Cheryl Colby, CFO of Charming Florist Ltd., has created the firms pro forma balance sheet for the next fiscal year. Sales are projected to grow by 10 percent to $440 million. Current assets, fixed assets, and short-term debt are 15 percent, 75 percent, and 5 percent of sales, respectively. The company pays out 25 percent of its net income in dividends. The company currently has $123 million of long-term debt, and $51 million in common stock par value. The profit margin is 8 percent.

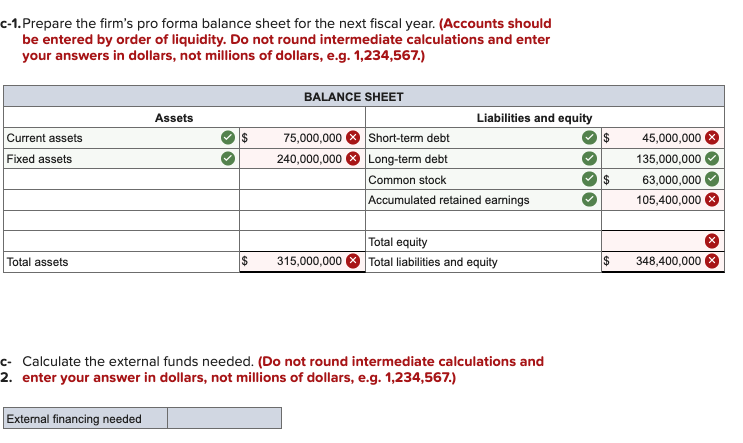

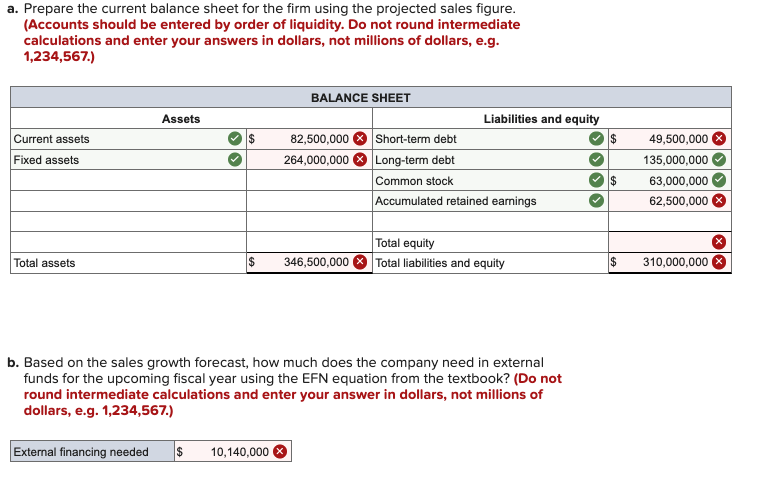

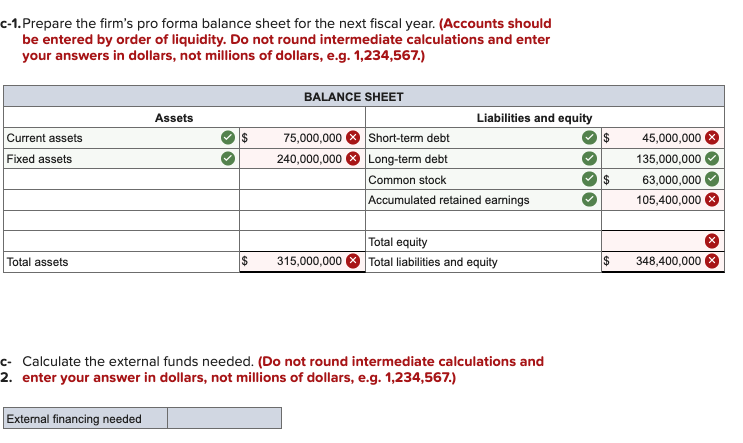

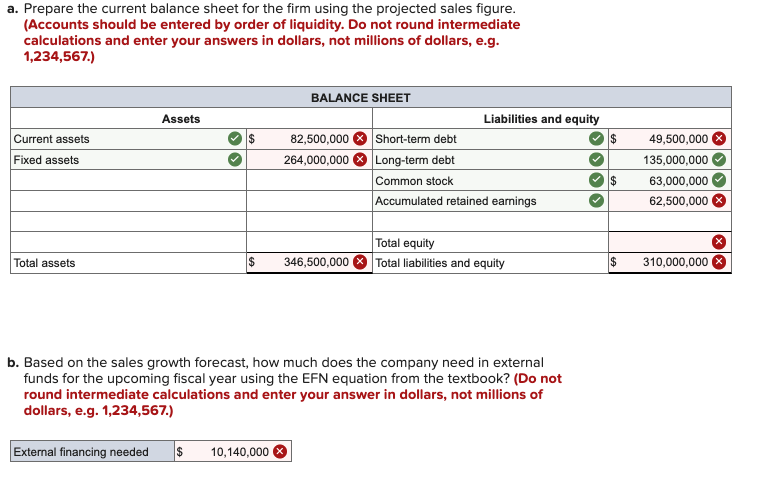

c-1. Prepare the firm's pro forma balance sheet for the next fiscal year. (Accounts should be entered by order of liquidity. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g. 1,234,567.) Current assets Fixed assets Total assets Assets External financing needed $ $ BALANCE SHEET 75,000,000 240,000,000 315,000,000 Liabilities and equity Short-term debt Long-term debt Common stock Accumulated retained earnings Total equity Total liabilities and equity c- Calculate the external funds needed. (Do not round intermediate calculations and 2. enter your answer in dollars, not millions of dollars, e.g. 1,234,567.) $ $ $ 45,000,000 135,000,000 63,000,000 105,400,000 348,400,000 a. Prepare the current balance sheet for the firm using the projected sales figure. (Accounts should be entered by order of liquidity. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g. 1,234,567.) Current assets Fixed assets Total assets Assets $ BALANCE SHEET 82,500,000 264,000,000 $ 346,500,000 External financing needed $ 10,140,000 Liabilities and equity Short-term debt Long-term debt Common stock Accumulated retained earnings Total equity Total liabilities and equity b. Based on the sales growth forecast, how much does the company need in external funds for the upcoming fiscal year using the EFN equation from the textbook? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g. 1,234,567.) $ $ 49,500,000 135,000,000 63,000,000 62,500,000 $ 310,000,000 c-1. Prepare the firm's pro forma balance sheet for the next fiscal year. (Accounts should be entered by order of liquidity. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g. 1,234,567.) Current assets Fixed assets Total assets Assets External financing needed $ $ BALANCE SHEET 75,000,000 240,000,000 315,000,000 Liabilities and equity Short-term debt Long-term debt Common stock Accumulated retained earnings Total equity Total liabilities and equity c- Calculate the external funds needed. (Do not round intermediate calculations and 2. enter your answer in dollars, not millions of dollars, e.g. 1,234,567.) $ $ $ 45,000,000 135,000,000 63,000,000 105,400,000 348,400,000 a. Prepare the current balance sheet for the firm using the projected sales figure. (Accounts should be entered by order of liquidity. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g. 1,234,567.) Current assets Fixed assets Total assets Assets $ BALANCE SHEET 82,500,000 264,000,000 $ 346,500,000 External financing needed $ 10,140,000 Liabilities and equity Short-term debt Long-term debt Common stock Accumulated retained earnings Total equity Total liabilities and equity b. Based on the sales growth forecast, how much does the company need in external funds for the upcoming fiscal year using the EFN equation from the textbook? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g. 1,234,567.) $ $ 49,500,000 135,000,000 63,000,000 62,500,000 $ 310,000,000