Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ow Co., an advertiser shall pay PhP 100,000 to the Denver Co., the media supplier, inclusive of 12% VAT; Denver Co. is a TV

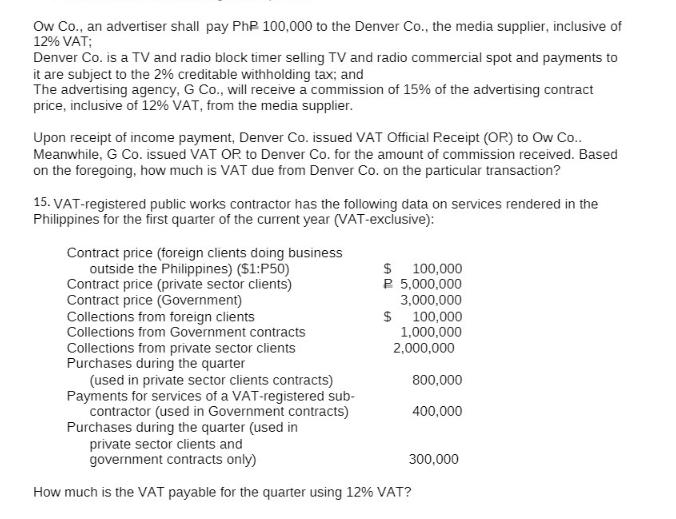

Ow Co., an advertiser shall pay PhP 100,000 to the Denver Co., the media supplier, inclusive of 12% VAT; Denver Co. is a TV and radio block timer selling TV and radio commercial spot and payments to it are subject to the 2% creditable withholding tax; and The advertising agency, G Co., will receive a commission of 15% of the advertising contract price, inclusive of 12% VAT, from the media supplier. Upon receipt of income payment, Denver Co. issued VAT Official Receipt (OR) to Ow Co.. Meanwhile, G Co. issued VAT OR to Denver Co. for the amount of commission received. Based on the foregoing, how much is VAT due from Denver Co. on the particular transaction? 15. VAT-registered public works contractor has the following data on services rendered in the Philippines for the first quarter of the current year (VAT-exclusive): Contract price (foreign clients doing business outside the Philippines) ($1:P50) Contract price (private sector clients) Contract price (Government) Collections from foreign clients Collections from Government contracts Collections from private sector clients Purchases during the quarter $ 100,000 P 5,000,000 3,000,000 $ 100,000 1,000,000 2,000,000 (used in private sector clients contracts) Payments for services of a VAT-registered sub- contractor (used in Government contracts) Purchases during the quarter (used in private sector clients and government contracts only) How much is the VAT payable for the quarter using 12% VAT? 800,000 400,000 300,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

For the first transaction involving Ow Co Denver Co and G Co lets calculate the VAT due from ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started