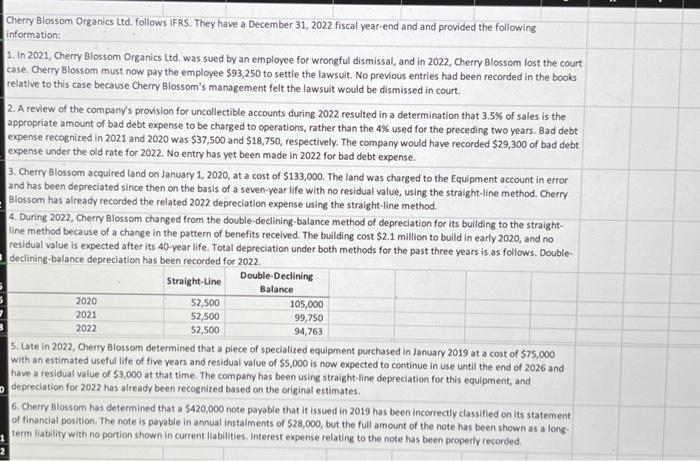

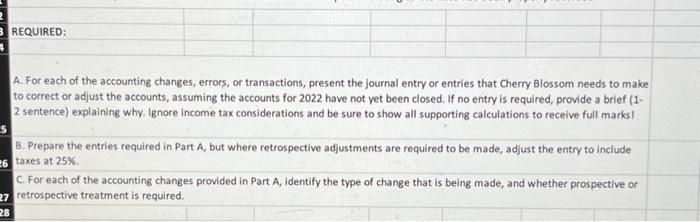

Cherry Blossom Organics Ltd. follows IFRS. They have a December 31, 2022 fiscal year-end and and provided the following information: 1. In 2021, Cherry Blossom Organics Ltd, was sued by an employee for wrongful dismissal, and in 2022, Cherry Blossom lost the court case. Cherry Blossom must now pay the employee $93,250 to settle the lawsuit. No previous entries had been recorded in the books relative to this case because Cherry Blossom's management felt the lawsuit would be dismissed in court. 2. A review of the company's provision for uncollectible accounts during 2022 resulted in a determination that 3.5% of sales is the appropriate amount of bad debt expense to be charged to operations, rather than the 4% used for the preceding two years. Bad debt expense recognized in 2021 and 2020 was $37,500 and $18,750, respectively. The company would have recorded $29,300 of bad debt expense under the old rate for 2022 . No entry has yet been made in 2022 for bad debt expense. 3. Cherry Blossom acquired land on January 1, 2020, at a cost of $133,000. The land was charged to the Equipment account in error and has been depreciated since then on the basis of a seven-year life with no residual value, using the straight-line method. Cherry Blossom has already recorded the related 2022 depreciation expense using the straight-line method. 4. During 2022, Cherry Blossom changed from the double-declining-balance method of depreciation for its bullding to the straightline method because of a change in the pattern of benefits recelved. The building cost $2.1 million to build in early 2020 , and no residual value is expected after its 40 -year life. Total depreciation under both methods for the past three years is as follows. Doubledeclining-balance depreciation has been recorded for 2022 . 5. Late in 2022, Cherry Blossom determined that a piece of specialized equipment purchased in January 2019 at a cost of 575,000 with an estimated useful life of five years and residual value of $5,000 is now expected to continue in use until the end of 2026 and have a residual value of $3,000 at that time. The company has been using straight-line depreciation for this equipment, and depreciation for 2022 has alreody been recognired based on the original estimates. 6. Cherry Blossom has determined that a $420,000 note payable that it issued in 2019 has been incorrectly classified on its statement of financial position. The note is payable in annual instalments of $28,000, but the full amount of the note has been shown as a longterm liability with no portion shown in current liabilities. Interest expense relating to the note has been properly recorded. A. For each of the accounting changes, errors, or transactions, present the journal entry or entries that Cherry Blossom needs to make to correct or adjust the accounts, assuming the accounts for 2022 have not yet been closed. If no entry is required, provide a brief (12 sentence) explaining why. Ignore income tax considerations and be sure to show all supporting calculations to receive full marks! B. Prepare the entries required in Part A, but where retrospective adjustments are required to be made, adjust the entry to include taxes at 2.5%. C. For each of the accounting changes provided in Part A, identify the type of change that is being made, and whether prospective or retrospective treatment is required