Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Choose a company of your liking from a list of companies registered and traded on Saudi stock exchange and do the following. 1. Provide a

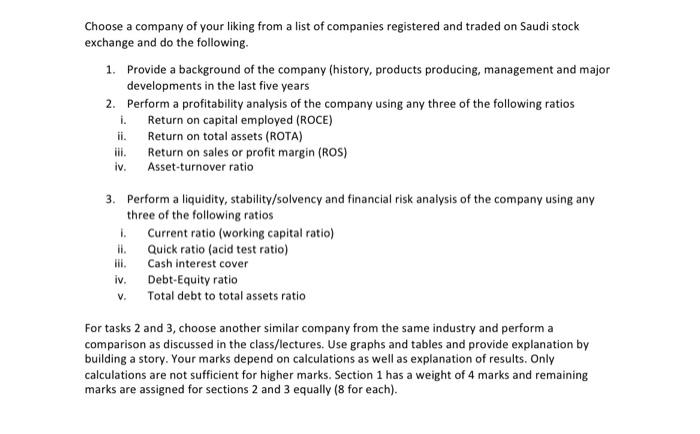

Choose a company of your liking from a list of companies registered and traded on Saudi stock exchange and do the following.

1. Provide a background of the company (history, products producing, management and major developments in the last five years 2. Perform a profitability analysis of the company using any three of the following ratios Return on capital employed (ROCE) Return on total assets (ROTA) i. ii. iii. iv. Return on sales or profit margin (ROS) Asset-turnover ratio

3. Perform a liquidity, stability/solvency and financial risk analysis of the company using any three of the following ratios i. ii. iii. iv. V. Current ratio (working capital ratio) Quick ratio (acid test ratio) Cash interest cover Debt-Equity ratio Total debt to total assets ratio For tasks 2 and 3, choose another similar company from the same industry and perform a comparison as discussed in the class/lectures. Use graphs and tables and provide explanation by building a story. Your marks depend on calculations as well as explanation of results. Only calculations are not sufficient for higher marks. Section 1 has a weight of 4 marks and remaining marks are assigned for sections 2 and 3 equally (8 for each).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started