Question

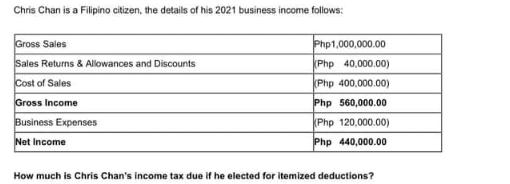

Chris Chan is a Filipino citizen, the details of his 2021 business income follows: Gross Sales Sales Returns & Allowances and Discounts Cost of

Chris Chan is a Filipino citizen, the details of his 2021 business income follows: Gross Sales Sales Returns & Allowances and Discounts Cost of Sales Gross Income Business Expenses Net Income Php1,000,000.00 (Php 40,000.00) (Php 400,000.00) Php 560,000.00 (Php 120,000.00) Php 440,000.00 How much is Chris Chan's income tax due if he elected for itemized deductions?

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Chris Chans income tax due if he elected for itemized deductions we need to determine h...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles Volume 1

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

8th Canadian Edition

111950242X, 1-119-50242-5, 978-1119502425

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App