Question

choose from following accounts: Accumulated Other Comprehensive Income Allowance for Investment Impairment Bond Investment at Amortized Cost Cash Commission Expense Dividends Receivable Dividend Revenue FV-NI

choose from following accounts:

Accumulated Other Comprehensive Income

Allowance for Investment Impairment

Bond Investment at Amortized Cost

Cash

Commission Expense

Dividends Receivable

Dividend Revenue

FV-NI Investments

FV-OC|Investments

Gain on Disposal of Investments - FV-NI

Gain on Disposal of Investments - FV-OCI

Gain on Sale of Investments

GST Receivable

Interest Expense

Interest Income

Interest Payable

Interest Receivable

Investment in Associate

Investment Income or Loss

Loss on Discontinued Operations

Loss on Disposal of Investments FV-NI

Loss on Disposal of Investments FV-OCI

Loss on Impairment

Loss on Sale of Investments

No Entry

Note Investment at Amortized Cost

Other Investments

Recovery of Loss from Impairment

Retained Earnings

Unrealized Gain or Loss

Unrealized Gain or Loss - OCI

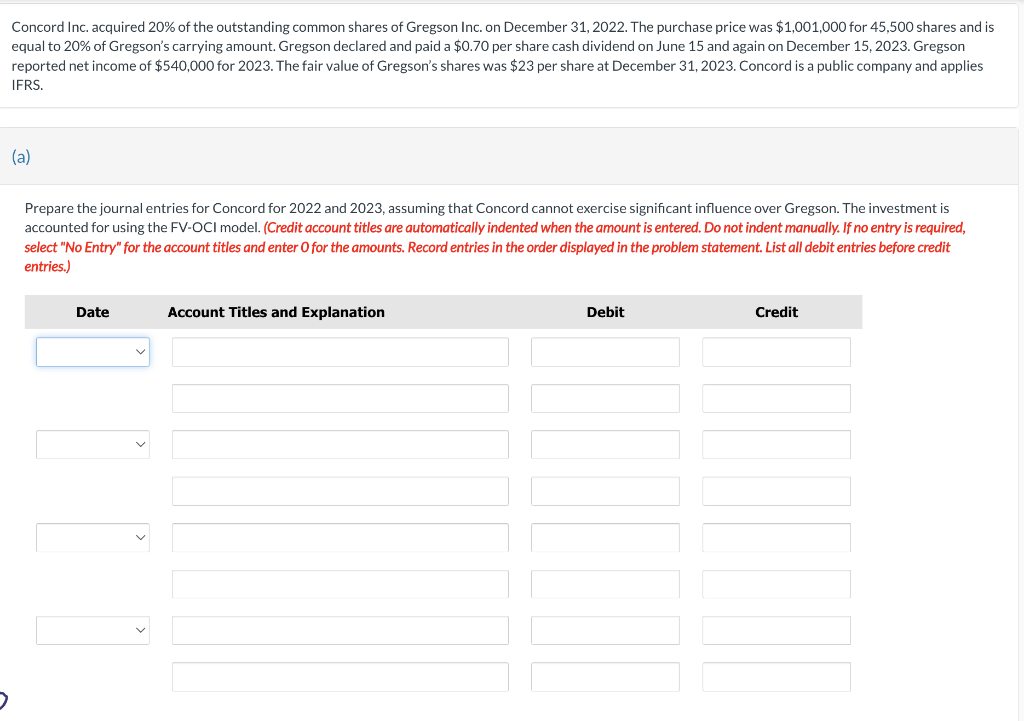

Concord Inc. acquired 20% of the outstanding common shares of Gregson Inc. on December 31,2022 . The purchase price was $1,001,000 for 45,500 shares and is equal to 20% of Gregson's carrying amount. Gregson declared and paid a $0.70 per share cash dividend on June 15 and again on December 15,2023 . Gregson reported net income of $540,000 for 2023 . The fair value of Gregson's shares was $23 per share at December 31,2023 . Concord is a public company and applies IFRS. (a) Prepare the journal entries for Concord for 2022 and 2023 , assuming that Concord cannot exercise significant influence over Gregson. The investment is accounted for using the FV-OCI model. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record entries in the order displayed in the problem statement. List all debit entries before credit entries.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started