Question

Chum Company has just completed its first year of operations. During the year, Chum Company purchased $527,000 of materials. The year-end balance reported in the

Chum Company has just completed its first year of operations. During the year, Chum Company purchased $527,000 of materials. The year-end balance reported in the raw materials account was $52,000. $29,000 of the raw materials consumed was considered as indirect materials and entered into manufacturing overhead. Chum Company incurred $1,248,000 in total direct labor wages during the year. Factory workers are paid $26 per hour. Total manufacturing overhead during the year amounted to $354,000, which was $36,000 less than estimated. Total factory worker hours were 10% less than estimated. Chum Company's manufacturing overhead was allocated using direct labor hours as the allocation base. Chum Company charges any over or under- allocated manufacturing overhead to cast of goods sold. During the year, Chum Company started and completed Job 003. This job consumed 35% of the total direct direct materials used this year and 45% of the direct labor hours. Determine the total cost for Job 003. Do not enter dollar signs or commas in the input boxes. Round the predetermined overhead tov

2 decimal places. Round all other answers to the nearest whole number. FOTO

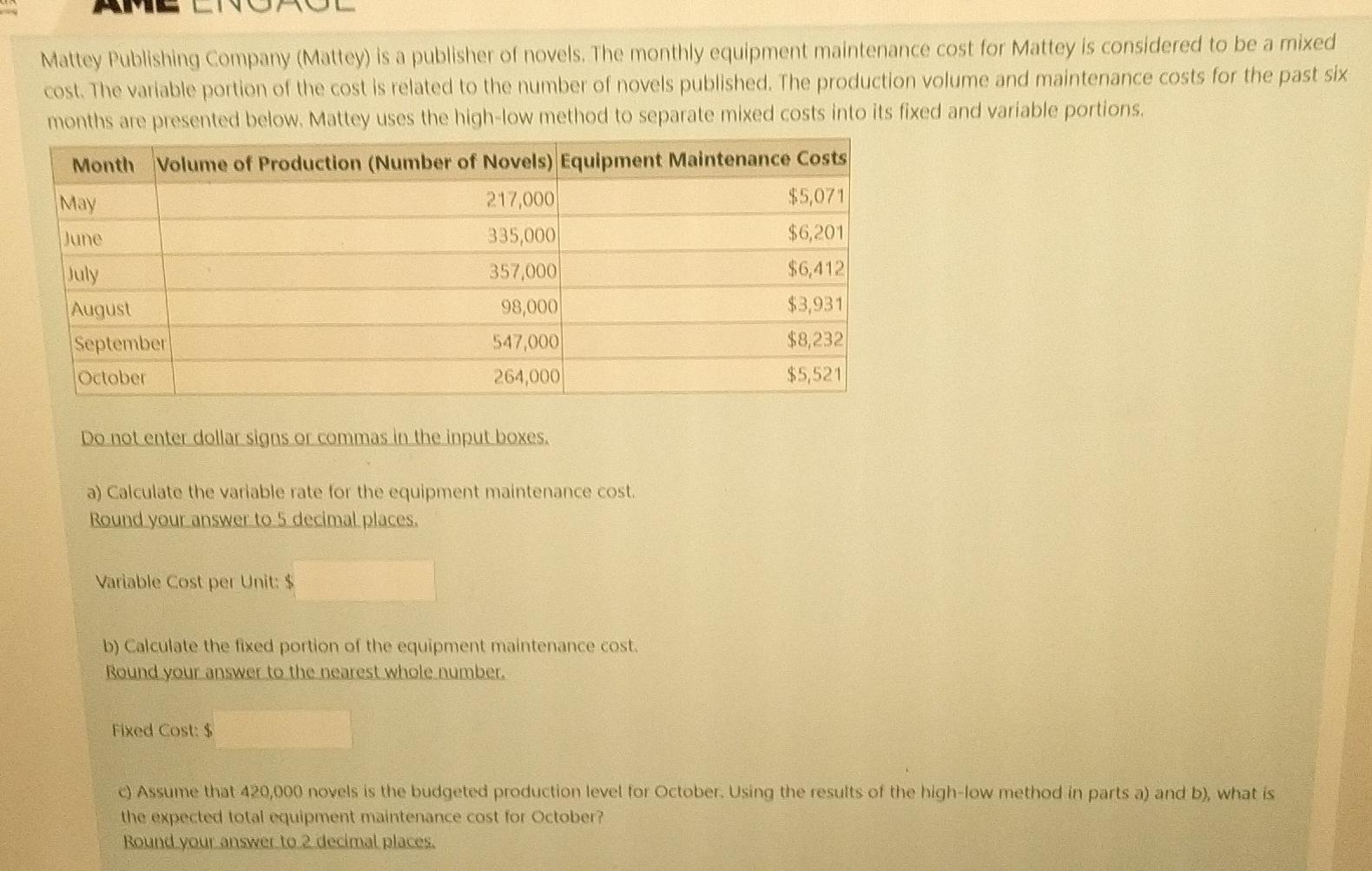

Mattey Publishing Company (Mattey) is a publisher of novels. The monthly equipment maintenance cost for Mattey is considered to be a mixed cost. The variable portion of the cost is related to the number of novels published. The production volume and maintenance costs for the past six months are presented below. Mattey uses the high-low method to separate mixed costs into its fixed and variable portions. Do not enter dollar signs or commas in the input boxes. a) Calculate the variable rate for the equipment maintenance cost. Round your answer to 5 decimal places. Variable Cost per Unit: b) Calculate the fixed portion of the equipment maintenance cost. Round your answer to the nearest whole number. rixed cost: c) Assume that 420,000 novels is the budgeted production level for October. Using the results of the high-low method in parts a) and b), what is the expected total equipment maintenance cost for October? Round your answer to 2 dedmal places. Mattey Publishing Company (Mattey) is a publisher of novels. The monthly equipment maintenance cost for Mattey is considered to be a mixed cost. The variable portion of the cost is related to the number of novels published. The production volume and maintenance costs for the past six months are presented below. Mattey uses the high-low method to separate mixed costs into its fixed and variable portions. Do not enter dollar signs or commas in the input boxes. a) Calculate the variable rate for the equipment maintenance cost. Round your answer to 5 decimal places. Variable Cost per Unit: b) Calculate the fixed portion of the equipment maintenance cost. Round your answer to the nearest whole number. rixed cost: c) Assume that 420,000 novels is the budgeted production level for October. Using the results of the high-low method in parts a) and b), what is the expected total equipment maintenance cost for October? Round your answer to 2 dedmal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started