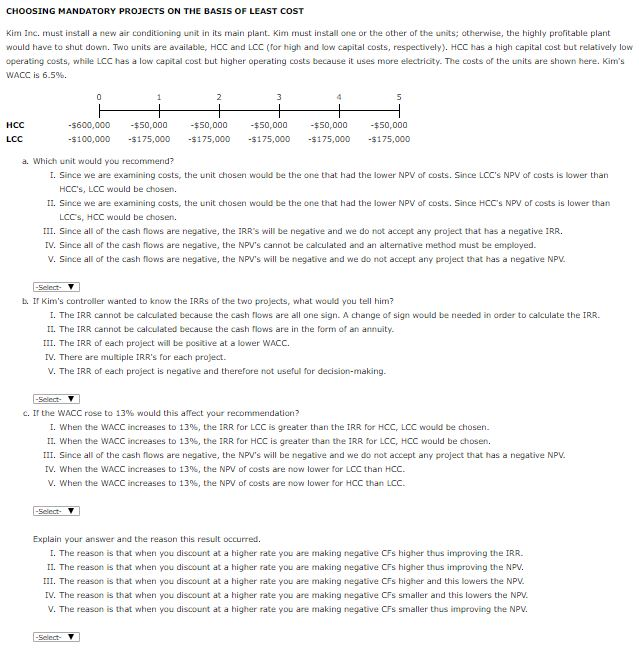

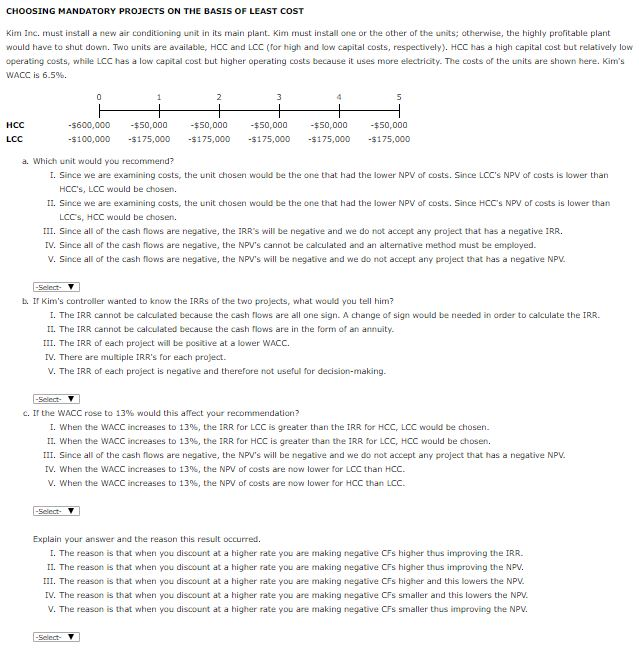

CHOOSING MANDATORY PROJECTS ON THE BASIS OF LEAST COST Kim Inc. must install a new air conditioning unit in its main plant. Kim must install one or the other of the units; otherwise, the highly profitable plant would have to shut down. Two units are available, HCC and LCC (for high and low capital costs, respectively). HCC has a high capital cost but relatively low operating costs, while LCC has a low capital cost but higher operating costs because it uses more electricity. The costs of the units are shown here. Kims WACC is 6.5%. HCC -$600,000$50,000 -$100,000 175,000 $175,000 $175,000 -$175,000$175,000 -$50,000 -$50,000 -$50,000 -$50,000 LCC a. Which unit would you recommend? . Since we are examining costs, the unit chosen would be the one that had the lower NPV of costs. Since LCC's NPV of costs is lower than HCC's, LCC would be chosen. I. Since we are examining costs, the unit chosen would be the one that had the lower NPV of costs. Since HCC's NPV of costs is lower than LCCs, HCC would be chosen. III. Since all of the cash flows are negative, the IRR's will be negative and we do not accept any project that has a negative IRR. IV. Since all of the cash nows are negative, the NPV's cannot be calculated and an alternative method must be employed. V. Since all of the cash fows are negative, the NPV's will be negative and we do not accept any project that has a negative NPV b. If Kim's controller wanted to know the IRRs of the two projects, what would you tell him? . The IRR cannot be calculated because the cash flows are all one sign. A change of sign would be needed in order to calculate the IRR. I. The IRR cannot be calculated because the cash flows are in the form of an annuity. III. The IRR of each project will be positive at a lower WACC. IV. There are multiple IRR's for each project. V. The IRR of each project is negative and therefore not useful for decision-making. C. If the WACC rose to 13% would this affect your recommendation? 1. when the WACC increases to 13%, the IRR ror LCC is greater than the IRR for ???, LCC would be chosen. 11. When the WACC increases to 13%, the IRR ror HCC is greater than the IRR for LCC, HCC would be chosen. III. Since all of the cash flows are negative, the NPV's will be negative and we do not accept any project that has a negative NPV IV, when the WACC increases to 13%, the NPV of costs are now lower for LCC than HCC. V. When the WACC increases to 13%, the NPV or costs are now lower for HCC than LCC. Explain your answer and the reason this resuit occurred. I. The reason is that when you discount at a higher rate you are making negative CFs higher thus improving the IRR I. The reason is that when you discount at a higher rate you are making negative CFs higher thus improving the NPV III. The reason is that when you discount at a higher rate you are making negative CFs higher and this lowers the NPV IV. The reason is that when you discount at a higher rate you are making negative CFs smaller and this lowers the NPV V. The reason is that when you discount at a higher rate you are making negative CFs smaller thus improving the NPV