Increase in income tax payable 4,700 Decrease in accounts payable (3,200) Increase in accounts receivable (8,200) Increase in inventory (13,000) 56,300 Net cash provided by operating activities 325,400* Cash flows from investing activities Sale of land 35,000 Purchase of building (144,000) Net cash used by investing activities (109,000) Cash flows from financing activities Issuance of bonds 206,000 Payment of dividend (12,000) Purchase of treasury stock (32,000) Net cash provided by financing activities 162,000 Net Increase in cash 378,400 Cash at beginning of period 35,000 Cash at end of period $413,400 Salt Company is considering investing in a new facility to extract and produce salt. The facility will increase revenues by $220,000, but it will also increase annual expenses by $160,000. The facility will cost $980,000 to build, and it will have a $20,000 salvage value at the end of its useful life. 1. What method was used to create this cash flow statement? How do you know? 2. What does each section mean? (Operating, Investing, Financing)

Depreciation expense $76,000 Increase in income tax payable 4,700 Decrease in accounts payable (3,200) Increase in accounts receivable (8,200) Increase in inventory (13,000) 56,300 Net cash provided by operating activities 325,400* Cash flows from investing activities Sale of land 35,000 Purchase of building (144,000) Net cash used by investing activities (109,000) Cash flows from financing activities Issuance of bonds 206,000 Payment of dividend (12,000) Purchase of treasury stock (32,000) Net cash provided by financing activities 162,000 Net Increase in cash 378,400 Cash at beginning of period 35,000 Cash at end of period $413,400 Salt Company is considering investing in a new facility to extract and produce salt. The facility will increase revenues by $220,000, but it will also increase annual expenses by $160,000. The facility will cost $980,000 to build, and it will have a $20,000 salvage value at the end of its useful life. 1. What method was used to create this cash flow statement? How do you know? 2. What does each section mean? (Operating, Investing, Financing)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started