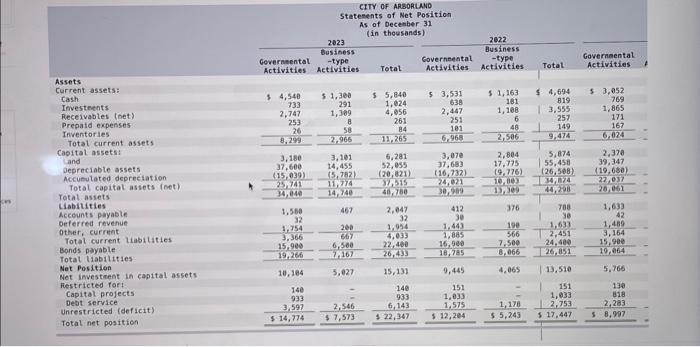

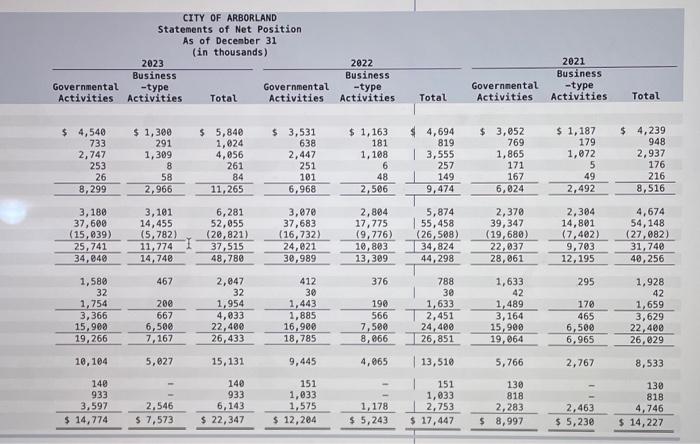

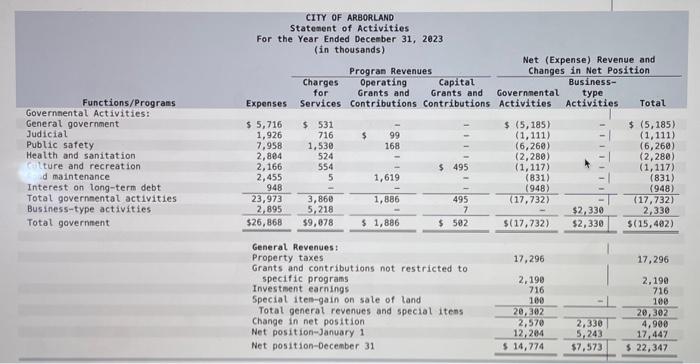

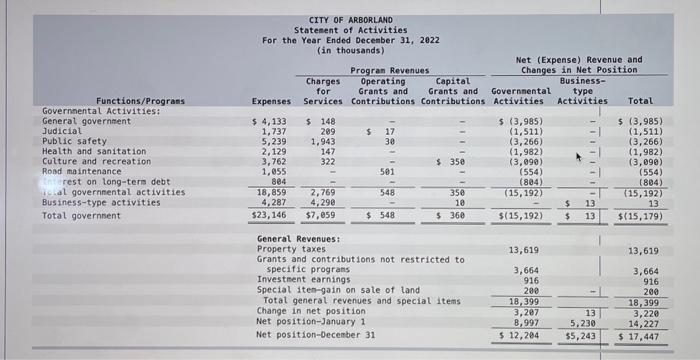

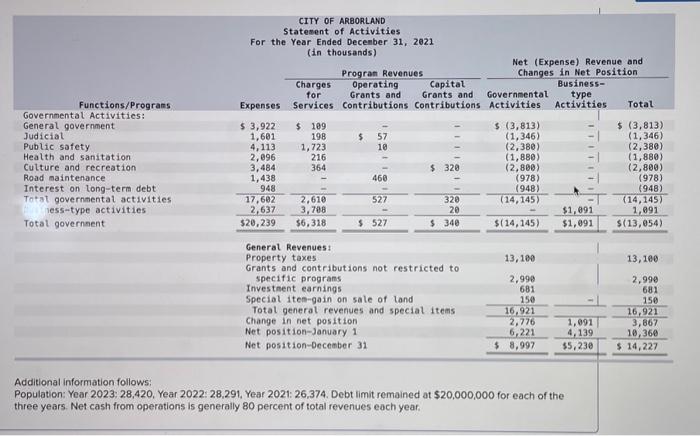

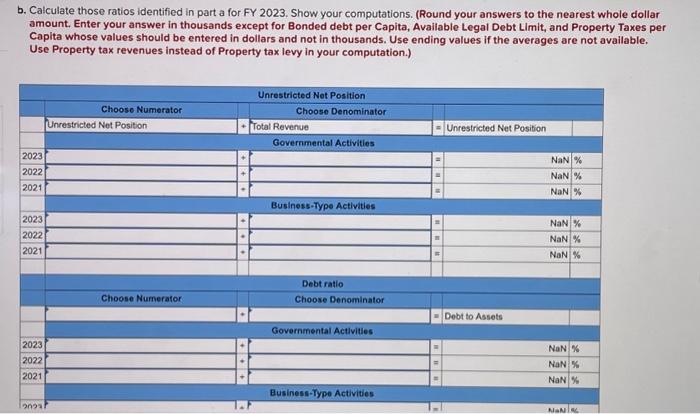

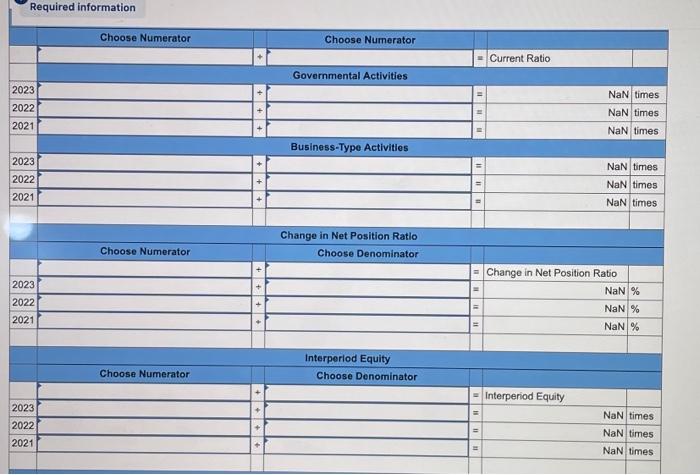

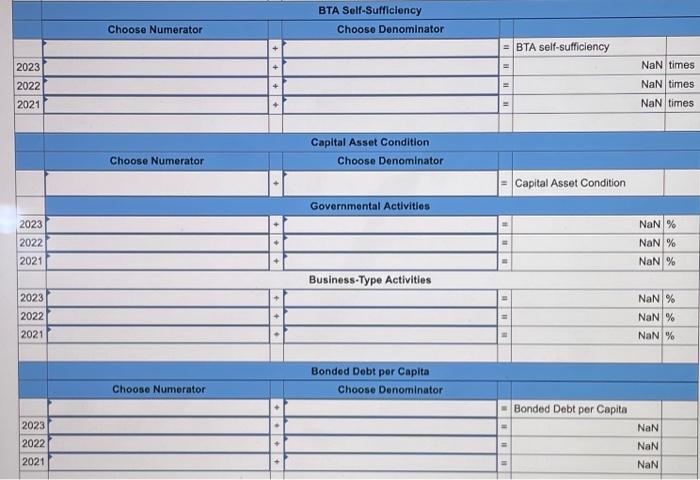

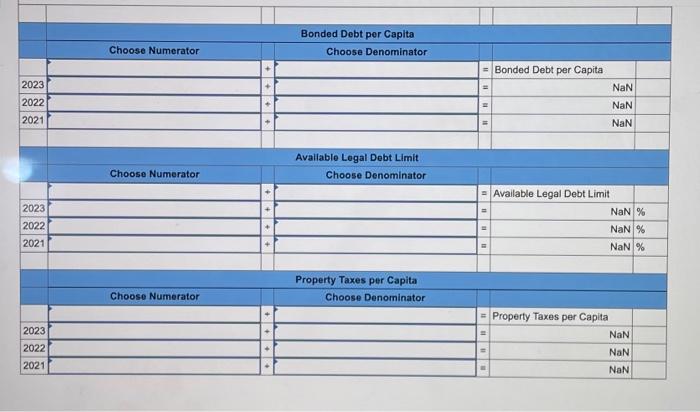

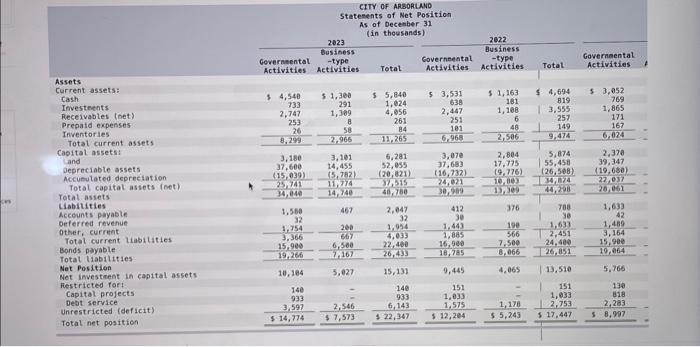

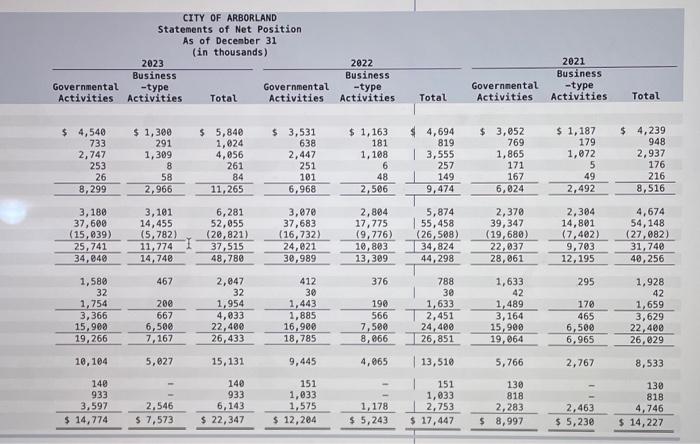

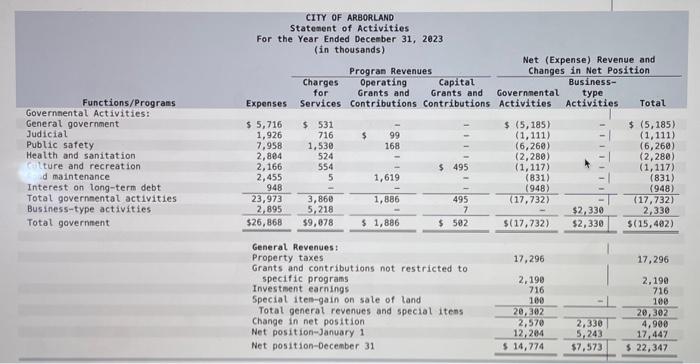

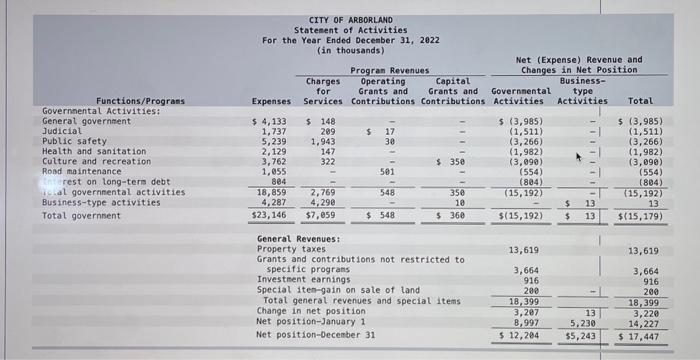

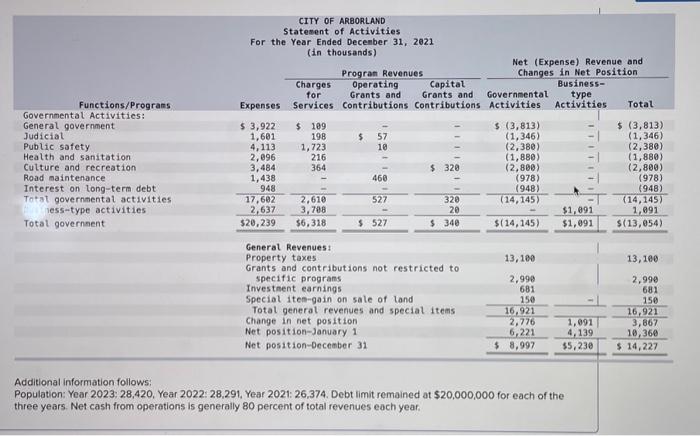

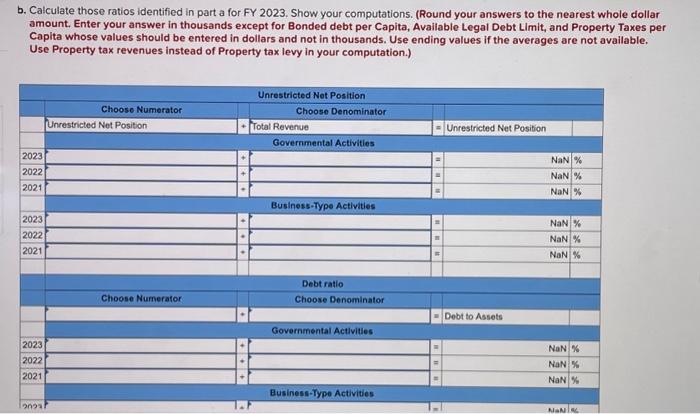

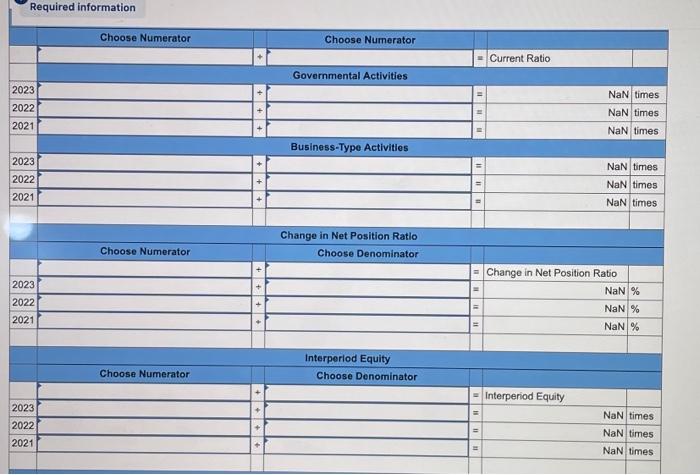

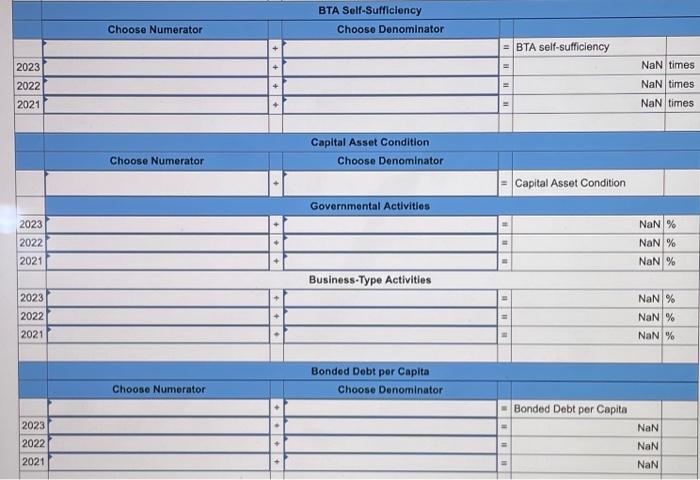

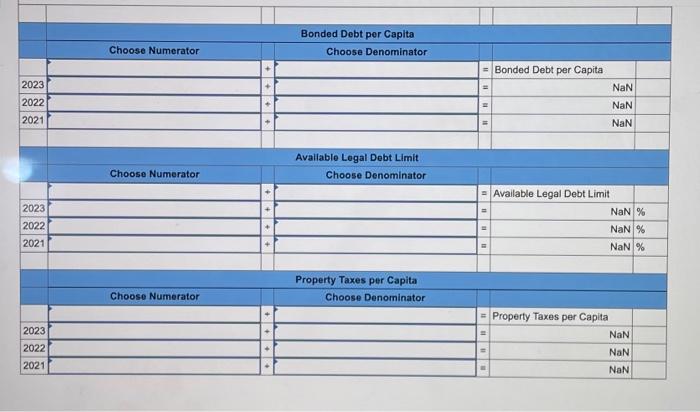

CITY OF ARBORLAND Statements of Net Position As of Decenber 31 CITY OF ARBORLAND Statenent of Activities For the Year Ended December 31, 2023 (in thousands) Net (Expense) Revenue and Changes in Net Position Functions/ProgransExpensesServicesContributionsContributionsActivitiesActivitiesTotal.forGrantsandGrantsandGovernmentalGeGe Governentat Activities: General government Judicial Public safety Health and sanitation lture and recreation d maintenance Interest on long-term debt Total governmental activities Business-type activities Total government General Revenues: Property taxes Grants and contributions not restricted to specific programs Investient earnings Special iten-gain on sale of land Total general revenues and special itens Change in net position Net position-January 1 Net position-December 31 CITY OF ARBORLANO Statement of Activities For the Year Ended December 31, 2022 (in thousands) Net (Expense) Revenue and Governnental Activities: General government Judicial Public safety Health and sanitation Culture and recreation Rond maintenance rest on long-teri debt ichal governnental activities Business-type activities Total governnent General Revenues: Property taxes Grants and contributions not restricted to specific prograns Investinent earnings Special iten-gain on sale of land Total general revenues and special items Change in net position Net position-January 1 Net position-December 31 Additional information follows: Population: Year 2023: 28,420, Year 2022:28,291, Year 2021: 26,374. Debt limit remained at $20,000,000 for each of the three years. Net cash from operations is generally 80 percent of total revenues each year. b. Calculate those ratios identified in part a for FY 2023 . Show your computations. (Round your answers to the nearest whole dollar amount. Enter your answer in thousands except for Bonded debt per Capita, Available Legal Debt Limit, and Property Taxes per Capita whose values should be entered in dollars and not in thousands. Use ending values if the averages are not available. Use Property tax revenues instead of Property tax levy in your computation.) Required information BTA Self-Sufficlency CITY OF ARBORLAND Statements of Net Position As of Decenber 31 CITY OF ARBORLAND Statenent of Activities For the Year Ended December 31, 2023 (in thousands) Net (Expense) Revenue and Changes in Net Position Functions/ProgransExpensesServicesContributionsContributionsActivitiesActivitiesTotal.forGrantsandGrantsandGovernmentalGeGe Governentat Activities: General government Judicial Public safety Health and sanitation lture and recreation d maintenance Interest on long-term debt Total governmental activities Business-type activities Total government General Revenues: Property taxes Grants and contributions not restricted to specific programs Investient earnings Special iten-gain on sale of land Total general revenues and special itens Change in net position Net position-January 1 Net position-December 31 CITY OF ARBORLANO Statement of Activities For the Year Ended December 31, 2022 (in thousands) Net (Expense) Revenue and Governnental Activities: General government Judicial Public safety Health and sanitation Culture and recreation Rond maintenance rest on long-teri debt ichal governnental activities Business-type activities Total governnent General Revenues: Property taxes Grants and contributions not restricted to specific prograns Investinent earnings Special iten-gain on sale of land Total general revenues and special items Change in net position Net position-January 1 Net position-December 31 Additional information follows: Population: Year 2023: 28,420, Year 2022:28,291, Year 2021: 26,374. Debt limit remained at $20,000,000 for each of the three years. Net cash from operations is generally 80 percent of total revenues each year. b. Calculate those ratios identified in part a for FY 2023 . Show your computations. (Round your answers to the nearest whole dollar amount. Enter your answer in thousands except for Bonded debt per Capita, Available Legal Debt Limit, and Property Taxes per Capita whose values should be entered in dollars and not in thousands. Use ending values if the averages are not available. Use Property tax revenues instead of Property tax levy in your computation.) Required information BTA Self-Sufficlency