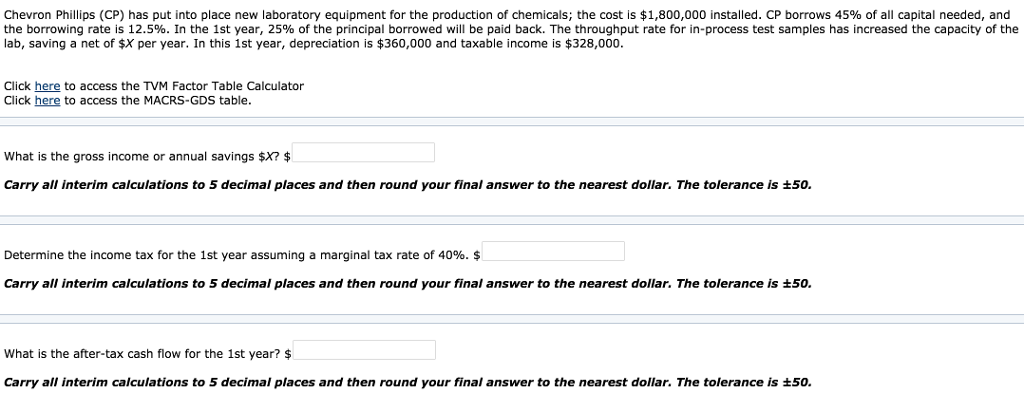

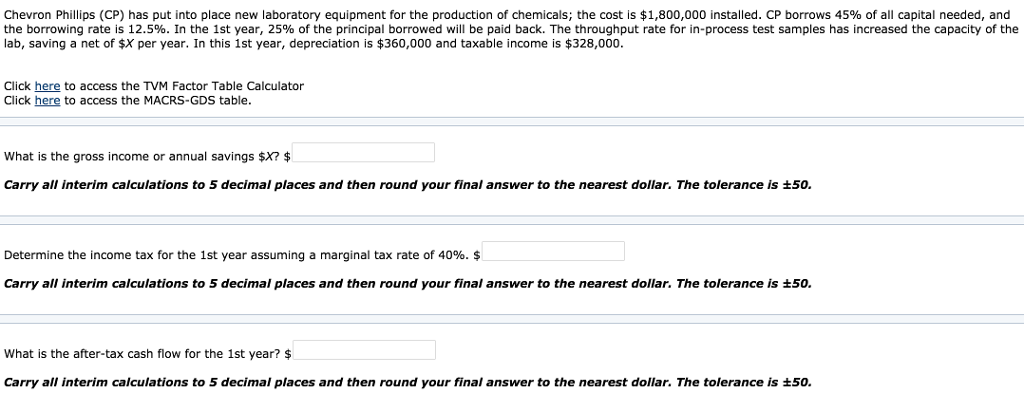

Chevron Phillips (CP) has put into place new laboratory equipment for the production of chemicals; the cost is $1,800,000 installed. CP borrows 45% of all capital needed, and the borrowing rate is 12.5%. In the 1st year, 25% of the principal borrowed will be paid back. The throughput rate for in-process test samples has increased the capacity of the lab, saving a net of $X per year. In this 1st year, depreciation is $360,000 and taxable income is $328,000 Click here to access the TVM Factor Table Calculator Click here to access the MACRS-GDS table what is the gross income or annual savings SX? Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is 50. Determine the income tax for the 1st year assuming a marginal tax rate of 40%. $ Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is 50. What is the after-tax cash flow for the 1st year? $ carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is 50. Chevron Phillips (CP) has put into place new laboratory equipment for the production of chemicals; the cost is $1,800,000 installed. CP borrows 45% of all capital needed, and the borrowing rate is 12.5%. In the 1st year, 25% of the principal borrowed will be paid back. The throughput rate for in-process test samples has increased the capacity of the lab, saving a net of $X per year. In this 1st year, depreciation is $360,000 and taxable income is $328,000 Click here to access the TVM Factor Table Calculator Click here to access the MACRS-GDS table what is the gross income or annual savings SX? Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is 50. Determine the income tax for the 1st year assuming a marginal tax rate of 40%. $ Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is 50. What is the after-tax cash flow for the 1st year? $ carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is 50