Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FEZX Co. wishes to acquire a $100,000 multifaceted cutting machine. The machine is expected to be used for eight years, after which there is a

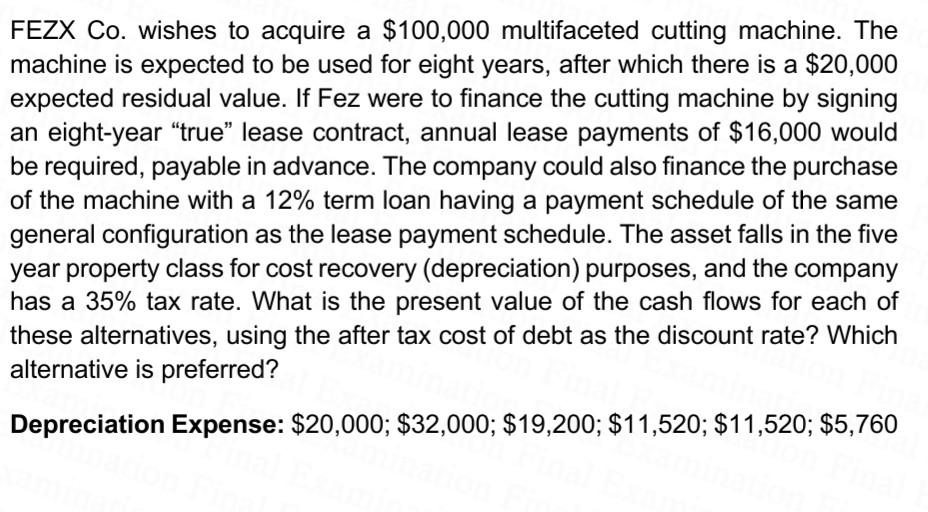

FEZX Co. wishes to acquire a $100,000 multifaceted cutting machine. The machine is expected to be used for eight years, after which there is a $20,000 expected residual value. If Fez were to finance the cutting machine by signing an eight-year "true" lease contract, annual lease payments of $16,000 would be required, payable in advance. The company could also finance the purchase of the machine with a 12% term loan having a payment schedule of the same general configuration as the lease payment schedule. The asset falls in the five year property class for cost recovery (depreciation) purposes, and the company has a 35% tax rate. What is the present value of the cash flows for each of these alternatives, using the after tax cost of debt as the discount rate? Which alternative is preferred? Depreciation Expense: $20,000; $32,000; $19,200; $11,520; $11,520; $5,760 FEZX Co. wishes to acquire a $100,000 multifaceted cutting machine. The machine is expected to be used for eight years, after which there is a $20,000 expected residual value. If Fez were to finance the cutting machine by signing an eight-year "true" lease contract, annual lease payments of $16,000 would be required, payable in advance. The company could also finance the purchase of the machine with a 12% term loan having a payment schedule of the same general configuration as the lease payment schedule. The asset falls in the five year property class for cost recovery (depreciation) purposes, and the company has a 35% tax rate. What is the present value of the cash flows for each of these alternatives, using the after tax cost of debt as the discount rate? Which alternative is preferred? Depreciation Expense: $20,000; $32,000; $19,200; $11,520; $11,520; $5,760

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started