Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chris is applying for a $397,240 loan to buy a building that is priced at $545,000. The lender has already agreed to a 6.21% interest

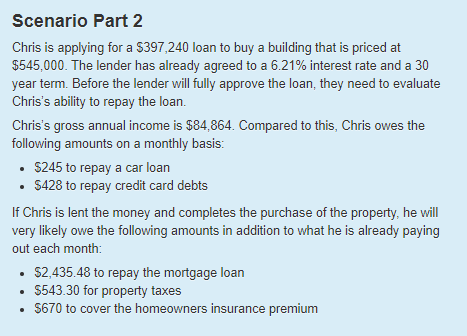

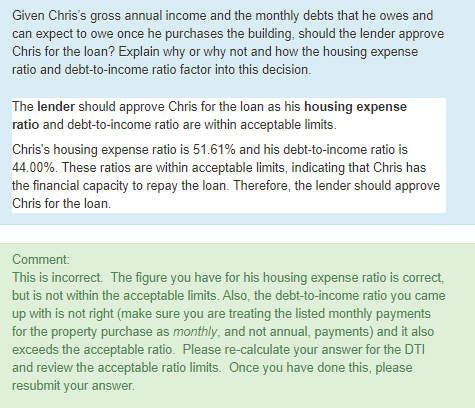

Chris is applying for a $397,240 loan to buy a building that is priced at $545,000. The lender has already agreed to a 6.21% interest rate and a 30 year term. Before the lender will fully approve the loan, they need to evaluate Chris's ability to repay the loan. Chris's gross annual income is $84,864. Compared to this, Chris owes the following amounts on a monthly basis: - \$245 to repay a car loan - $428 to repay credit card debts If Chris is lent the money and completes the purchase of the property, he will very likely owe the following amounts in addition to what he is already paying out each month: - $2,435.48 to repay the mortgage loan - $543.30 for property taxes - $670 to cover the homeowners insurance premium Given Chris's gross annual income and the monthly debts that he owes and can expect to owe once he purchases the building, should the lender approve Chris for the loan? Explain why or why not and how the housing expense ratio and debt-to-income ratio factor into this decision. The lender should approve Chris for the loan as his housing expense ratio and debt-to-income ratio are within acceptable limits. Chris's housing expense ratio is 51.61% and his debt-to-income ratio is 44.00%. These ratios are within acceptable limits, indicating that Chris has the financial capacity to repay the loan. Therefore, the lender should approve Chris for the loan. Comment: This is incorrect. The figure you have for his housing expense ratio is correct, but is not within the acceptable limits. Also, the debt-to-income ratio you came up with is not right (make sure you are treating the listed monthly payments for the property purchase as monthly, and not annual, payments) and it also exceeds the acceptable ratio. Please re-calculate your answer for the DTI and review the acceptable ratio limits. Once you have done this, please resubmit your

Chris is applying for a $397,240 loan to buy a building that is priced at $545,000. The lender has already agreed to a 6.21% interest rate and a 30 year term. Before the lender will fully approve the loan, they need to evaluate Chris's ability to repay the loan. Chris's gross annual income is $84,864. Compared to this, Chris owes the following amounts on a monthly basis: - \$245 to repay a car loan - $428 to repay credit card debts If Chris is lent the money and completes the purchase of the property, he will very likely owe the following amounts in addition to what he is already paying out each month: - $2,435.48 to repay the mortgage loan - $543.30 for property taxes - $670 to cover the homeowners insurance premium Given Chris's gross annual income and the monthly debts that he owes and can expect to owe once he purchases the building, should the lender approve Chris for the loan? Explain why or why not and how the housing expense ratio and debt-to-income ratio factor into this decision. The lender should approve Chris for the loan as his housing expense ratio and debt-to-income ratio are within acceptable limits. Chris's housing expense ratio is 51.61% and his debt-to-income ratio is 44.00%. These ratios are within acceptable limits, indicating that Chris has the financial capacity to repay the loan. Therefore, the lender should approve Chris for the loan. Comment: This is incorrect. The figure you have for his housing expense ratio is correct, but is not within the acceptable limits. Also, the debt-to-income ratio you came up with is not right (make sure you are treating the listed monthly payments for the property purchase as monthly, and not annual, payments) and it also exceeds the acceptable ratio. Please re-calculate your answer for the DTI and review the acceptable ratio limits. Once you have done this, please resubmit your Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started