Question

Choose correct answer. 1- Comparison of a companys financial results to other peer companies for the same time period is called: A - technical analysis.

Choose correct answer.

1- Comparison of a companys financial results to other peer companies for the same time period is called:

A -technical analysis.

B -time-series analysis.

C- cross-sectional analysis.

2- Which ratio would a company most likely use to measure its ability to meet short-term obligations?

A- Current ratio.

B- Payables turnover.

C- Gross profit margin.

3- What does the Price/Earning ratio measure?

A- The multiple that the stock market places on a companys EPS.

B -The relationship between dividends and market prices.

C- The earnings for one common share of stock.

4- A creditor most likely would consider a decrease in which of the following ratios to be positive news?

A -Interest coverage (times interest earned).

B -Debt-to-total assets.

C- Return on assets.

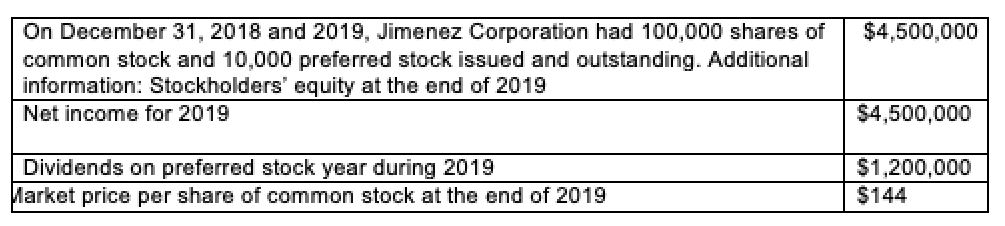

5- The price-earning ratio on common stock at December 31, 2019 was

A- 10 to 1

B- 12 to 1

C- 14 to 1

D- 16 to 1

$4,500,000 On December 31, 2018 and 2019, Jimenez Corporation had 100,000 shares of common stock and 10,000 preferred stock issued and outstanding. Additional information: Stockholders' equity at the end of 2019 Net income for 2019 $4,500,000 Dividends on preferred stock year during 2019 Market price per share of common stock at the end of 2019 $1,200,000 $144Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started