Answered step by step

Verified Expert Solution

Question

1 Approved Answer

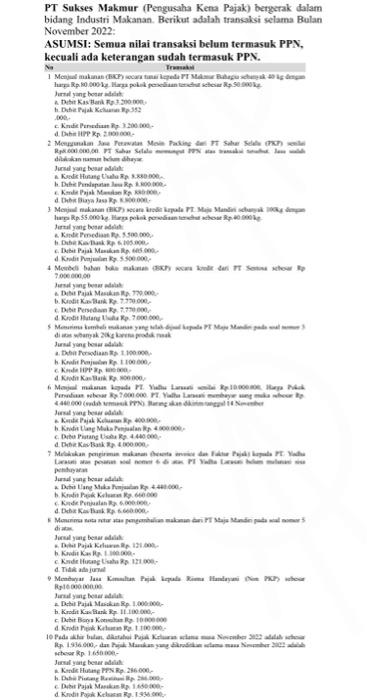

Choose one correct answer for each of the following questions: PT Sukses Makmur (Taxable Entrepreneur) operates in the Food Industry sector. Following are the transactions

Choose one correct answer for each of the following questions:

PT Sukses Makmur (Taxable Entrepreneur) operates in the Food Industry sector. Following are the transactions during the Month

November 2022:

ASSUMPTION: All transaction values do not include VAT, unless stated that VAT is included.

1. Selling 40 kg of food (BKP) in cash to PT Makmur Bahagia with

price IDR 80,000/kg. The cost of the inventory is IDR 50,000/kg.

The correct journal is:

a. Cash/Bank Debit Rp. 3,200,000,-

b. Output Tax Debit IDR 352,000.-

c. Inventory Credit Rp. 3,200,000,-

d. HPP debit Rp. 2,000,000,-

2. Use Packing Machine Maintenance Services from PT Sabar Always (PKP) worth

Rp. 8,000,000.00. PT Sabar always collects VAT on these transactions. Services already

done but not yet paid.

The correct journal is:

a. Accounts Payable Credit Rp. 8,880,000,-.

b. Debit Service Revenue Rp. 8,800,000,-

c. Input Tax Credit Rp. 880,000,-

d. Debit Service Fee Rp. 8,800,000,-

3. Selling food (BKP) on credit to PT. Maju Mandiri as much as 100kg at a price of IDR 55,000/kg. The cost of the inventory is IDR 40,000/kg.

The correct journal is:

a. Inventory Credit Rp. 5,500,000,-

b. Cash/Bank Debit Rp. 6,105,000,-

c. Input Tax Debit Rp. 605,000,-

d. Sales Credit Rp. 5,500,000,-

4. Purchased food raw materials (BKP) on credit from PT Sentosa amounting to Rp

7,000,000.00

The correct journal is:

a. Input Tax Debit Rp. 770,000,-

b. Cash/Bank Credit Rp. 7,770,000,-

c. Inventory Debit Rp. 7,770,000,-

d. Accounts Payable Credit Rp. 7,000,000,-

5. Received back 20kg of food that had been sold to PT Maju Mandiri in question number 3 above because the product was damaged

The correct journal is:

a. Inventory Debit Rp. 1,100,000,-

b. Sales Credit Rp. 1,100,000,-

c. HPP credit Rp. 800,000,-

d. Cash/Bank Credit Rp. 800,000,-

6. Selling food to PT. Yudha Larasati worth IDR 10,000,000, basic price

Inventory amounting to IDR 7,000,000. PT. Yudha Larasati paid a down payment of Rp.

4,440,000 (including VAT). Items will be shipped November 14th

The correct journal is:

a. Output Tax Credit Rp. 400,000,-

b. Sales Advance Credit Rp. 4,000,000,-

c. Debit Accounts Receivable Rp. 4,440,000,-

d. Cash/Bank Debit Rp. 4,000,000,-

7.Delivering food (along with invoices and Tax Invoices) to PT. Yudha

Larasati for the order for question number 6 above. PT Yudha Larasati has not paid off the remaining payment

The correct journal is:

a. Debit Sales Advances Rp. 4,440,000,-

b. Output Tax Credit Rp. 660,000

c. Sales Credit Rp. 6,000,000,-

d. Cash/Bank Debit Rp. 6,660,000,-

8 Receive a return note for the return of food from PT Maju Mandiri in question number 5 above

The correct journal is:

a. Output Tax Debit Rp. 121,000,-

b. Cash Credit Rp. 1,100,000,-

c. Accounts Payable Credit Rp. 121,000,-

d. No journal

9. Paid Tax Consultant Services to Risma Handavani (Non PKP) in the amount of IDR 10,000,000.00.

The correct journal is:

a. Input Tax Debit Rp. 1,000,000,-

b. Cash/Bank Credit Rp. 11,100,000,-

c. Consultant Fee Debit Rp. 10,000,000

d. Output Tax Credit Rp. 1,100,000,-

10. At the end of the month, it is known that the Output Tax for the period November 2022 is Rp. 1,936,000,- and the Input Tax credited during November 2022 is IDR. 1,650,000,-

The correct journal is:

a. VAT Payable Credit Rp. 286,000,-

b. Debit Restitution Receivables Rp. 286,000,-

c. Input Tax Debit Rp. 1,650,000,-

d. Output Tax Credit Rp. 1,936,000,-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started