Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cherry Blossom Designs is in its first year of operations as a retailer of home goods. It specializing in selling goods handcrafted in the U.S.,

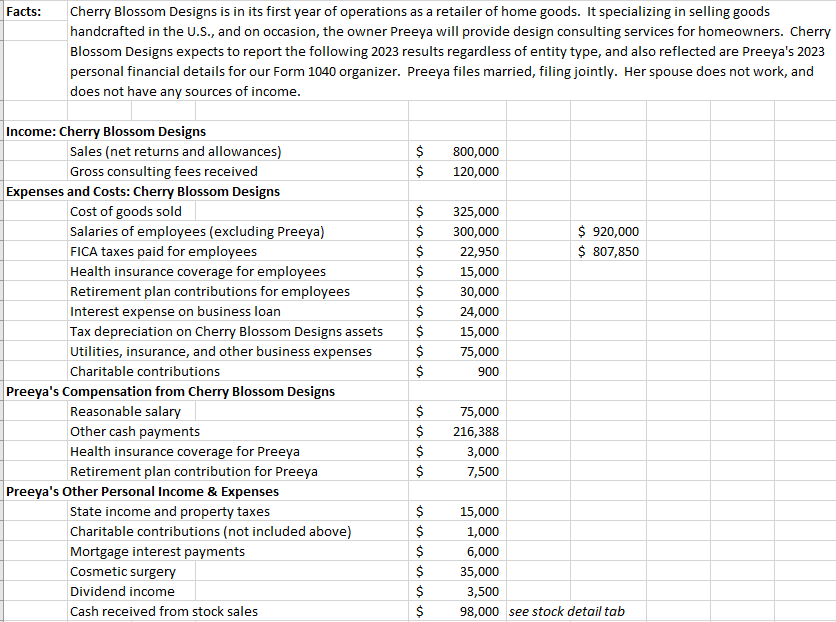

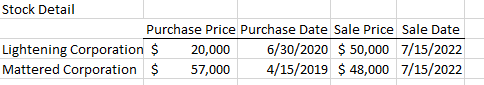

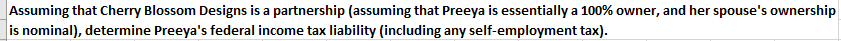

Cherry Blossom Designs is in its first year of operations as a retailer of home goods. It specializing in selling goods handcrafted in the U.S., and on occasion, the owner Preeya will provide design consulting services for homeowners. Cherry Blossom Designs expects to report the following 2023 results regardless of entity type, and also reflected are Preeya's 2023 Stock Detail \begin{tabular}{l|l|r|r|r|r|} & \multicolumn{2}{c}{ Purchase Price Purchase Date Sale Price } & Sale Date \\ \hline Lightening Corporation $ & 20,000 & 6/30/2020 & $50,000 & 7/15/2022 \\ \hline Mattered Corporation $ & 57,000 & 4/15/2019 & $48,000 & 7/15/2022 \end{tabular} Assuming that Cherry Blossom Designs is a partnership (assuming that Preeya is essentially a 100% owner, and her spouse's ownership is nominal), determine Preeya's federal income tax liability (including any self-employment tax). Cherry Blossom Designs is in its first year of operations as a retailer of home goods. It specializing in selling goods handcrafted in the U.S., and on occasion, the owner Preeya will provide design consulting services for homeowners. Cherry Blossom Designs expects to report the following 2023 results regardless of entity type, and also reflected are Preeya's 2023 Stock Detail \begin{tabular}{l|l|r|r|r|r|} & \multicolumn{2}{c}{ Purchase Price Purchase Date Sale Price } & Sale Date \\ \hline Lightening Corporation $ & 20,000 & 6/30/2020 & $50,000 & 7/15/2022 \\ \hline Mattered Corporation $ & 57,000 & 4/15/2019 & $48,000 & 7/15/2022 \end{tabular} Assuming that Cherry Blossom Designs is a partnership (assuming that Preeya is essentially a 100% owner, and her spouse's ownership is nominal), determine Preeya's federal income tax liability (including any self-employment tax)

Cherry Blossom Designs is in its first year of operations as a retailer of home goods. It specializing in selling goods handcrafted in the U.S., and on occasion, the owner Preeya will provide design consulting services for homeowners. Cherry Blossom Designs expects to report the following 2023 results regardless of entity type, and also reflected are Preeya's 2023 Stock Detail \begin{tabular}{l|l|r|r|r|r|} & \multicolumn{2}{c}{ Purchase Price Purchase Date Sale Price } & Sale Date \\ \hline Lightening Corporation $ & 20,000 & 6/30/2020 & $50,000 & 7/15/2022 \\ \hline Mattered Corporation $ & 57,000 & 4/15/2019 & $48,000 & 7/15/2022 \end{tabular} Assuming that Cherry Blossom Designs is a partnership (assuming that Preeya is essentially a 100% owner, and her spouse's ownership is nominal), determine Preeya's federal income tax liability (including any self-employment tax). Cherry Blossom Designs is in its first year of operations as a retailer of home goods. It specializing in selling goods handcrafted in the U.S., and on occasion, the owner Preeya will provide design consulting services for homeowners. Cherry Blossom Designs expects to report the following 2023 results regardless of entity type, and also reflected are Preeya's 2023 Stock Detail \begin{tabular}{l|l|r|r|r|r|} & \multicolumn{2}{c}{ Purchase Price Purchase Date Sale Price } & Sale Date \\ \hline Lightening Corporation $ & 20,000 & 6/30/2020 & $50,000 & 7/15/2022 \\ \hline Mattered Corporation $ & 57,000 & 4/15/2019 & $48,000 & 7/15/2022 \end{tabular} Assuming that Cherry Blossom Designs is a partnership (assuming that Preeya is essentially a 100% owner, and her spouse's ownership is nominal), determine Preeya's federal income tax liability (including any self-employment tax) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started