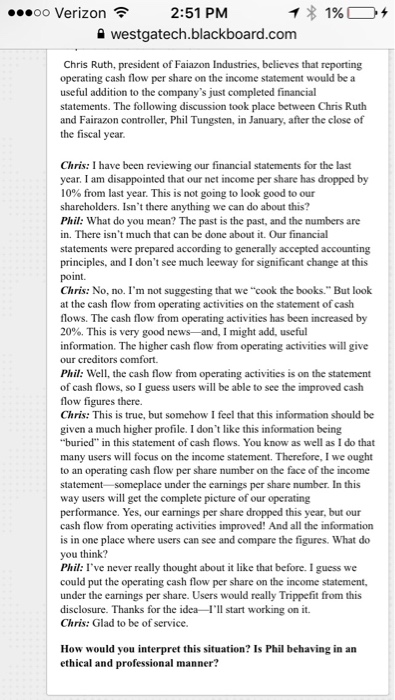

Chris Ruth, president of Faiazon Industries, believes that reporting operating cash flow per share on the income statement would be a useful addition to the company's just completed financial statements. The following discussion took place between Chris Ruth and Fairazon controller. Phil Tungsten, in January, after the close of the fiscal year. I have been reviewing our financial statements for the last year. I am disappointed that our net income per share has dropped by 10% from last year. This is not going to look good to our shareholders. Isn't there anything we can do about this? What do you mean? The past is the past, and the numbers arc in. There isn't much that can be done about it. Our financial statements were prepared according to generally accepted accounting principles, and I don't see much leeway for significant change at this point. No. no. I'm not suggesting that we "cook the books." But look at the cash flow from operating activities on the statement of cash flows. The cash flow from operating activities has been increased by 20%. This is very good news-and, I might add. useful information. The higher cash flow from operating activities will give our creditors comfort. Well, the cash flow from operating activities is on the statement of cash flows, so I guess users will be able to see the improved cash flow figures there. This is true, but somehow I feel that this information should be given a much higher profile. I don't like this information being "buried" in this statement of cash flows. You know as well as I do that many users will focus on the income statement. Therefore. I we ought to an operating cash flow per share number on the face of the income statement-someplace under the earnings per share number. In this way users will get the complete picture of our operating performance. Yes. our earnings per share dropped this year, but our cash flow from operating activities improved! And all the information is in one place where users can sec and compare the figures What do you think? I've never really thought about it like that before. I guess we could put the operating cash flow per share on the income statement, under the earnings per share. Users would really Trippefit from this disclosure. Thanks for the idea-I'll start working on it. Glad to be of service. How would you interpret this situation? Is Phil behaving in an ethical and professional manner