Question

1.) How much is output tax for the Quarter? 2.) How much is the total amount of input taxes for the Quarter? 3.) How much

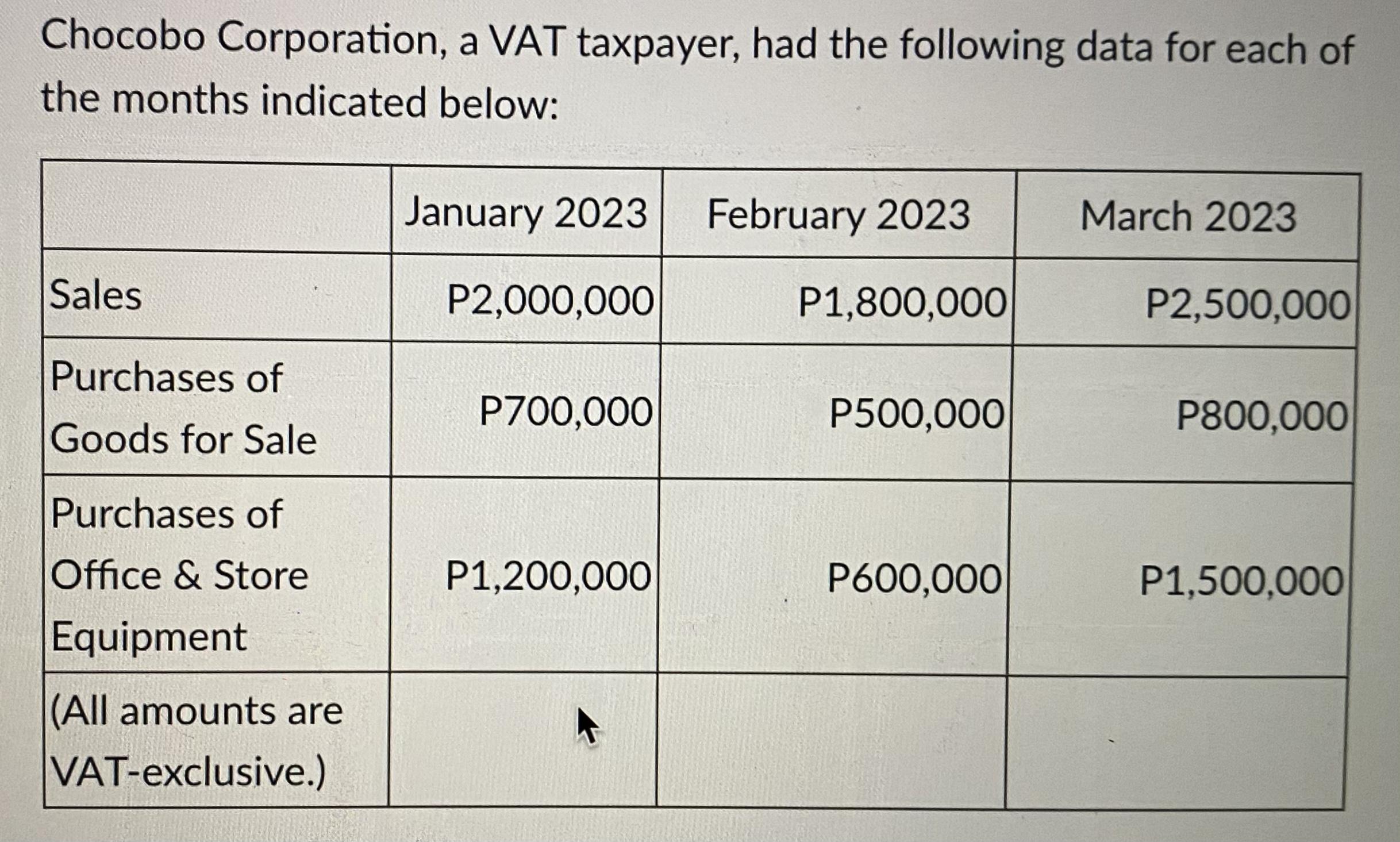

1.) How much is output tax for the Quarter?

2.) How much is the total amount of input taxes for the Quarter?

3.) How much is VAT still payable (after deducting monthly payments) for the Quarter?

Chocobo Corporation, a VAT taxpayer, had the following data for each of the months indicated below: Sales Purchases of Goods for Sale Purchases of Office & Store Equipment (All amounts are VAT-exclusive.) January 2023 February 2023 P1,800,000 P2,000,000 P700,000 P1,200,000 P500,000 P600,000 March 2023 P2,500,000 P800,000 P1,500,000

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To compute the output tax and input tax for the quarter we need to determine the applicable tax rate...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cornerstones of Financial and Managerial Accounting

Authors: Rich, Jeff Jones, Dan Heitger, Maryanne Mowen, Don Hansen

2nd edition

978-0538473484, 538473487, 978-1111879044

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App