Question

Chim & Co, a US MNC, is considering an investment project in Sydney, Australia. The project required an initial investment cost of 1 million AUD;

Chim & Co, a US MNC, is considering an investment project in Sydney, Australia. The project required an initial investment cost of 1 million AUD; the AUD is currently value at $0.7/AUD. In the first two years, the project is expected to generate 700,000 AUD each year. After two years, Chim and Co will terminate the project with the expected salvage value is 300,000 AUD. The discount rate of the project is 12 percent. Given the following information. Currently there is no withholding tax on the dividend remittance to the United States, but there is a 20 percent chance that host government will impose a withholding tax of 10% There is a 50 percent chance that the salvage value will 100,000 AUD instead of 300,000 AUD. The Australian dollars is expected to remain stable over the next two years. a) Determine the NPV of the project for each of the possible scenarios b) Compute the expected NPV of the project and make a recommendation to Chim & Co regarding its feasibility. Please show the working.

.d) Chim and Co also has a wholly owned subsidiary in France. Use the following information to translate financial statement of the French subsidiary using the Monetary/ Non-Monetary and the current rate method. methods. (4 points) Assumption: The subsidiary is at the end of its first year of operation The historical exchange rate is $1.60/ and the most recent exchange rate is $2.00/

e) The following information is selected amount from the separate financial statement of Chim and Co and the French subunit (unconsolidated). Given the following information, provide the consolidated financial statement for Home Depot (2 Points) Chim and Co owes French subsidiary $70 During the year, French subsidiary transferred $250 dividend back to Home Depot. French subsidiary owns the building that Chim and Co rents for $200 During the year, parent sold inventory to subsidiary for $2,200. It had cost the parent $1,500.

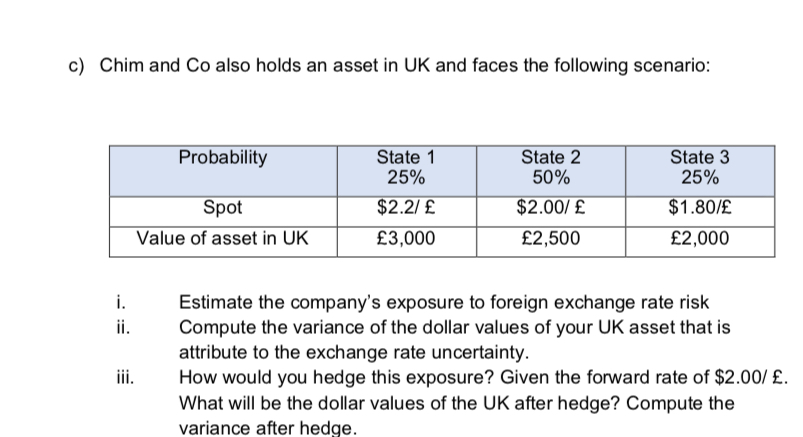

Chim and Co also holds an asset in UK and faces the following scenario: i. Estimate the company's exposure to foreign exchange rate risk ii. Compute the variance of the dollar values of your UK asset that is attribute to the exchange rate uncertainty. iii. How would you hedge this exposure? Given the forward rate of $2.00/. What will be the dollar values of the UK after hedge? Compute the variance after hedgeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started