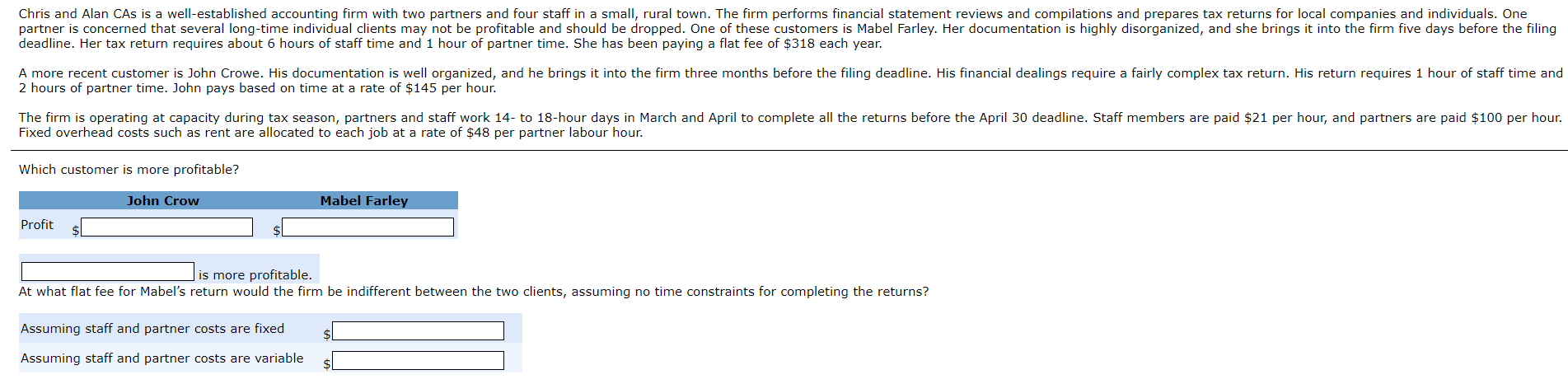

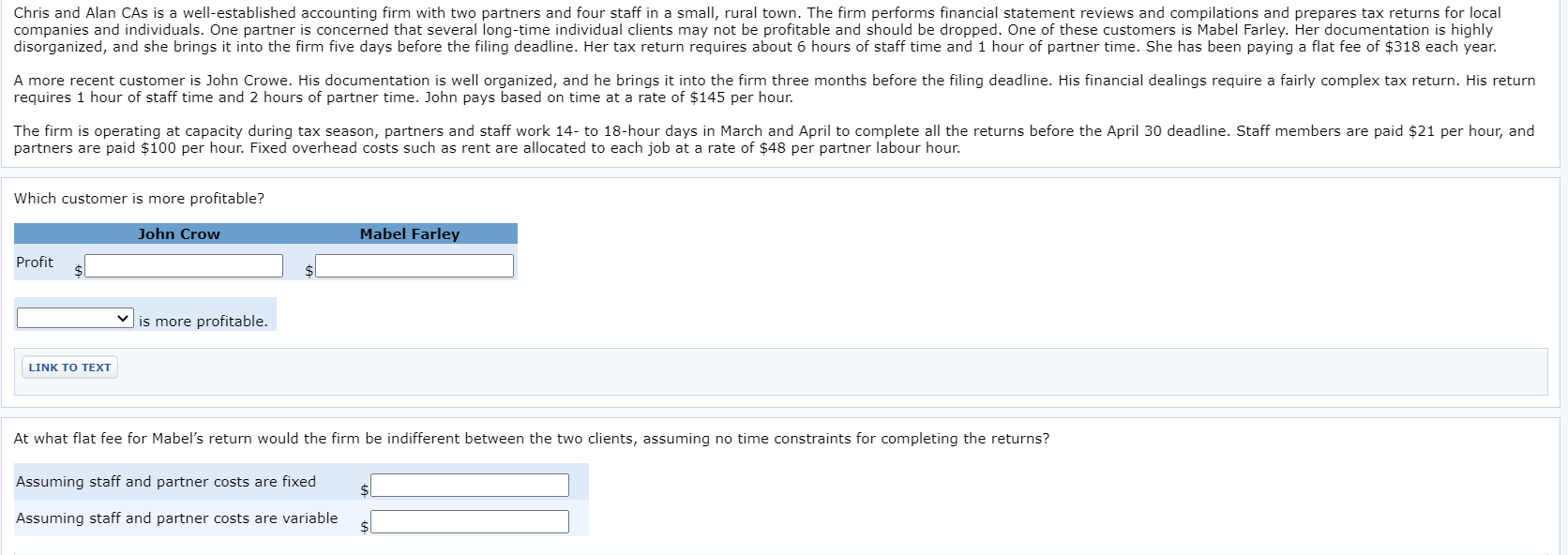

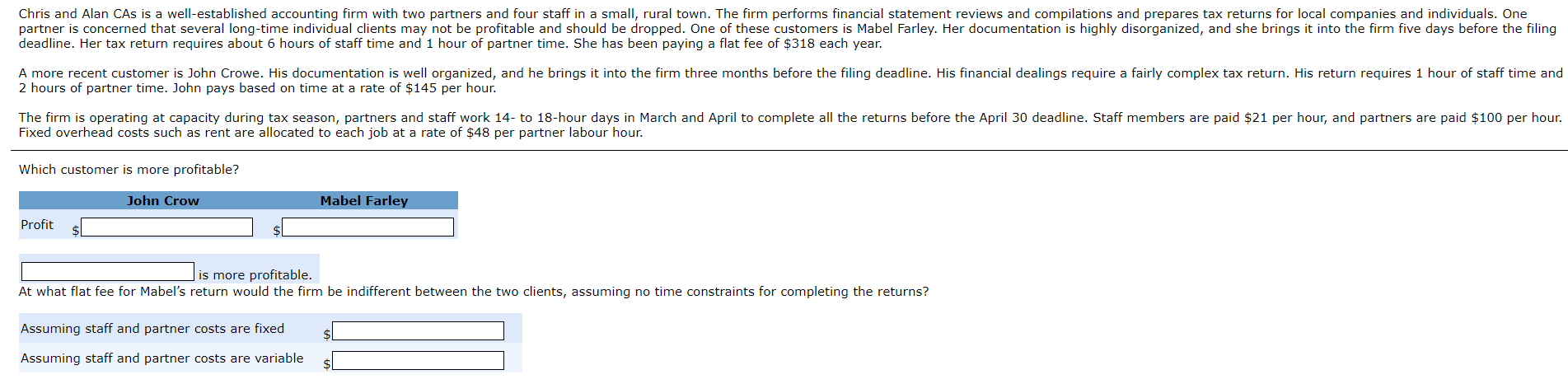

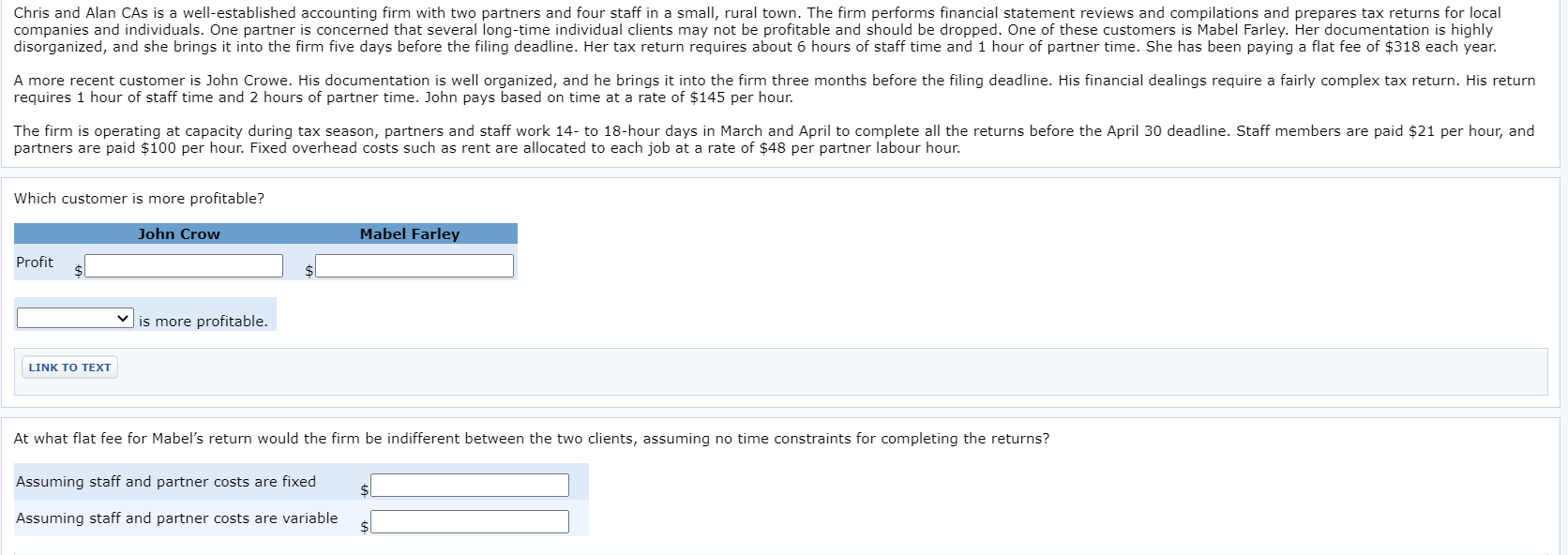

Chris and Alan CAS is a well-established accounting firm with two partners and four staff in a small, rural town. The firm performs financial statement reviews and compilations and prepares tax returns for local companies and individuals. One partner is concerned that several long-time individual clients may not be profitable and should be dropped. One of these customers is Mabel Farley. Her documentation is highly disorganized, and she brings it into the firm five days before the filing deadline. Her tax return requires about 6 hours of staff time and 1 hour of partner time. She has been paying a flat fee of $318 each year. A more recent customer is John Crowe. His documentation is well organized, and he brings it into the firm three months before the filing deadline. His financial dealings require a fairly complex tax return. His return requires 1 hour of staff time and 2 hours of partner time. John pays based on time at a rate of $145 per hour. The firm is operating at capacity during tax season, partners and staff work 14- to 18-hour days in March and April to complete all the returns before the April 30 deadline. Staff members are paid $21 per hour, and partners are paid $100 per hour. Fixed overhead costs such as rent are allocated to each job at a rate of $48 per partner labour hour. Which customer is more profitable? John Crow Mabel Farley Profit is more profitable. At what flat fee for Mabel's return would the firm be indifferent between the two clients, assuming no time constraints for completing the returns? Assuming staff and partner costs are fixed Assuming staff and partner costs are variable Chris and Alan CAs is a well-established accounting firm with two partners and four staff in a small, rural town. The firm performs financial statement reviews and compilations and prepares tax returns for local companies and individuals. One partner is concerned that several long-time individual clients may not be profitable and should be dropped. One of these customers is Mabel Farley. Her documentation is highly disorganized, and she brings it into the firm five days before the filing deadline. Her tax return requires about 6 hours of staff time and 1 hour of partner time. She has been paying a flat fee of $318 each year. A more recent customer is John Crowe. His documentation is well organized, and he brings it into the firm three months before the filing deadline. His financial dealings require a fairly complex tax return. His return requires 1 hour of staff time and 2 hours of partner time. John pays based on time at a rate of $145 per hour. The firm is operating at capacity during tax season, partners and staff work 14- to 18-hour days in March and April to complete all the returns before the April 30 deadline. Staff members are paid $21 per hour, and partners are paid $100 per hour. Fixed overhead costs such as rent are allocated to each job at a rate of $48 per partner labour hour. Which customer is more profitable? John Crow Mabel Farley Profit $ is more profitable. LINK TO TEXT At what flat fee for Mabel's return would the firm be indifferent between the two clients, assuming no time constraints for completing the returns? Assuming staff and partner costs are fixed $ Assuming staff and partner costs are variable