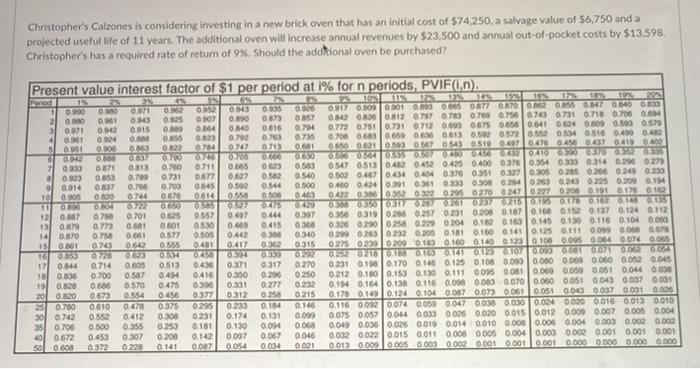

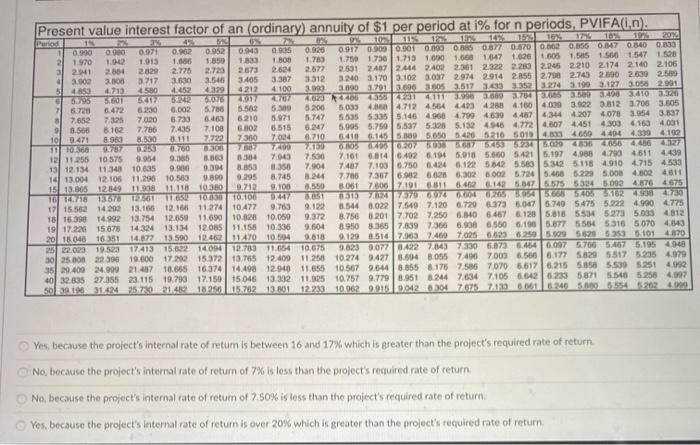

Christopher's Calzones is considering investing in a new brick oven that has an initial cost of $74.250, a salvage value of $6,750 and a projected useful life of 11 years. The additional oven will increase annual revenues by $23,500 and annual out-of-pocket costs by $13,598. Christopher's has a required rate of return of 9%. Should the addional oven be purchased? Present value interest factor of $1 per period at % for n periods, PVIF(Un). Pend 0.900 071 0917 010 0101 09 0877 02 0858847OMO 0633 0.00 0. 0.00 0904 0907 00 0.873 0.857 0.542 8200.812 0.77 0.0 0.750 0.7436.731 0.7180.700.0 3 0.02 09 ODIS 0 0 104 0.840 0.816 07 0.772 0.750 0.71 0.72 0.000 0.675 0.6 0.641 0.24 0.000 0.00 0.58 4 0.001 DON OS oss 03 . 0.750 0735 0.78 0.6 0.6 0.656 613 0572 054 0510 0.400.400 5 095 OMS 74 077 0713 041 0.000620030317 0543 05190407 0.476 044 0457 0.418 402 ON 003 6730 35 0 0 50657663355 0.000 0871 0.813 0.700 0711 0665 06 0.500 0.547 05130.482 0.452 0495 0400 0.375 0.354 0.33 0.314 0.29 0.27 0.323 ORSO 0.700 0.731 0677 0.627 0540 0.502 0.467 0.434 0.04 0.376 0.51 0.327.305 0285 0200 0.24 0.239 0.914 0.837 0.79 0.700 0.545 0.52 0544 0500 0.460 044 0.31 0.3 0.333 0.30 0.24 0.23 0.20 0.22 0.200 0.194 TO aos 0.00 0744 0.620 0614 OS 0.463 0.412 00.352 032 0295 0270 0247 022702080.1910.176 010 7660 0252 O703 03000051207022 021 01/15 12 0.887 0.70 0701 0.625 0557 0.497 0.30 0.356 0.319 0.25 0.25% 0.21 0.208 0.167 0.16 0.152 0.1370124 0.112 13 0.00 0.772 06 0.001 05:30 0.400 0.415 03 0326 0.200 0.250 0.22 0.2040182 0165 0.15 0.15 0.116 0.1040000 14 0.870 0.750 0.661 0.577 2.sos 0442 030 0340 0200200232 0.205 0.101 0.160 161 ISLO 0143 125 0.111 000 000 00 0.480 0.417 OM 0315 0275 0.239020061190.160 0.10 0.125 0.10 0.005 0064 0.074 0.065 10 054 22 03247610 TONOSOTTOSO 100026 17 0.344 0.714 0.005 0.519 0.37 0317 0270 0.231 0.19 0.170 0.15 0.125 0.100 0.000 0.000 0.00 0.00 0.002 0.045 10 0836 0.700 0587 0.414 0416 0.350 0290 0.250 0212 0.100.153 0.10 0.111 0.005 0.00 0.00 0.00 0.051 0.04 0.000 19 0.820 0.686 0.570 0.475 0.396 0331 0277 0232 0.14 0.1640.138 0.116 0.050 0083 0070 0.000 0.051 0.043 0.037 0.001 20 OO 0.673 0554 0.450 0377 0.312 0.250 0215 0.17801400.124 0.104 0087 0073 00510.051 000 0.037 0,091 0006 0.780 0610 0.478 0.375 0233 0.154 0.146 0.116 00920.074 0.05 0.0470038 0.000 0.024 0.00 0.01000130010 30 0.742 0.552 0.412 0300 0.231 0.174 0.131 0.00 0075 0.057 0.044 0033 0.02000200015 0.012 0.000 0.007 0.005 0.004 35 0.700 0.500 0.356 0.253 0.180 0.130 0.014 00 0.049 0.05 0.026 0019 0.014 0.010 0.00 0.00 0.004 0.003 0.002 0.002 40 0.453 0.307 0.200 0.142 0.007 0.046 0.032 0022 0.015 0.011 0.008 0.005 0.000 0.000 0.000 0.001 0.001 0.001 sol 0.600 0372 0.141 00 0.054 0034 0.001 0.013 0.000 0.005 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0672 Present value interest factor of an (ordinary) annuity of $1 per period at i% for n periods, PVIFA(in). Pertad 1 EN 10 11 16 1 0.900 0.971 0.952 0513 06 09170009 0.01 0.00035 0.877 06700.00 0.655 17 0.840 0.833 2 1.970 1.92 1.013 1.00 1.850 1833 1.800 1.703 1.750 1.730 1713 1.000 1.658 1647 1.626.005 1.585 1560 1.547 1.528 3 241 2829 2.775 2.573 2694 2.577 2.531 2487 2444 2.402 2.61 2.322 220 2.242.210 2.174 2.140 2.106 4 3.000 2.000 3717 3.630 3.540 3465 3.387 3312 3.240 3.1703.102 3.037 2.974 2.914 2855 2.70 2.745 2.800 2.00 2.589 5 4.713 580 4.452 4329 4212 4.100 3.999 3.0903.7013.8963605 3.517 3.43333523.274 3.1903.127 3.08 2.991 5295 5.601 63012 3106 07 3563141113.990 760 3.78435500 37TU3ZITO 2 6.72 6.472 6230 0.002 5.780 5.562 5.300 5.200 5.033 4.00 4.712 4564 443 428 4100 4.099 3.522 3.812 3.706 3.505 3 7.652 7.325 7.020 6.733 8.403 5210 3971 5.747 5.535 5335 5.146 4966 4.7994630 448743444.207 40783.054 3.637 9 8.500 810 7.706 7.435 7.100 6.802 6.515 5.247 5.995 5.750 5.537 5.3285.132 4.94647724.607 4451 4303 4160 4.001 101 9.471 8.30 8.530 8.11 2722 7300 6.710 5.418 5.145 5.89 5.65054215 216 50154333 4650 4404 4.399 4.192 11 101368 DS 8.750 7807 70 250 6.06.207 007 5253 5234564564655 446 1211255 10 575 9054 9.35 8.30 8.34 7.943 7.550 7.101 60146402 6.194 5.918 5.600 54215.197 4988 4.7904611 4439 13 12.134 11.348 10.035 9.900 9.394 853 3.350 7.904 7.487 7.100 6.750 6.424 0.125.542 5.560 5.342 5.1184.910 4.715 4.533 14 13.004 12 106 11.200 10500 9.800 0295 8.745 8.24 7.736 73876.92 8.628 6.302 6.0025.7245.460 5.229 5.000 4.8004011 1513.865 12.149 11.908 10380 9.712 9.100 0.550 3.001 760079168116.42 6.142 5.84755755,324 5.092 4.8764.675 TO 13578 127561 1176 1050 TO 100 0515157000 55688540SSX430 4730 17 15.50214200 13.166 12.16 11.274 10.472 9.703 8.54480227.549 7.1206.720.373 6.0675.740 5.475 5.222 4.990 4.775 18 16.390 14.992 13.754 12.659 11.690 10.328 10.050 9.372 8.7568.201 7.702 7.250 6.40 6.4676.125.818 5534 5.273 5.033 4812 19 17.22 15 678143 13.114 12085 11.158 10.336 9.604 8.950 8.365 7.839 7366 6.000 6.500 6.1905.677 5564 5316 5.070 4.643 2018.048 16351 14.677 13.101246211470 10.504 2.818 9.1298.51476374007025 0.623 62505.009562053535.101 4870 25 22.023 1023 17/413 15.60216096 12.783 1654 10.675 9.077B422 7.8437330 6.073 6.464 0.097 5.700 467 5.195 30 25.000 2239619.000 17.202 15.372 13.765 12.400 11.250 10.274 94278.694 8055 74067000 6.566 6.177 5.8295.517 5235 4.979 3529.400 24.999 21.487 10.668 16374 14.498 12.940 11.655 10.567 9.648.855 8.175 7.586 70706,617 6.215 5.8585.530 5251 4992 4032835 27.855 23.115 19.793 17.150 15046 13332 11.025 10.757 9.779 3.951 6244 7.634 7.105 0.6420 233 58715.548 5.258 4.007 502142425.780214121826 15.702_13.00112 233 10.062_9015904203047675743366246556545202490 Ves, because the project's internal rate of retum is between 16 and 17% which is greater than the project's required rate of return No, because the project's internal rate of retum of 7% is less than the project's required rate of return No, because the project's internal rate of retum of 7.50% is less than the project's required rate of return Yes, because the project's internal rate of retum is over 20% which is greater than the project's required rate of return