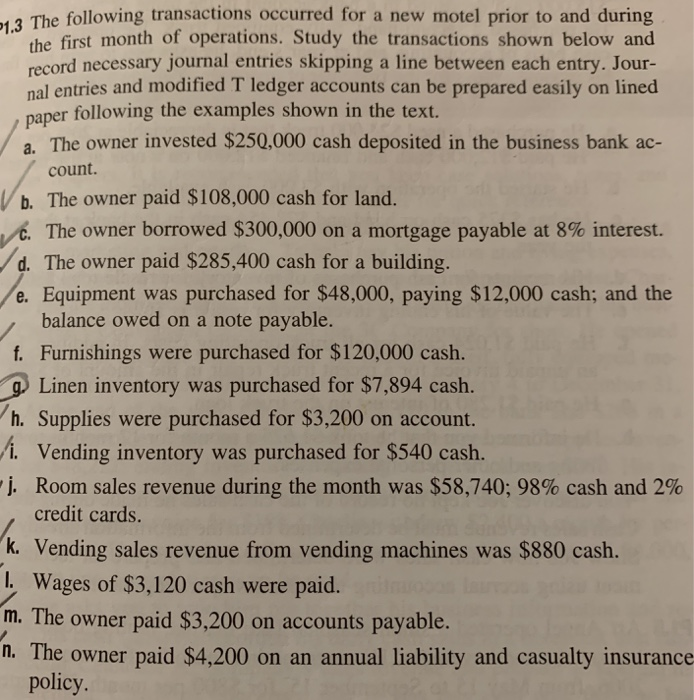

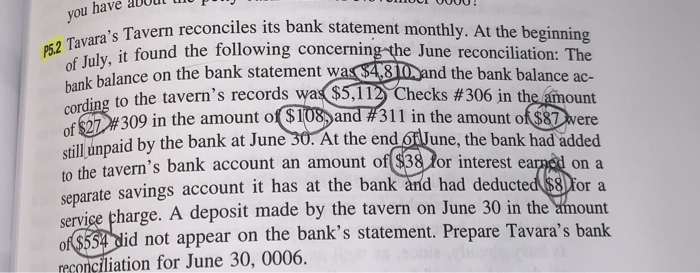

The following transactions occurred for a new motel prior to and during the first month of operations. Study the transactions shown below and record necessary journal entries skipping a line between each entry. Jour- 1. al entries and modified T ledger accounts can be prepared easily on lined paper following the examples shown in the text. a. The owner invested $250,000 cash deposited in the business bank ac- count. b. The owner paid $108,000 cash for land. The owner borrowed $300,000 on a mortgage payable at 8% interest. d. The owner paid $285,400 cash for a building. e. Equipment was purchased for $48,000, paying $12,000 cash; and the balance owed on a note payable. f. Furnishings were purchased for $120,000 cash. Linen inventory was purchased for $7,894 cash h. Supplies were purchased for $3,200 on account. . Vending inventory was purchased for $540 cash j, Room sales revenue during the month was $58,740; 98% cash and 2% credit cards. k. Vending sales revenue from vending machines was $880 cash. l. Wages of $3,120 cash were paid. m. The owner paid $3,200 on accounts payable. n. The owner paid $4,200 on an annual liability and casualty insurance policy you have a s Tavern reconciles its bank statement monthly. At the beginning 52 Tavara's of July, it bank balance on the bank statement wa $48 ound the following concerning the June reconciliation: The 1Oand the bank balance ac- Checks #306 in theamount dingtothe tavern's records wa($5 11 e #309 in the amount o($10 and of still anpaid by the bank 311inthe amount of 87 here at June 30: At the end otune, the bank had added to the tavern's bank account an amount of $38 for interest separate savings account it has at the bank and had deducte on a d 8for a servige pharge. A deposit made by the tavern on June 30 in the mount id not appear on the bank's statement. Prepare Tavara's bank reconciliation for June 30, 0006 The following transactions occurred for a new motel prior to and during the first month of operations. Study the transactions shown below and record necessary journal entries skipping a line between each entry. Jour- 1. al entries and modified T ledger accounts can be prepared easily on lined paper following the examples shown in the text. a. The owner invested $250,000 cash deposited in the business bank ac- count. b. The owner paid $108,000 cash for land. The owner borrowed $300,000 on a mortgage payable at 8% interest. d. The owner paid $285,400 cash for a building. e. Equipment was purchased for $48,000, paying $12,000 cash; and the balance owed on a note payable. f. Furnishings were purchased for $120,000 cash. Linen inventory was purchased for $7,894 cash h. Supplies were purchased for $3,200 on account. . Vending inventory was purchased for $540 cash j, Room sales revenue during the month was $58,740; 98% cash and 2% credit cards. k. Vending sales revenue from vending machines was $880 cash. l. Wages of $3,120 cash were paid. m. The owner paid $3,200 on accounts payable. n. The owner paid $4,200 on an annual liability and casualty insurance policy you have a s Tavern reconciles its bank statement monthly. At the beginning 52 Tavara's of July, it bank balance on the bank statement wa $48 ound the following concerning the June reconciliation: The 1Oand the bank balance ac- Checks #306 in theamount dingtothe tavern's records wa($5 11 e #309 in the amount o($10 and of still anpaid by the bank 311inthe amount of 87 here at June 30: At the end otune, the bank had added to the tavern's bank account an amount of $38 for interest separate savings account it has at the bank and had deducte on a d 8for a servige pharge. A deposit made by the tavern on June 30 in the mount id not appear on the bank's statement. Prepare Tavara's bank reconciliation for June 30, 0006