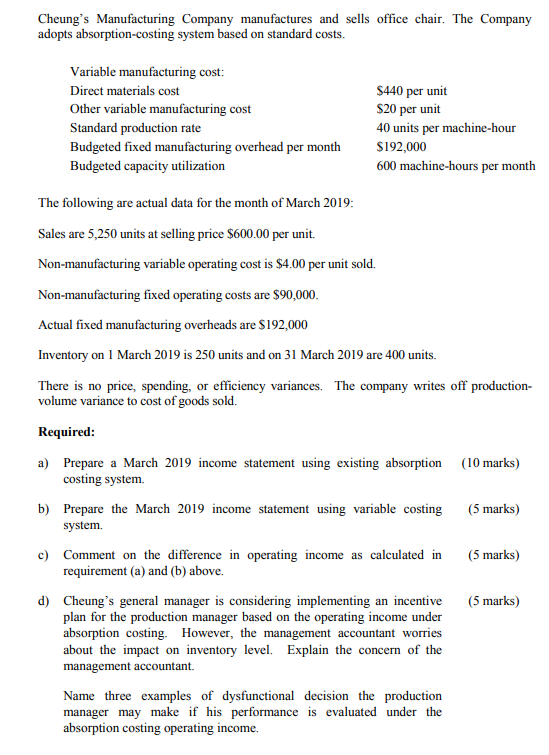

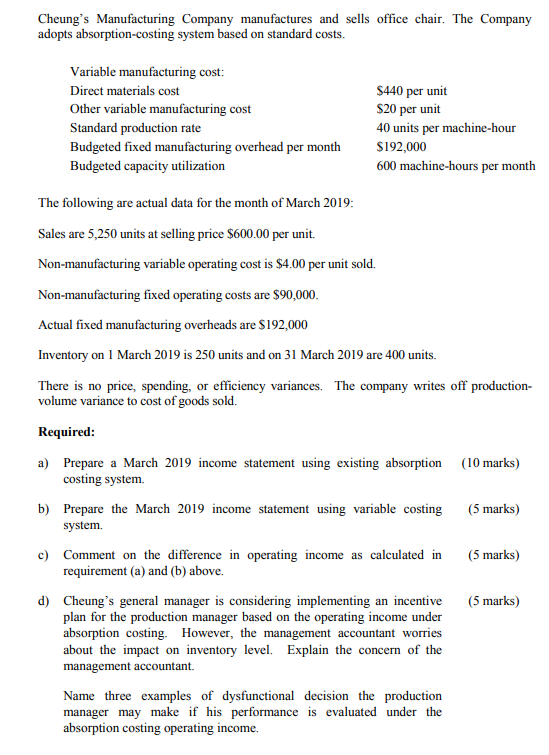

Cheung's Manufacturing Company manufactures and sells office chair. The Company adopts absorption-costing system based on standard costs. Variable manufacturing cost: Direct materials cost Other variable manufacturing cost Standard production rate Budgeted fixed manufacturing overhead per month Budgeted capacity utilization S440 per unit S20 per unit 40 units per machine-hour S192,000 600 machine-hours per month The following are actual data for the month of March 2019 Sales are 5,250 units at selling price $600.00 per unit. Non-manufacturing variable operating cost is $4.00 per unit sold. Non-manufacturing fixed operating costs are $90,000 Actual fixed manufacturing overheads are S192,000 Inventory on 1 March 2019 is 250 units and on 31 March 2019 are 400 units. There is no price, spending, or efficiency variances. The company writes off production- volume variance to cost of goods sold. Required a) Prepare a March 2019 income statement using existing absorption (10 marks) costing system. b) Prepare the March 2019 income statement using variable costing 5 marks) system. c) Comment on the difference in operating income as calculated in 5 marks) requirement (a) and (b) above. d) Cheung's general manager is considering implementing an incentive 5 marks) plan for the production manager based on the operating income under absorption costing. However, the management accountant worries about the impact on inventory level. Explain the concern of the management accountant. Name three examples of dysfunctional decision the production manager may make if his performance is evaluated under the absorption costing operating income. Cheung's Manufacturing Company manufactures and sells office chair. The Company adopts absorption-costing system based on standard costs. Variable manufacturing cost: Direct materials cost Other variable manufacturing cost Standard production rate Budgeted fixed manufacturing overhead per month Budgeted capacity utilization S440 per unit S20 per unit 40 units per machine-hour S192,000 600 machine-hours per month The following are actual data for the month of March 2019 Sales are 5,250 units at selling price $600.00 per unit. Non-manufacturing variable operating cost is $4.00 per unit sold. Non-manufacturing fixed operating costs are $90,000 Actual fixed manufacturing overheads are S192,000 Inventory on 1 March 2019 is 250 units and on 31 March 2019 are 400 units. There is no price, spending, or efficiency variances. The company writes off production- volume variance to cost of goods sold. Required a) Prepare a March 2019 income statement using existing absorption (10 marks) costing system. b) Prepare the March 2019 income statement using variable costing 5 marks) system. c) Comment on the difference in operating income as calculated in 5 marks) requirement (a) and (b) above. d) Cheung's general manager is considering implementing an incentive 5 marks) plan for the production manager based on the operating income under absorption costing. However, the management accountant worries about the impact on inventory level. Explain the concern of the management accountant. Name three examples of dysfunctional decision the production manager may make if his performance is evaluated under the absorption costing operating income