Question

Chill Lemonade Inc. Chill Lemonade Inc. is a beverage manufacturer in Vancouver, British Columbia who is in the process of a major expansion and is

Chill Lemonade Inc.

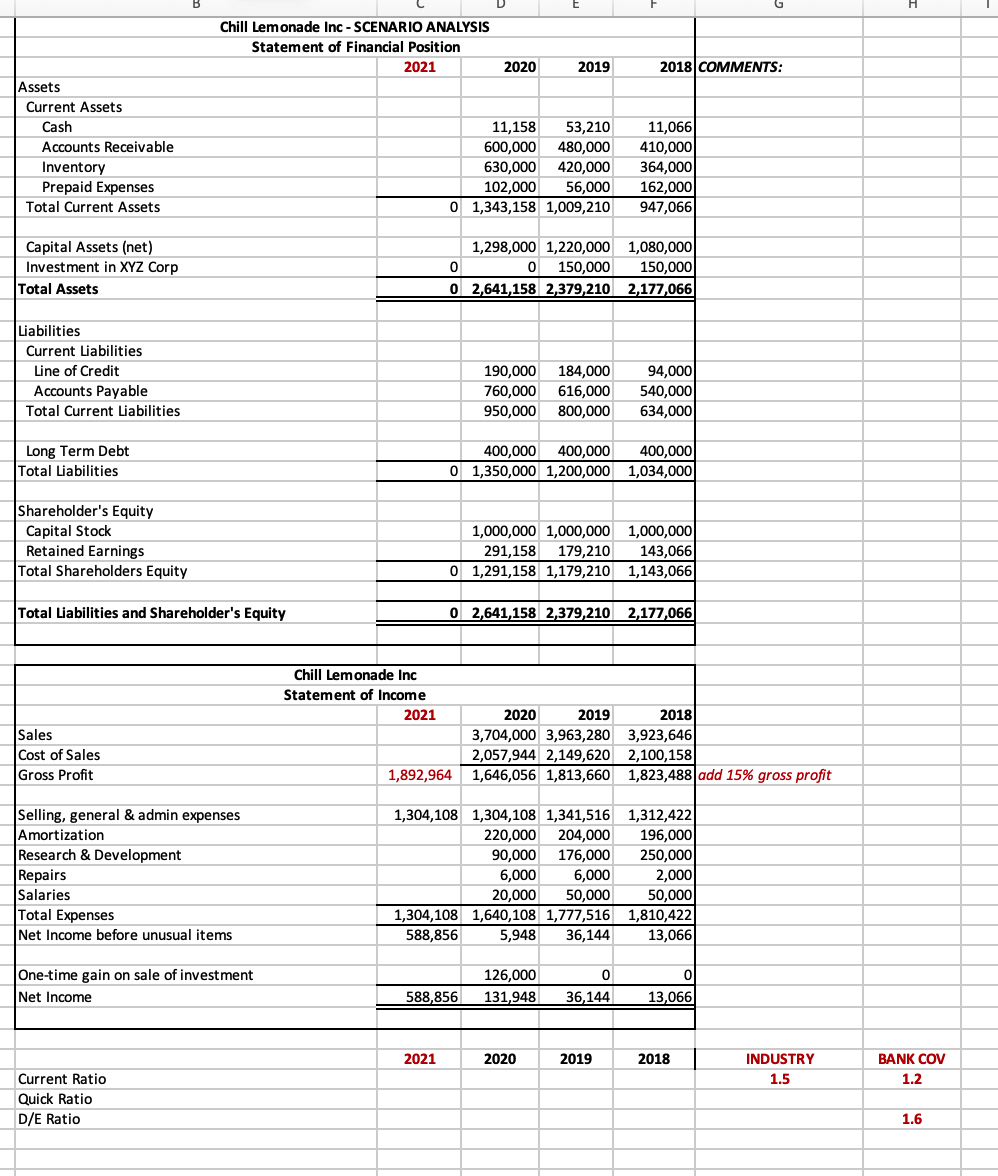

Chill Lemonade Inc. is a beverage manufacturer in Vancouver, British Columbia who is in the process of a major expansion and is looking into bank financing for the acquisition of manufacturing equipment to be used in its lemonade-making facilities. The new acquisition is estimated to increase gross profit by 15%.

Chills cash cycle is tight; although its sales and production have expanded considerably, over the past 10 years, liquidity is less than the industry average of 1.5. All its other key ratios are good, which is what is allowing Chill to consider financing an expansion.

The founder and major shareholder of Chill, Sebastian, is concerned about maintaining a healthy current ratio and debt to equity ratio as he believes this will be important in the future, and the minority shareholders have shown some concern over these ratios in the past.

Chill has hired you to assist in exploring various alternatives available to the company, described below. They have asked for a detailed analysis with any impact these choices will have on the financial statements, along with any qualitative impacts you deem appropriate in the circumstances.

DETAILS:

- The company intends to purchase a bottling beverage machine on January 1, 2021 that can bottle 100 cases of lemonade per minute. The fair value of this machine is $500,000. The machine is expected to have a useful life of 10 years after which it could be sold for $50,000.

The bank will agree to a loan for the machine providing the debt to equity ratio does not increase above 1.6 and the current ratio is maintained at a minimum of 1.2. If a loan is granted interest is to be paid annually at a fixed rate of 6%. Payments will be fixed at $8,300 per month plus $2,500 interest per month.

- During the year, a visitor to the facility slipped and fell on some spilled lemonade and broke their leg. They have subsequently sued Chill for $800,000. Chills lawyers believe there is a 20% chance it will be dismissed, a 60% chance that Chill will have to pay $200,000, and a 20% chance it will have to pay

$400,000. The lawsuit will be settled by the end of the current period (2021).

- Chill is considering promoting a contest with a coupon that is attached to each lemonade product. Any customer who collects five coupons may send them to Chill and redeem them for a CHILL t-shirt. The contest would be open until the end of the current period 2021). It is estimated that all the coupons will be redeemed as this has been a successful promotion in the past. Total value of the coupons are

$150,000. Chill would like advice on whether or not to proceed with the contest.

The Companys Financial Statements are provided on the next page to assist with your analysis. For the purpose of this case, assume that the Balance Sheet and Income Statement for 2021 are the same as 2020 except for the inclusion of any new details as deemed required from the information presented above.

Required: Using the critical analysis outline, provide your analysis and recommendations to Chill. In the analysis, remember to consider the following:

*Use the Excel Template provided in order to create the Pro-forma 2021 financial statements pertaining to your recommendations. (You may need to add additional line items to your financial statements if they do not already exist!) In order to help you to make your decision, you may wish to create multiple scenarios of your proforma statements (based on choices in #2 and #3) in order to determine which option provides the optimal outcome for Chill.

*Remember to re-calculate the ratios in order to make your recommendation!

*Probability Calculation: To calculate the probability of an outcome using the following formula:

= (% x value of first outcome) + (% x value of second outcome) + (% x value of third outcome)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started