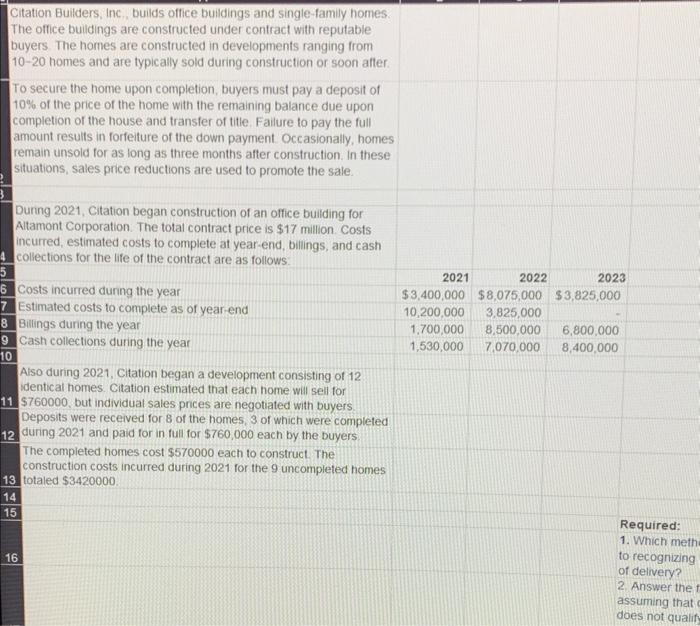

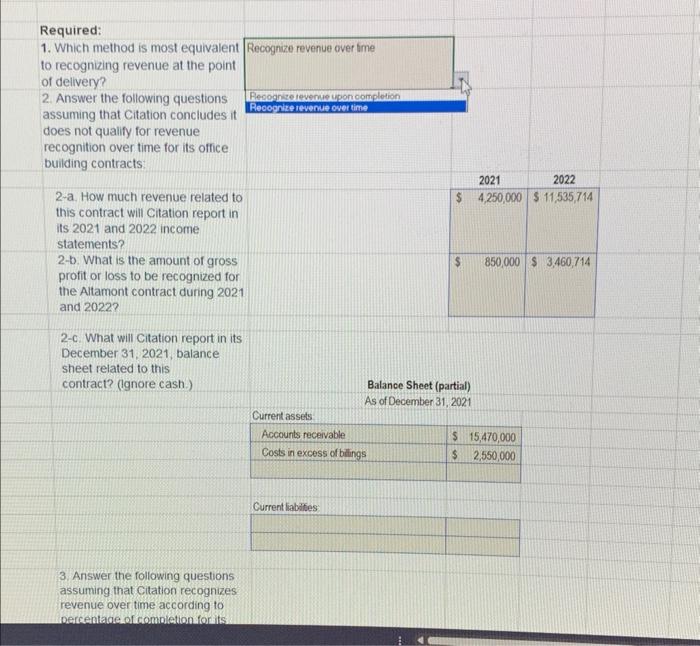

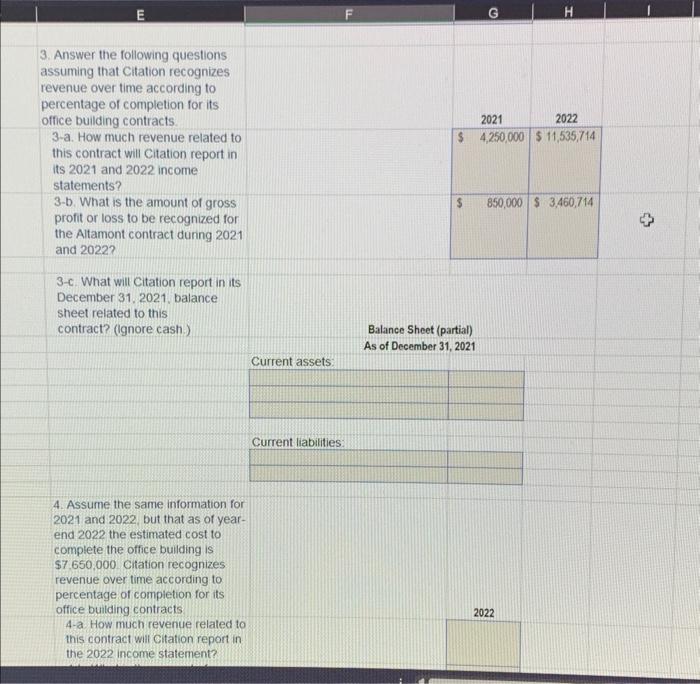

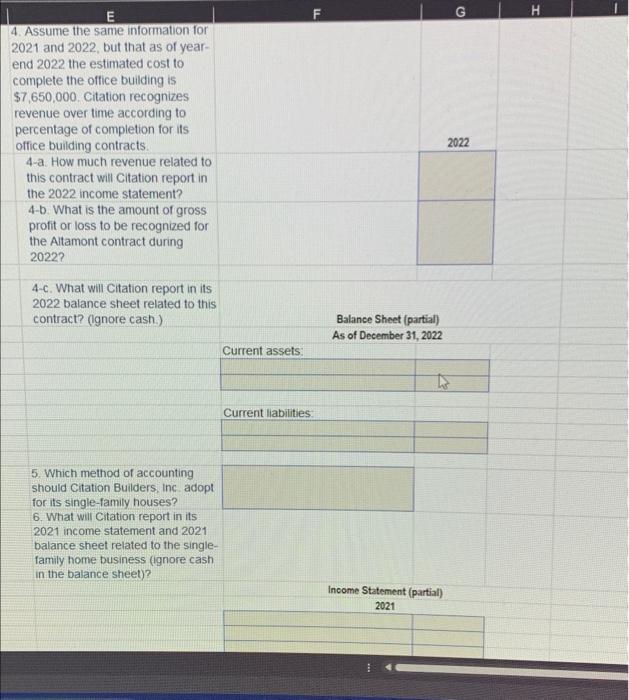

Citation Auldors Ine hulde nffien huildinne sand einalo. familu hnme TtbiIC Required: 1. Which method is most equivalent Recognize revenue over ime to recognizing revenue at the point of delivery? 2. Answer the following questions assuming that Citation concludes it does not qualify for revenue recognition over time for its office building contracts: 2-a. How much revenue related to this contract will Citation report in its 2021 and 2022 income statements? 2-b. What is the amount of gross profit or loss to be recognized for the Altamont contract during 2021 and 2022 ? 2-c. What will citation report in its December 31,2021 , balance sheet related to this contract? (ignore cash.) Balance Sheet (partial) As of December 31, 2021 Current assets Current labidtes: 3. Answer the following questions assuming that citation recognizes revenue over time according to bercentade of combietion forits. 4. Assume the same information for 2021 and 2022 , but that as of yearend 2022 the estimated cost to complete the office building is $7,650,000 Citation recognizes revenue over time according to percentage of compietion for its office building contracts 4-a How much revenue related to this contract wilt citation report in the 2022 income statement? 4. Assume the same information for 2021 and 2022 , but that as of yearend 2022 the estimated cost to complete the office building is $7,650,000. Citation recognizes revenue over time according to percentage of completion for its office building contracts. 4-a. How much revenue related to this contract will Citation report in the 2022 income statement? 4-b. What is the amount of gross profit or loss to be recognized for the Altamont contract during 2022? 4-c. What will Citation report in its 2022 balance sheet related to this contract? (Ignore cash.) Balance Sheet (partial) As of December 31, 2022 Current assets: Current liabilities. 5. Which method of accounting should Citation Builders, inc. adopt for its single-family houses? 6. What will Citation report in its 2021 income statement and 2021 balance sheet related to the singlefamily home business (ignore cash in the balance sheet)? Income Statement (partial) 2021 Current liabilities: 5. Which method of accounting should Citation Builders, Inc adopt for its single-family houses? 6. What will Citation report in its 2021 income statement and 2021 balance sheet related to the singlefamily home business (ignore cash in the balance sheet)? Income Statement (partial) 2021 Balance Sheet (partial) As of December 31, Current assets: Current liabilities: Citation Auldors Ine hulde nffien huildinne sand einalo. familu hnme TtbiIC Required: 1. Which method is most equivalent Recognize revenue over ime to recognizing revenue at the point of delivery? 2. Answer the following questions assuming that Citation concludes it does not qualify for revenue recognition over time for its office building contracts: 2-a. How much revenue related to this contract will Citation report in its 2021 and 2022 income statements? 2-b. What is the amount of gross profit or loss to be recognized for the Altamont contract during 2021 and 2022 ? 2-c. What will citation report in its December 31,2021 , balance sheet related to this contract? (ignore cash.) Balance Sheet (partial) As of December 31, 2021 Current assets Current labidtes: 3. Answer the following questions assuming that citation recognizes revenue over time according to bercentade of combietion forits. 4. Assume the same information for 2021 and 2022 , but that as of yearend 2022 the estimated cost to complete the office building is $7,650,000 Citation recognizes revenue over time according to percentage of compietion for its office building contracts 4-a How much revenue related to this contract wilt citation report in the 2022 income statement? 4. Assume the same information for 2021 and 2022 , but that as of yearend 2022 the estimated cost to complete the office building is $7,650,000. Citation recognizes revenue over time according to percentage of completion for its office building contracts. 4-a. How much revenue related to this contract will Citation report in the 2022 income statement? 4-b. What is the amount of gross profit or loss to be recognized for the Altamont contract during 2022? 4-c. What will Citation report in its 2022 balance sheet related to this contract? (Ignore cash.) Balance Sheet (partial) As of December 31, 2022 Current assets: Current liabilities. 5. Which method of accounting should Citation Builders, inc. adopt for its single-family houses? 6. What will Citation report in its 2021 income statement and 2021 balance sheet related to the singlefamily home business (ignore cash in the balance sheet)? Income Statement (partial) 2021 Current liabilities: 5. Which method of accounting should Citation Builders, Inc adopt for its single-family houses? 6. What will Citation report in its 2021 income statement and 2021 balance sheet related to the singlefamily home business (ignore cash in the balance sheet)? Income Statement (partial) 2021 Balance Sheet (partial) As of December 31, Current assets: Current liabilities