Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CHOICES OF ANSWERS: 1,675,000 (2,225,000) none of the choices (2,475,000) timed task, please answer for an upvote :)) The decedent was under the system of

CHOICES OF ANSWERS:

1,675,000

(2,225,000) none of the choices

(2,475,000)

timed task, please answer for an upvote :))

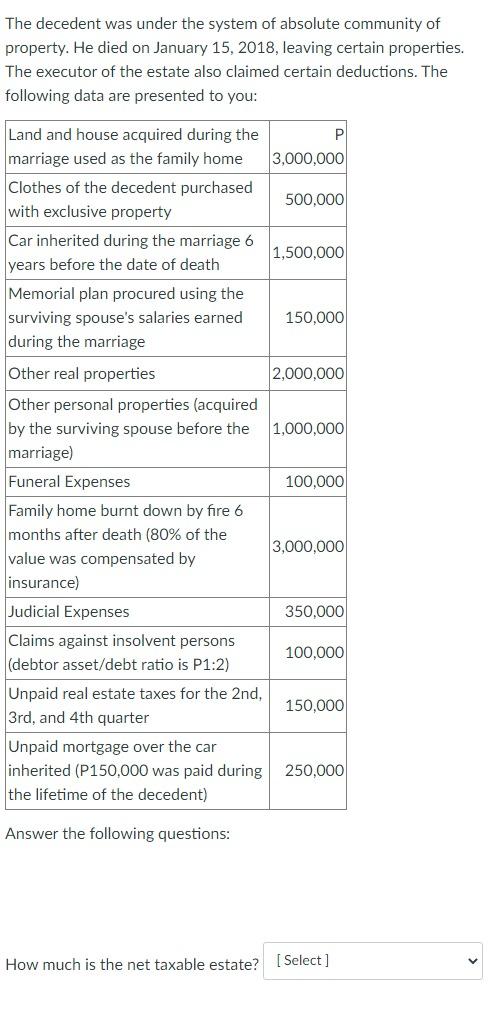

The decedent was under the system of absolute community of property. He died on January 15, 2018, leaving certain properties. The executor of the estate also claimed certain deductions. The following data are presented to you: Land and house acquired during the marriage used as the family home 3,000,000 Clothes of the decedent purchased 500,000 with exclusive property Car inherited during the marriage 6 1,500,000 years before the date of death Memorial plan procured using the surviving spouse's salaries earned 150,000 during the marriage Other real properties 2,000,000 Other personal properties (acquired by the surviving spouse before the 1,000,000 marriage) Funeral Expenses 100,000 Family home burnt down by fire 6 months after death (80% of the 3,000,000 value was compensated by insurance) Judicial Expenses 350.000 Claims against insolvent persons 100,000 (debtor asset/debt ratio is P1:2) Unpaid real estate taxes for the 2nd, 150,000 3rd, and 4th quarter Unpaid mortgage over the car inherited (P150,000 was paid during 250,000 the lifetime of the decedent) Answer the following questions: How much is the net taxable estate? Select]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started