Chun Hoop Sdn. Bhd. (CHSB) is the company involved in manufacturing and trading household products incorporated with paid up capital of RM2.45 million and

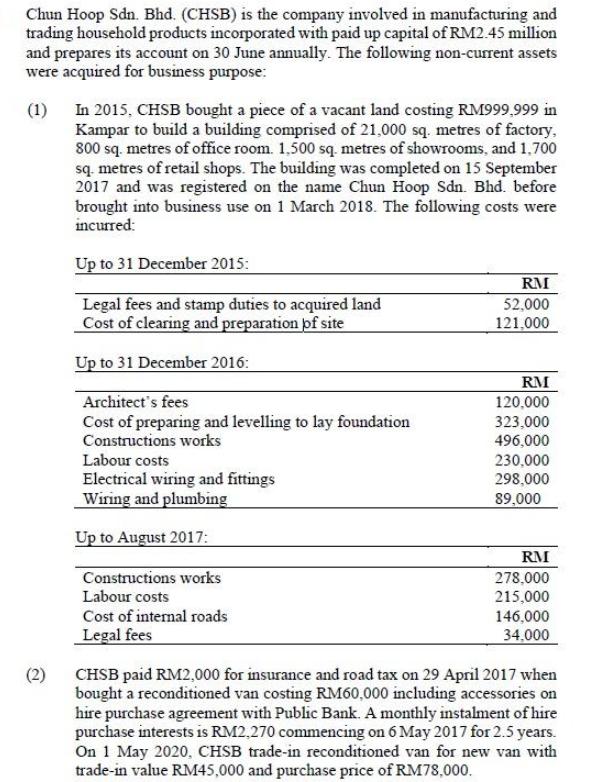

Chun Hoop Sdn. Bhd. (CHSB) is the company involved in manufacturing and trading household products incorporated with paid up capital of RM2.45 million and prepares its account on 30 June annually. The following non-current assets were acquired for business purpose: (1) In 2015, CHSB bought a piece of a vacant land costing RM999,999 in Kampar to build a building comprised of 21,000 sq. metres of factory, 800 sq. metres of office room. 1,500 sq. metres of showrooms, and 1,700 sq. metres of retail shops. The building was completed on 15 September 2017 and was registered on the name Chun Hoop Sdn. Bhd. before brought into business use on 1 March 2018. The following costs were incurred: Up to 31 December 2015: RM Legal fees and stamp duties to acquired land Cost of clearing and preparation pf site 52,000 121,000 Up to 31 December 2016: RM 120,000 Architect's fees Cost of preparing and levelling to lay foundation Constructions works 323,000 496,000 Labour costs 230,000 Electrical wiring and fittings Wiring and plumbing 298,000 89,000 Up to August 2017: RM Constructions works 278.000 Labour costs 215,000 Cost of intemal roads 146,000 Legal fees 34,000 CHSB paid RM2,000 for insurance and road tax on 29 April 2017 when bought a reconditioned van costing RM60,000 including accessories on hire purchase agreement with Public Bank. A monthly instalment of hire purchase interests is RM2,270 commencing on 6 May 2017 for 2.5 years. On 1 May 2020, CHSB trade-in reconditioned van for new van with trade-in value RM45,000 and purchase price of RM78,000. (2) Required: Compute the capital allowances and the balancing charge/ allowance (if any) in respect of the various expenditures incurred for the relevant year of assessment up to year assessment 2020. Your answer should include the explanation for any adjustment made in arriving at the allowance or charge.

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

ANSWERS The company is entitled to capital allowances on the following expenditure 1 Legal fees and stamp duties to acquire land RM52000 2 Cost of clearing and preparation of site RM121000 3 Architect...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started