Question

Choose a company from Yahoo Finance. Then make the following assumptions: The companys 10% coupon non-callable bonds with 9 years to maturity are selling 12%

Choose a company from Yahoo Finance. Then make the following assumptions: The companys 10% coupon non-callable bonds with 9 years to maturity are selling 12% above par, the risk free rate is 5%, market risk premium is 6%, stock beta is 1.5 and the company has no preferred stock. With a free cash flow (FCF) of 100 million currency units and a constant FCF growth rate of 5%, what would be your estimate of the total value of this company? If the number of outstanding shares is 25 million, what would be your estimate of the stock price? Finally, what is your estimate of the total value of the companys debt? (All numbers are in the same currency units) (assue that the company's capital structure includes debt and common stock only (no preffered stock))

Choose a company from Yahoo Finance. Then make the following assumptions: The companys 10% coupon non-callable bonds with 9 years to maturity are selling 12% above par, the risk free rate is 5%, market risk premium is 6%, stock beta is 1.5 and the company has no preferred stock. With a free cash flow (FCF) of 100 million currency units and a constant FCF growth rate of 5%, what would be your estimate of the total value of this company? If the number of outstanding shares is 25 million, what would be your estimate of the stock price? Finally, what is your estimate of the total value of the companys debt? (All numbers are in the same currency units) (assue that the company's capital structure includes debt and common stock only (no preffered stock))

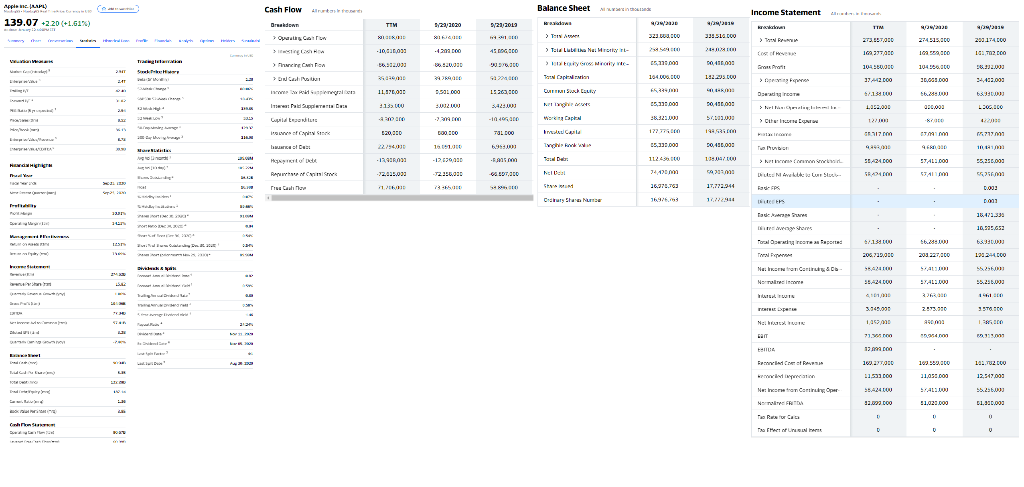

please use Apple's stock info.

WWW. w GOT (XT9T+)oZ2+ 20'GET WWW. w GOT (XT9T+)oZ2+ 20'GETStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started