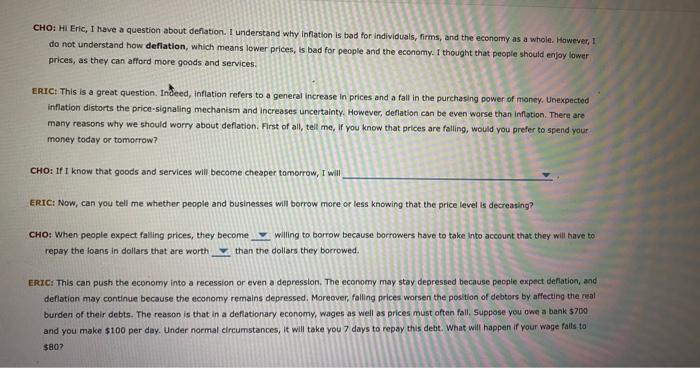

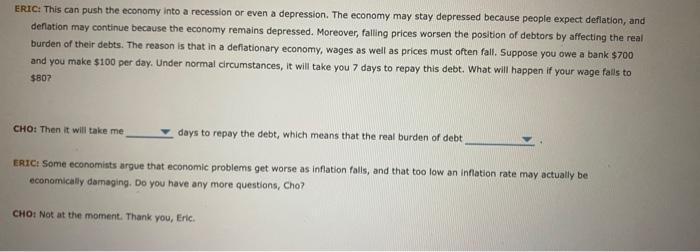

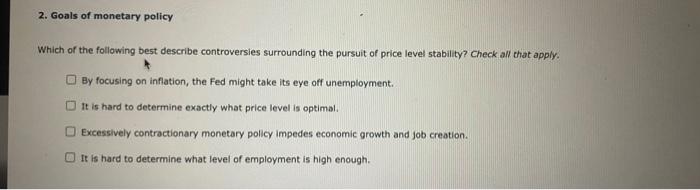

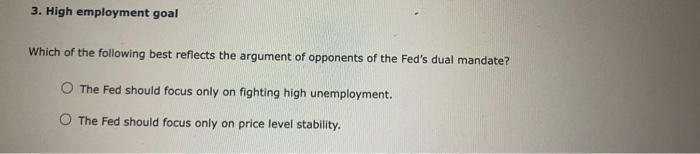

CHO: Hi Eric, I have a question about defiation. I understand why inflation is bod for individuals, firms, and the economy as a whole. Hawever, I do not understand how defiation, which means lower prices, is bad for people and the eccoomy. I thought that people should enjoy lower prices, as they can afford more goods and services. ERIC: This is a great question. Indeed, inflation refers to a general increase in prices and a fall in the purchasing power of moncy, Unexpected. inflation distorts the price-signaling mechanism and increases uncertainty. However, deflation can be even worse than inflation. There are many reasons why we should worry about deflation. First of all, tell me, if you know that prices are falling, would you prefer to spend your money today or tomorrow? CHO: If I know that goods and services will become cheaper tomorrow, I will ERIC: Now; can you tell me whether people and businesses will borrow more or less knowing that the price level is decreasing? CHO: When people expect falling prices, they become willing to borrow because bocrowers have to take into account that they will have to repay the loans in dollars that are worth than the dollars they borrowed. ERIC: This can push the economy into a recession or even a depression. The economy may stay depressed because pecple expect defation, and deflation may continue because the economy remains depressed, Moreover, falling prices worsen the position of debtors by affecting the real burden of their debts. The reason is that in a deflationary economy, wages as well as prices must often fall, suppose you one a bank $70. and you make $100 per day. Under noemal circumstances, it will take you 7 days to repay this debt. What will happen if your wage fails ta $807 ERIC: This can push the economy into a recession or even a depression. The economy may stay depressed because people expect deflation, and defiation may continue because the economy remains depressed. Moreover, falling prices worsen the position of debtors by affecting the real burden of their debts. The reason is that in a defiationary economy, wages as well as prices must often fall. Suppose you owe a bank $700 and you make $100 per day. Under normal circumstances, it will take you 7 days to repay this debt. What will happen if your wage falls to $807 CHO: Then it will take me days to repay the debt, which means that the real burden of debt ERtC: Some economists argue that economic problems get worse as inflation falls, and that too low an inflation rate may actually be economically damaging. Do you have any more questions, Cho? CHOt Not at the moment. Thank you, Eric. Which of the following best describe controversies surrounding the pursuit of price level stability? Check all chat apply. By focusing on inflation, the Fed might take its eye off unemployment. It is hard to determine exactly what price level is optimal. Excessively contractionary monetary policy impedes economic growth and job creation. It is hard to determine what level of employment is high enough. 3. High employment goal Which of the following best reflects the argument of opponents of the Fed's dual mandate? The Fed should focus only on fighting high unemployment. The Fed should focus only on price level stability