Question

Cirrus Logic, Inc. , is a leading designer and manufacturer of advanced integrated circuits that integrate algorithms and mixed-signal processing for mass storage, communications, consumer

| Cirrus Logic, Inc. , is a leading designer and manufacturer of advanced integrated circuits that integrate algorithms and mixed-signal processing for mass storage, communications, consumer electronics, and industrial markets. The companys 2011 financial statements contained the following information: |

| ($ in thousands) | ||

| Balance sheets | 2011 | 2010 |

| Current assets: | ||

| Accounts receivable, net | $40,118 | $24,583 |

| ($ in thousands) | ||

| Income statements | 2011 | 2010 |

| Net sales | $371,791 | $223,209 |

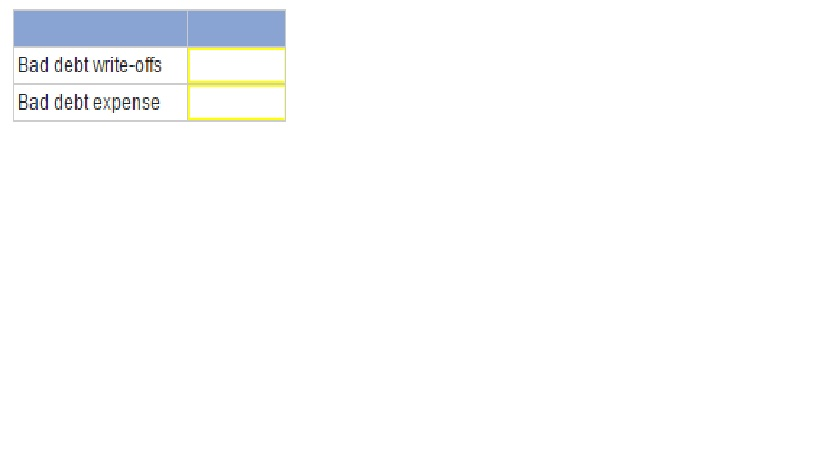

| In addition, the statement of cash flows disclosed that accounts receivable increased during 2011 by $15,535 (in thousands). This indicates that cash received from customers was $15,535 (in thousands) less than accrual sales revenue. Also, a disclosure note reported that the allowance for uncollectible accounts (in thousands) was $461 and $548 at the end of 2011 and 2010, respectively

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started