Answered step by step

Verified Expert Solution

Question

1 Approved Answer

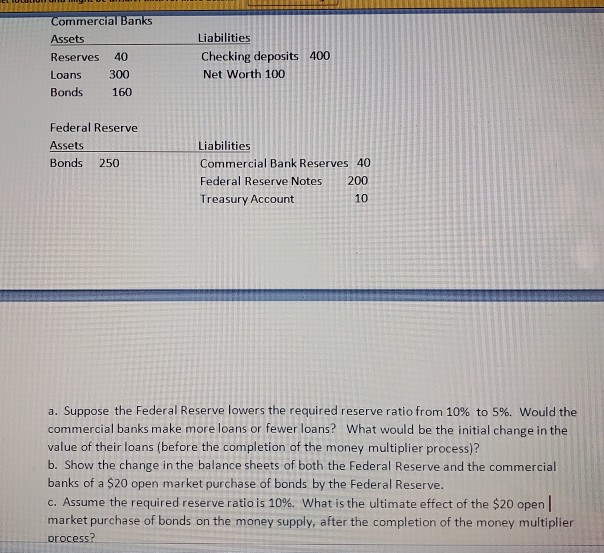

myDLI Commercial Banks Assets Reserves 40 Loans 300 Bonds 160 Liabilities Checking deposits 400 Net Worth 100 Federal Reserve Assets Bonds 250 Liabilities Commercial Bank

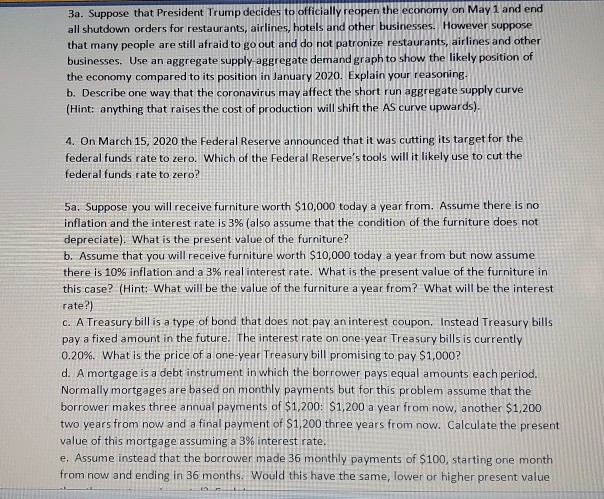

myDLI Commercial Banks Assets Reserves 40 Loans 300 Bonds 160 Liabilities Checking deposits 400 Net Worth 100 Federal Reserve Assets Bonds 250 Liabilities Commercial Bank Reserves 40 Federal Reserve Notes Treasury Account a. Suppose the Federal Reserve lowers the required reserve ratio from 10% to 5%. Would the commercial banks make more loans or fewer loans? What would be the initial change in the value of their loans (before the completion of the money multiplier process)? b. Show the change in the balance sheets of both the Federal Reserve and the commercial banks of a $20 open market purchase of bonds by the Federal Reserve. C. Assume the required reserve ratio is 10%. What is the ultimate effect of the $20 open market purchase of bonds on the money supply, after the completion of the money multiplier process? 3a. Suppose that President Trump decides to officia open the economy on May 1 and end all shutdown orders for restaurants, airlines, hotels and other businesses. However suppose that many people are still afraid to go out and do not patronize restaurants, airlines and other businesses. Use an aggregate supply aggregate demand graph to show the likely position of the economy compared to its position in January 2020. Explain your reasoning. b. Describe one way that the coronavirus may affect the short run aggregate supply curve (Hint: anything that raises the cost of production will shift the AS curve upwards). 4. On March 15, 2020 the Federal Reserve announced that it was cutting its target for the federal funds rate to zero. Which of the Federal Reserve's tools will it likely use to cut the federal funds rate to zero? 5a. Suppose you will receive furniture worth $10,000 today a year from. Assume there is no inflation and the interest rate is 3% (also assume that the condition of the furniture does not depreciate). What is the present value of the furniture? b. Assume that you will receive furniture worth $10,000 today a year from but now assume there is 10% inflation and a 3% real interest rate. What is the present value of the furniture in this case? (Hint: What will be the value of the furniture a year from? What will be the interest rate?) c. A Treasury bill is a type of bond that does not pay an interest coupon. Instead Treasury bills pay a fixed amount in the future. The interest rate on one year Treasury bills is currently 0.20%. What is the price of a one-year Treasury bill promising to pay $1,000? d. A mortgage is a debt instrument in which the borrower pays equal amounts each period. Normally mortgages are based on monthly payments but for this problem assume that the borrower makes three annual payments of $1,200: $1,200 a year from now, another $1,200 two years from now and a final payment of $1,200 three years from now. Calculate the present value of this mortgage assuming a 3% interest rate. e. Assume instead that the borrower made 36 monthly payments of $100, starting one month from now and ending in 36 months. Would this have the same, lower or higher present value myDLI Commercial Banks Assets Reserves 40 Loans 300 Bonds 160 Liabilities Checking deposits 400 Net Worth 100 Federal Reserve Assets Bonds 250 Liabilities Commercial Bank Reserves 40 Federal Reserve Notes Treasury Account a. Suppose the Federal Reserve lowers the required reserve ratio from 10% to 5%. Would the commercial banks make more loans or fewer loans? What would be the initial change in the value of their loans (before the completion of the money multiplier process)? b. Show the change in the balance sheets of both the Federal Reserve and the commercial banks of a $20 open market purchase of bonds by the Federal Reserve. C. Assume the required reserve ratio is 10%. What is the ultimate effect of the $20 open market purchase of bonds on the money supply, after the completion of the money multiplier process? 3a. Suppose that President Trump decides to officia open the economy on May 1 and end all shutdown orders for restaurants, airlines, hotels and other businesses. However suppose that many people are still afraid to go out and do not patronize restaurants, airlines and other businesses. Use an aggregate supply aggregate demand graph to show the likely position of the economy compared to its position in January 2020. Explain your reasoning. b. Describe one way that the coronavirus may affect the short run aggregate supply curve (Hint: anything that raises the cost of production will shift the AS curve upwards). 4. On March 15, 2020 the Federal Reserve announced that it was cutting its target for the federal funds rate to zero. Which of the Federal Reserve's tools will it likely use to cut the federal funds rate to zero? 5a. Suppose you will receive furniture worth $10,000 today a year from. Assume there is no inflation and the interest rate is 3% (also assume that the condition of the furniture does not depreciate). What is the present value of the furniture? b. Assume that you will receive furniture worth $10,000 today a year from but now assume there is 10% inflation and a 3% real interest rate. What is the present value of the furniture in this case? (Hint: What will be the value of the furniture a year from? What will be the interest rate?) c. A Treasury bill is a type of bond that does not pay an interest coupon. Instead Treasury bills pay a fixed amount in the future. The interest rate on one year Treasury bills is currently 0.20%. What is the price of a one-year Treasury bill promising to pay $1,000? d. A mortgage is a debt instrument in which the borrower pays equal amounts each period. Normally mortgages are based on monthly payments but for this problem assume that the borrower makes three annual payments of $1,200: $1,200 a year from now, another $1,200 two years from now and a final payment of $1,200 three years from now. Calculate the present value of this mortgage assuming a 3% interest rate. e. Assume instead that the borrower made 36 monthly payments of $100, starting one month from now and ending in 36 months. Would this have the same, lower or higher present value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started