Answered step by step

Verified Expert Solution

Question

1 Approved Answer

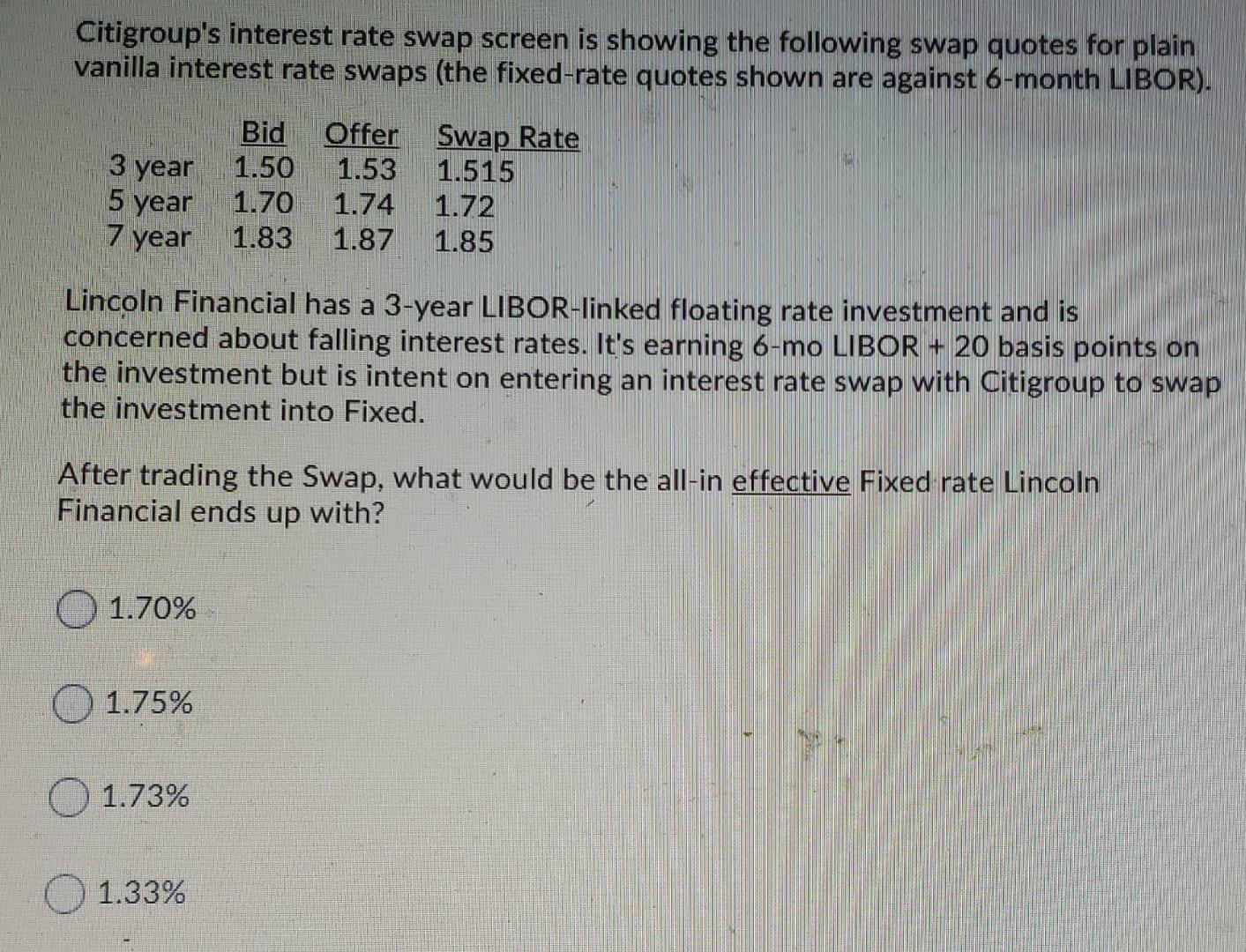

Citigroup's interest rate swap screen is showing the following swap quotes for plain vanilla interest rate swaps (the fixed-rate quotes shown are against 6-month LIBOR).

Citigroup's interest rate swap screen is showing the following swap quotes for plain vanilla interest rate swaps (the fixed-rate quotes shown are against 6-month LIBOR). 3 year 5 year 7 year Bid 1.50 1.70 1.83 Offer Swap Rate 1.53 1.515 1.74 1.72 1.87 1.85 Lincoln Financial has a 3-year LIBOR-linked floating rate investment and is concerned about falling interest rates. It's earning 6-mo LIBOR + 20 basis points on the investment but is intent on entering an interest rate swap with Citigroup to swap the investment into Fixed. After trading the Swap, what would be the all-in effective Fixed rate Lincoln Financial ends up with? 01.70% O 1.75% 1.73% 1.33%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started