Chester has negotiated a new labor contract for the next round that will affect the cost for their product Coat. Labor costs will go from $7.91 to $8.51 per unit. Assume all period and other variable costs remain the same. If Chester were to absorb the new labor costs without passing them on in the form of higher prices, how many units of product Coat would need to be sold next round to break even on the product? Chester has negotiated a new labor contract for the next round that will affect the cost for their product Coat. Labor costs will go from $7.91 to $8.51 per unit. Assume all period and other variable costs remain the same. If Chester were to absorb the new labor costs without passing them on in the form of higher prices, how many units of product Coat would need to be sold next round to break even on the product? |

| Select: 1 |

| |

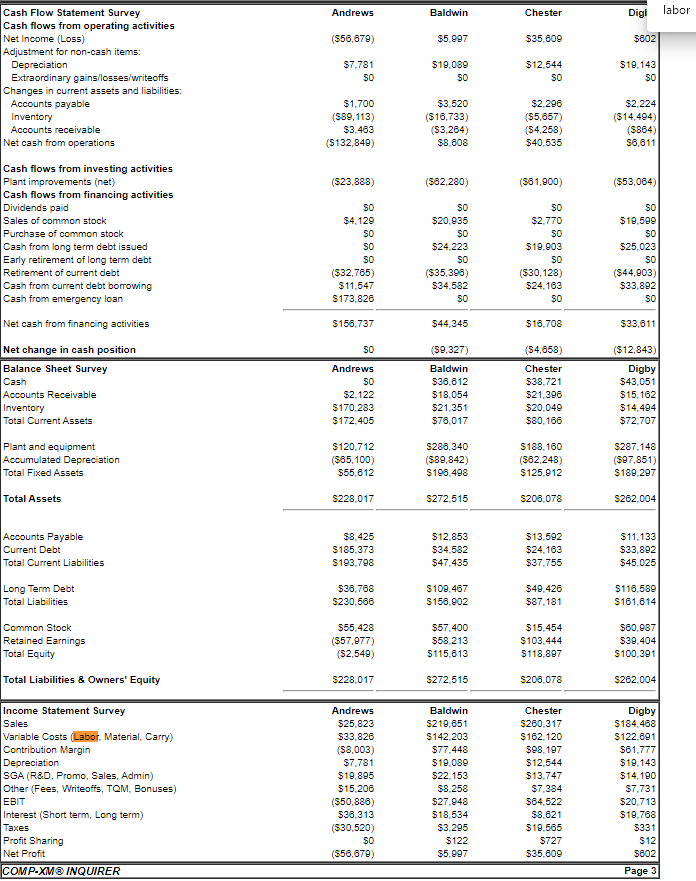

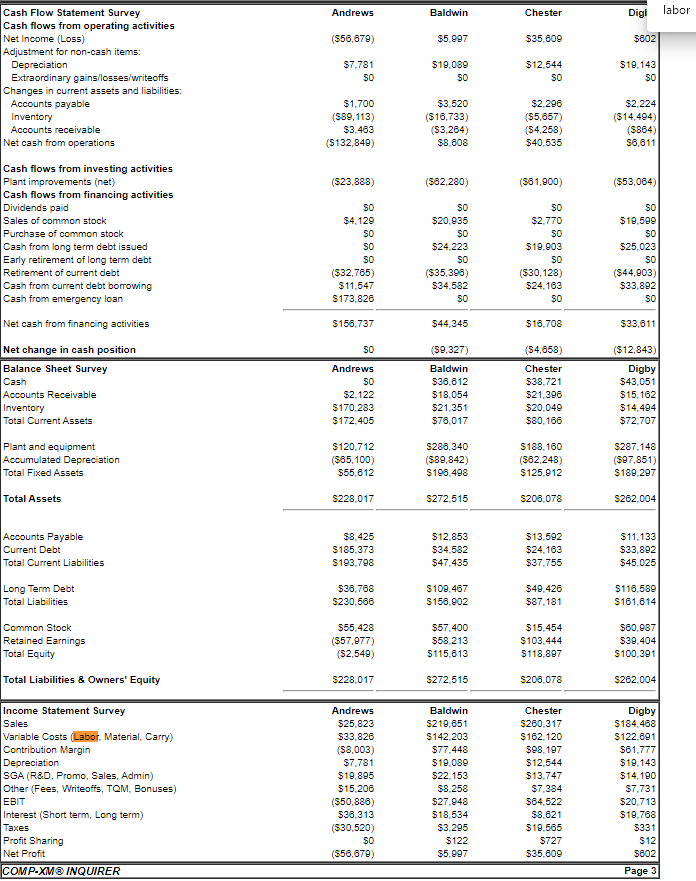

Andrews Baldwin Chester Dig! labor ($56,679) $5.997 $35.809 $802 Cash Flow Statement Survey Cash flows from operating activities Net Income (Loss) Adjustment for non-cash items: Depreciation Extraordinary gains/losses/writeoffs Changes in current assets and liabilities: Accounts payable Inventory Accounts receivable Net cash from operations $7.781 SO $19.089 SO $12.544 SO $19.143 SO $1.700 (889,113) $3.463 ($132.849) $3.520 ($16.733) ($3,264) $8.608 $2.296 ($5,657) (54.258) $40.535 $2,224 ($14.494) (5864) 30.611 ($23.888) ($62,280) ($81.900) ($53,064) Cash flows from investing activities Plant improvements (net) Cash flows from financing activities Dividends paid Sales of common stock Purchase of common stock Cash from long term debt issued Early retirement of long term debt Retirement of current debt Cash from current debt borrowing Cash from emergency loan SO $4,129 SO SO SO ($32,765) $11.547 $173.826 SO $20.935 SO $24.223 SO ($35,398) $34,582 SO SO $2.770 SO $19.903 SO ($30.128) $24.163 SO SO $19.599 SO $25,023 SO ($44,003) $33,892 SO Net cash from financing activities $158.737 $44,345 $16.708 $33,611 Net change in cash position SO (54,658) ($12.843) Balance Sheet Survey Cash Accounts Receivable Inventory Total Current Assets Andrews SO $2.122 $170,283 $172.405 (59,327) Baldwin $38.612 $18,054 $21.351 $78.017 Chester $38.721 $21,396 $20.049 $80.166 Digby $43.051 $15.162 $14.494 $72.707 Plant and equipment Accumulated Depreciation Total Fixed Assets $120.712 (565,100) $55,612 $288.340 ($89,842) $198.498 S188.160 ($62,248) $125.912 $287.148 ($97,851) $189.297 Total Assets S228,017 S272,515 S208.078 $262.004 Accounts Payable Current Debt Total Current Liabilities $8.425 $185.373 $193.798 $12.853 $34,582 $47.435 $13,592 $24.163 $37.755 $11.133 $33.892 $45.025 Long Term Debt Total Liabilities $36.768 $230.566 $109.487 $158.902 $40.426 $87.181 $116.589 $161.814 Common Stock Retained Earnings Total Equity $55.428 (557,977) ($2,549) $57.400 $58.213 $115,613 $15.454 $103.444 $118.897 $60.987 $39.404 $100,391 Total Liabilities & Owners' Equity S228.017 $272.515 S205.078 $262.004 Income Statement Survey Sales Variable Costs Labor. Material. Carry) Contribution Margin Depreciation SGA (R&D Promo, Sales, Admin) Other (Fees, Writeoffs, TQM. Bonuses) EBIT Interest (Short term, Long term) Taxes Profit Sharing Net Profit COMP-XM INQUIRER Andrews $25,823 $33.826 ($8,003) $7.781 $19.895 $15.200 ($50,886) $36.313 ($30,520) SO ($56,679) Baldwin $219.651 S142 203 $77.448 $19.089 $22.153 $8,258 $27.048 $18.534 $3.295 S122 $5.997 Chester $280.317 $162.120 $98.197 $12.544 $13.747 $7,384 $64.522 $8.821 $19.565 $727 $35,609 Digby $184.468 $122.691 $61.777 $19.143 $14.190 $7.731 $20.713 $19.768 $331 $12 $802 Page 3 Andrews Baldwin Chester Dig! labor ($56,679) $5.997 $35.809 $802 Cash Flow Statement Survey Cash flows from operating activities Net Income (Loss) Adjustment for non-cash items: Depreciation Extraordinary gains/losses/writeoffs Changes in current assets and liabilities: Accounts payable Inventory Accounts receivable Net cash from operations $7.781 SO $19.089 SO $12.544 SO $19.143 SO $1.700 (889,113) $3.463 ($132.849) $3.520 ($16.733) ($3,264) $8.608 $2.296 ($5,657) (54.258) $40.535 $2,224 ($14.494) (5864) 30.611 ($23.888) ($62,280) ($81.900) ($53,064) Cash flows from investing activities Plant improvements (net) Cash flows from financing activities Dividends paid Sales of common stock Purchase of common stock Cash from long term debt issued Early retirement of long term debt Retirement of current debt Cash from current debt borrowing Cash from emergency loan SO $4,129 SO SO SO ($32,765) $11.547 $173.826 SO $20.935 SO $24.223 SO ($35,398) $34,582 SO SO $2.770 SO $19.903 SO ($30.128) $24.163 SO SO $19.599 SO $25,023 SO ($44,003) $33,892 SO Net cash from financing activities $158.737 $44,345 $16.708 $33,611 Net change in cash position SO (54,658) ($12.843) Balance Sheet Survey Cash Accounts Receivable Inventory Total Current Assets Andrews SO $2.122 $170,283 $172.405 (59,327) Baldwin $38.612 $18,054 $21.351 $78.017 Chester $38.721 $21,396 $20.049 $80.166 Digby $43.051 $15.162 $14.494 $72.707 Plant and equipment Accumulated Depreciation Total Fixed Assets $120.712 (565,100) $55,612 $288.340 ($89,842) $198.498 S188.160 ($62,248) $125.912 $287.148 ($97,851) $189.297 Total Assets S228,017 S272,515 S208.078 $262.004 Accounts Payable Current Debt Total Current Liabilities $8.425 $185.373 $193.798 $12.853 $34,582 $47.435 $13,592 $24.163 $37.755 $11.133 $33.892 $45.025 Long Term Debt Total Liabilities $36.768 $230.566 $109.487 $158.902 $40.426 $87.181 $116.589 $161.814 Common Stock Retained Earnings Total Equity $55.428 (557,977) ($2,549) $57.400 $58.213 $115,613 $15.454 $103.444 $118.897 $60.987 $39.404 $100,391 Total Liabilities & Owners' Equity S228.017 $272.515 S205.078 $262.004 Income Statement Survey Sales Variable Costs Labor. Material. Carry) Contribution Margin Depreciation SGA (R&D Promo, Sales, Admin) Other (Fees, Writeoffs, TQM. Bonuses) EBIT Interest (Short term, Long term) Taxes Profit Sharing Net Profit COMP-XM INQUIRER Andrews $25,823 $33.826 ($8,003) $7.781 $19.895 $15.200 ($50,886) $36.313 ($30,520) SO ($56,679) Baldwin $219.651 S142 203 $77.448 $19.089 $22.153 $8,258 $27.048 $18.534 $3.295 S122 $5.997 Chester $280.317 $162.120 $98.197 $12.544 $13.747 $7,384 $64.522 $8.821 $19.565 $727 $35,609 Digby $184.468 $122.691 $61.777 $19.143 $14.190 $7.731 $20.713 $19.768 $331 $12 $802 Page 3

Chester has negotiated a new labor contract for the next round that will affect the cost for their product Coat. Labor costs will go from $7.91 to $8.51 per unit. Assume all period and other variable costs remain the same. If Chester were to absorb the new labor costs without passing them on in the form of higher prices, how many units of product Coat would need to be sold next round to break even on the product?

Chester has negotiated a new labor contract for the next round that will affect the cost for their product Coat. Labor costs will go from $7.91 to $8.51 per unit. Assume all period and other variable costs remain the same. If Chester were to absorb the new labor costs without passing them on in the form of higher prices, how many units of product Coat would need to be sold next round to break even on the product?