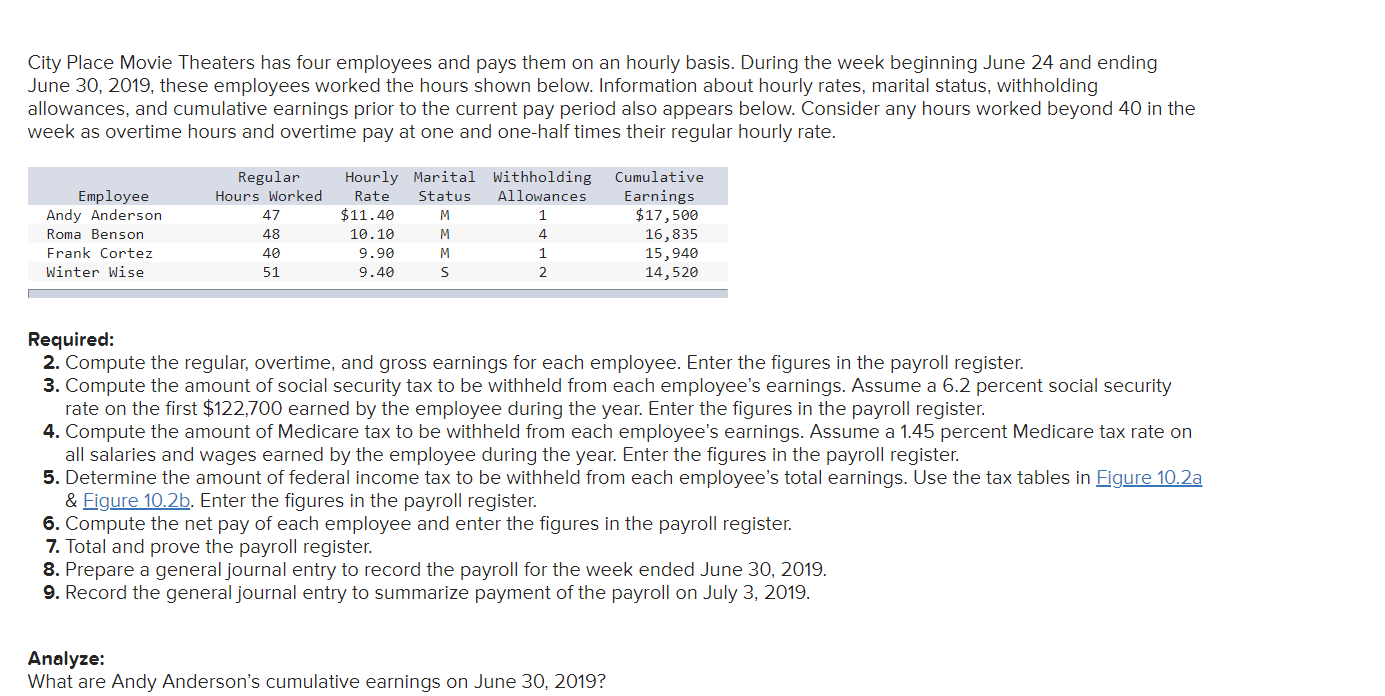

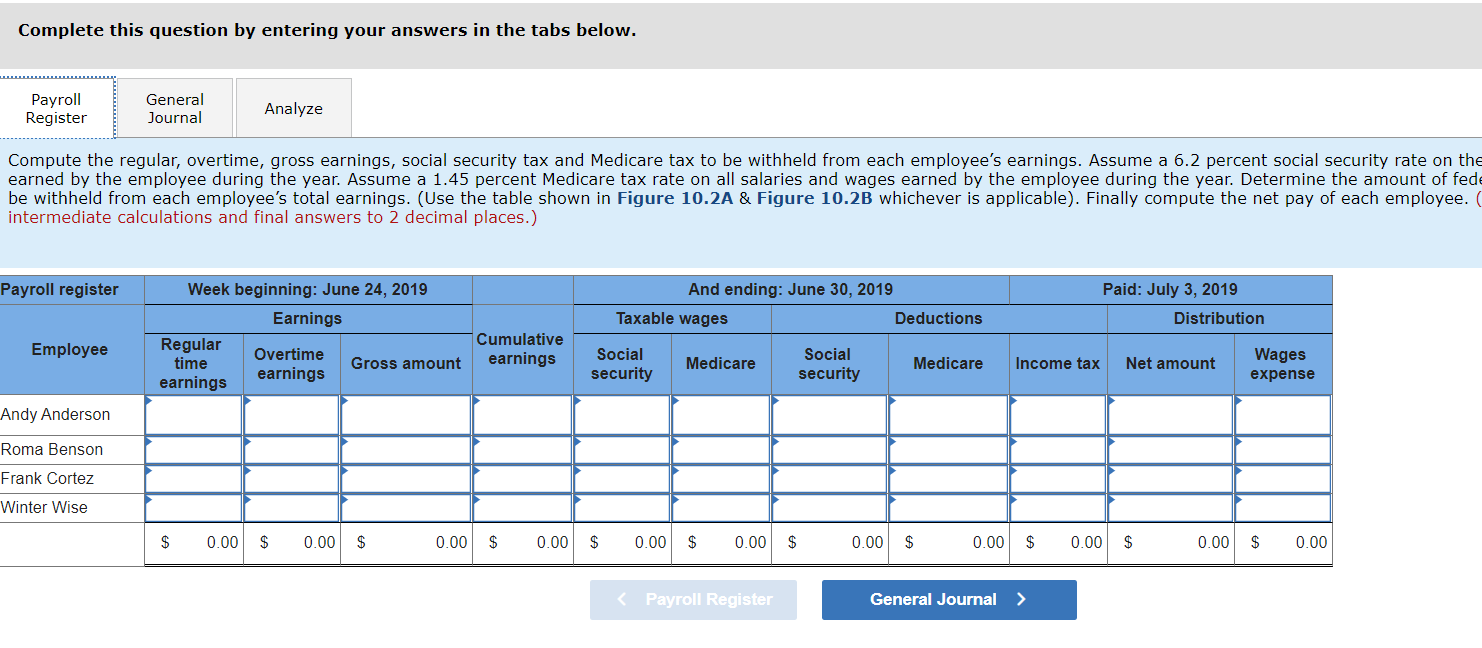

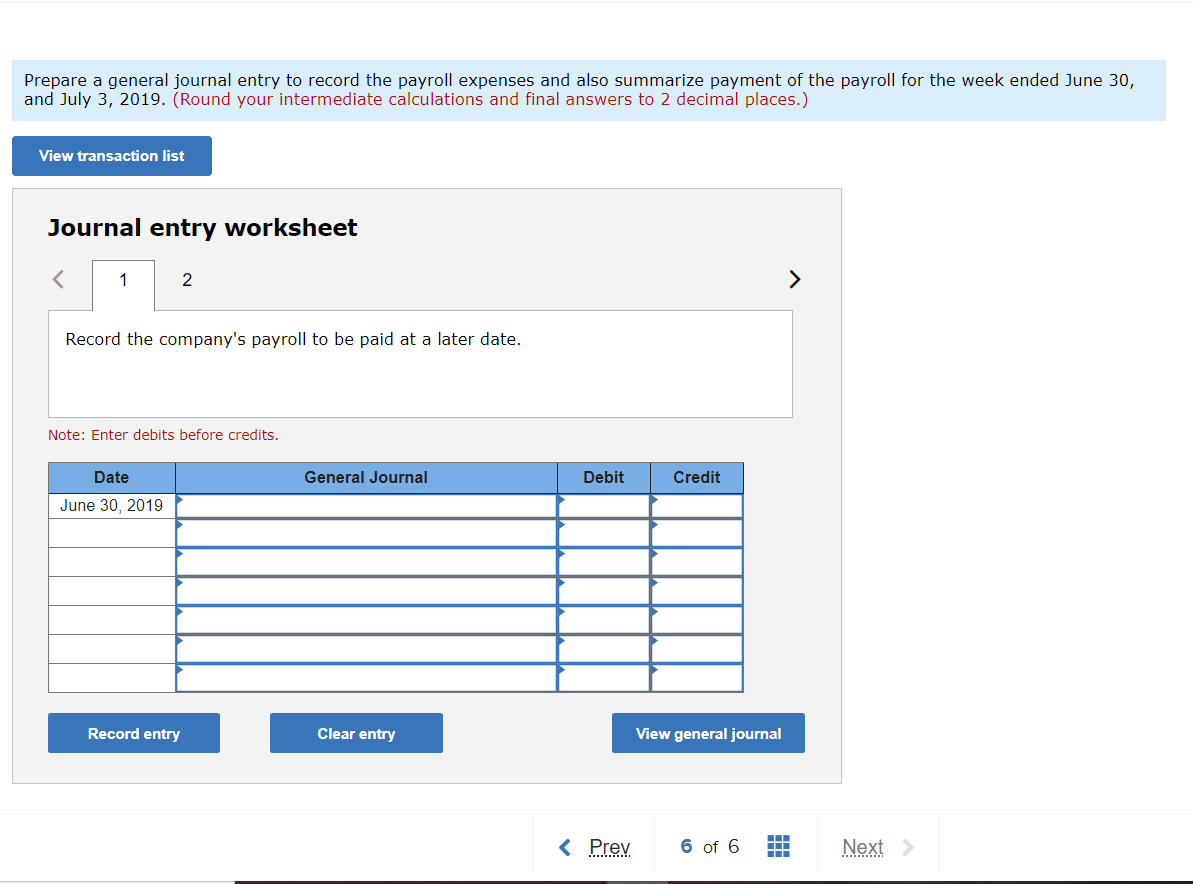

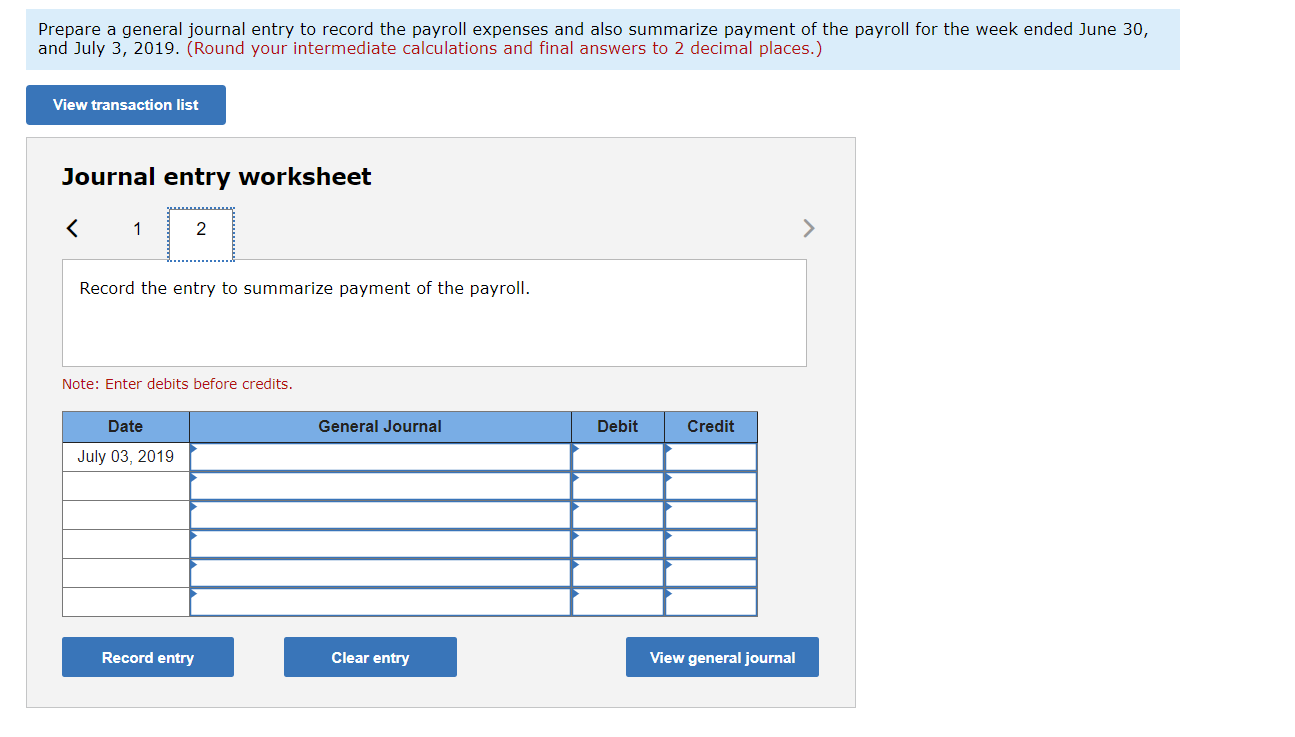

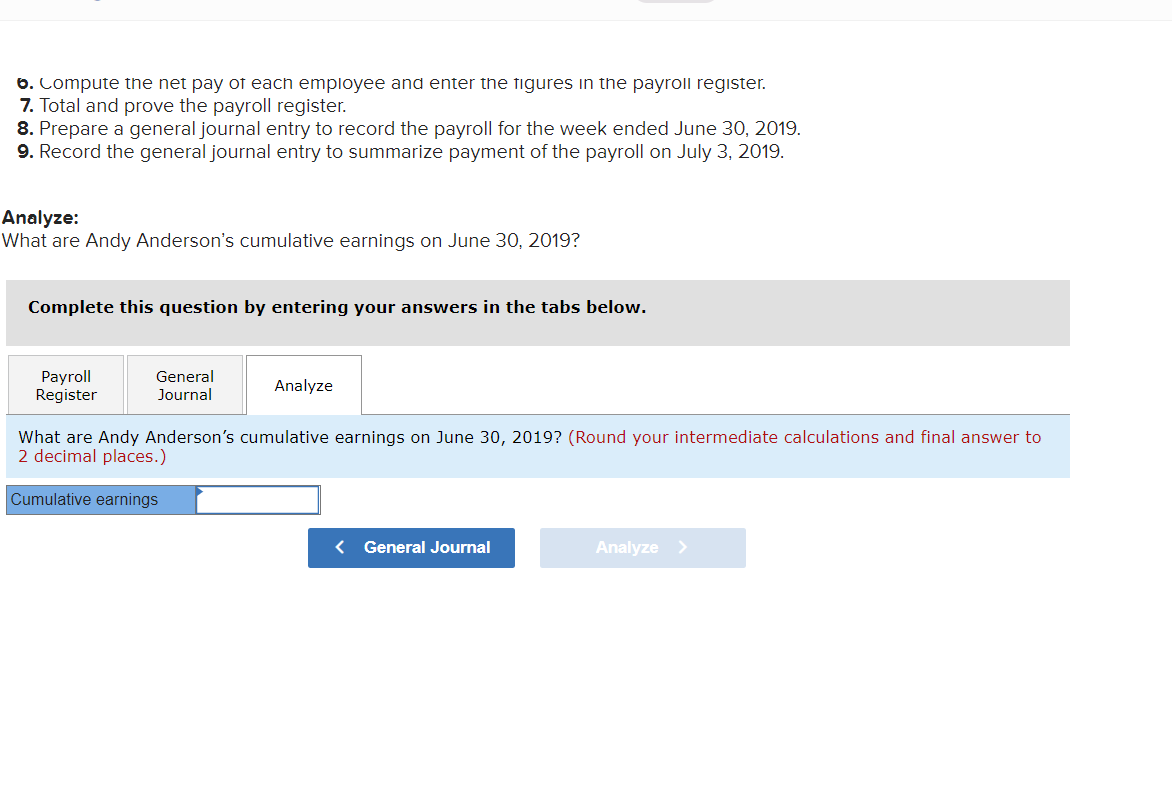

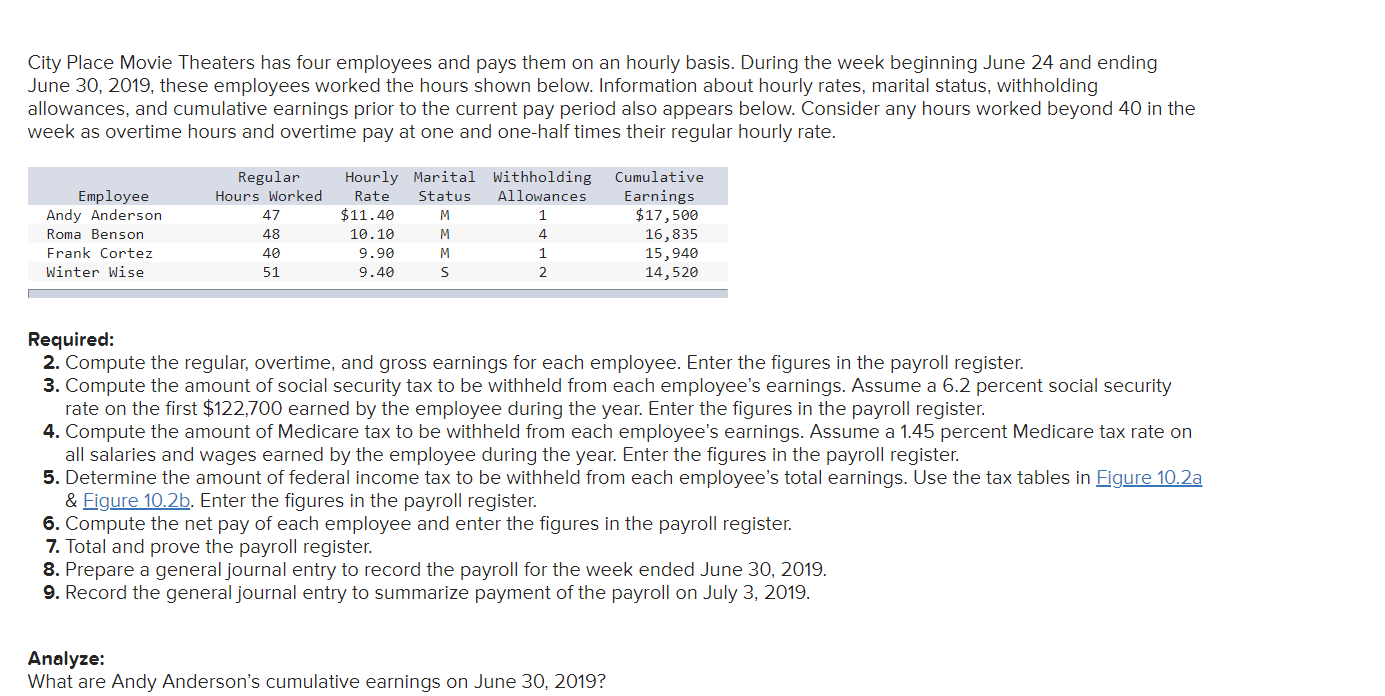

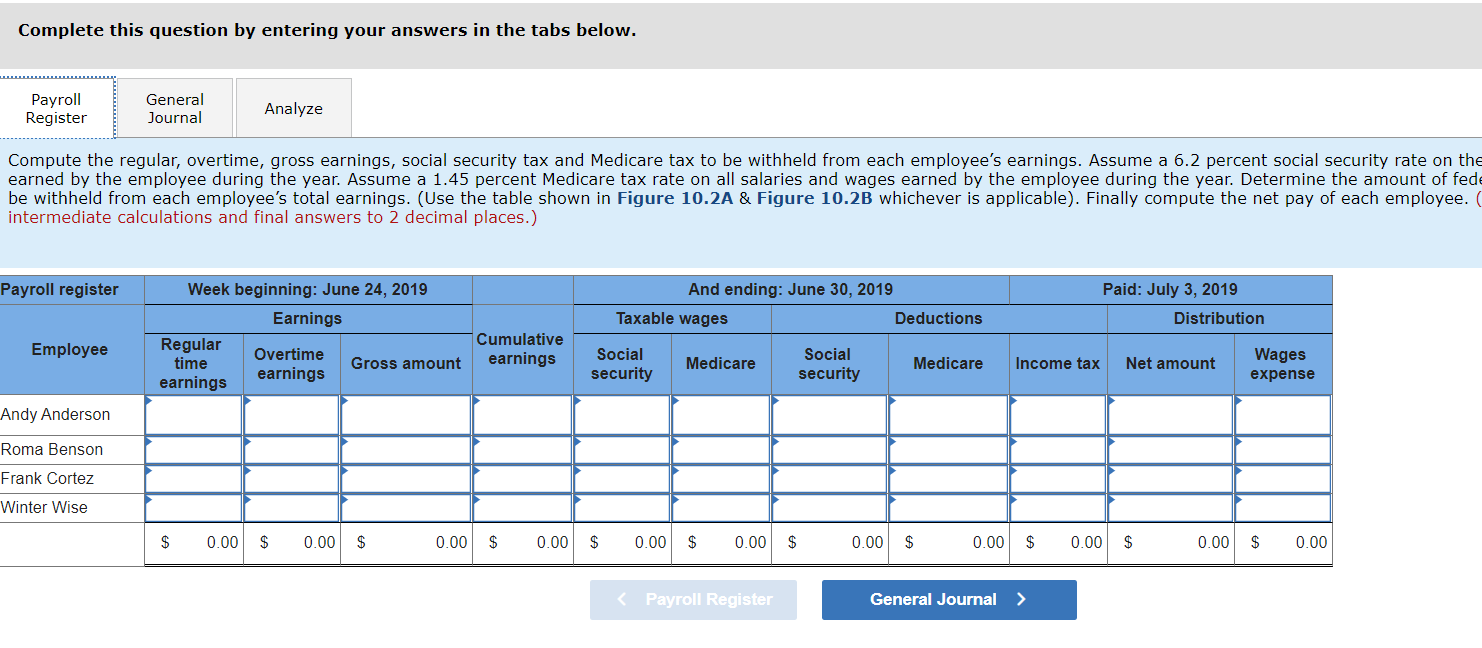

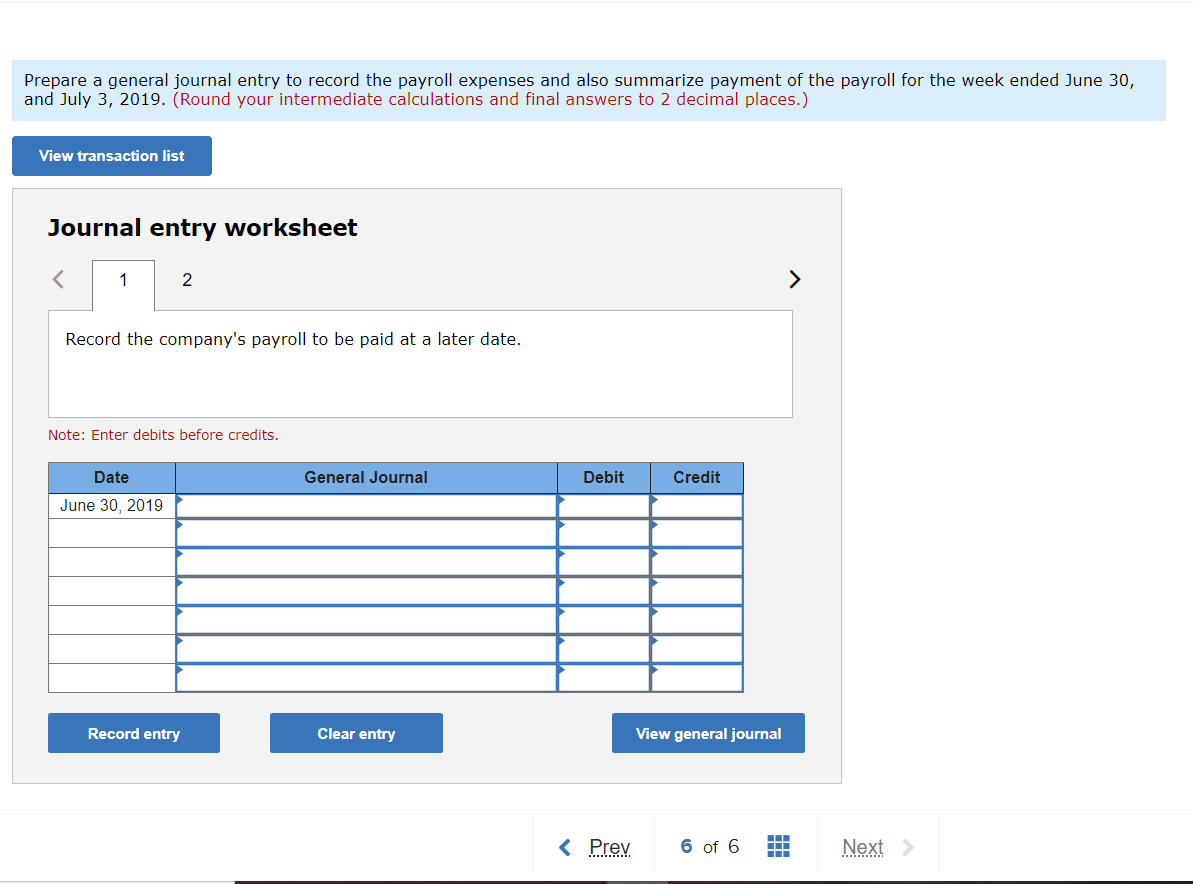

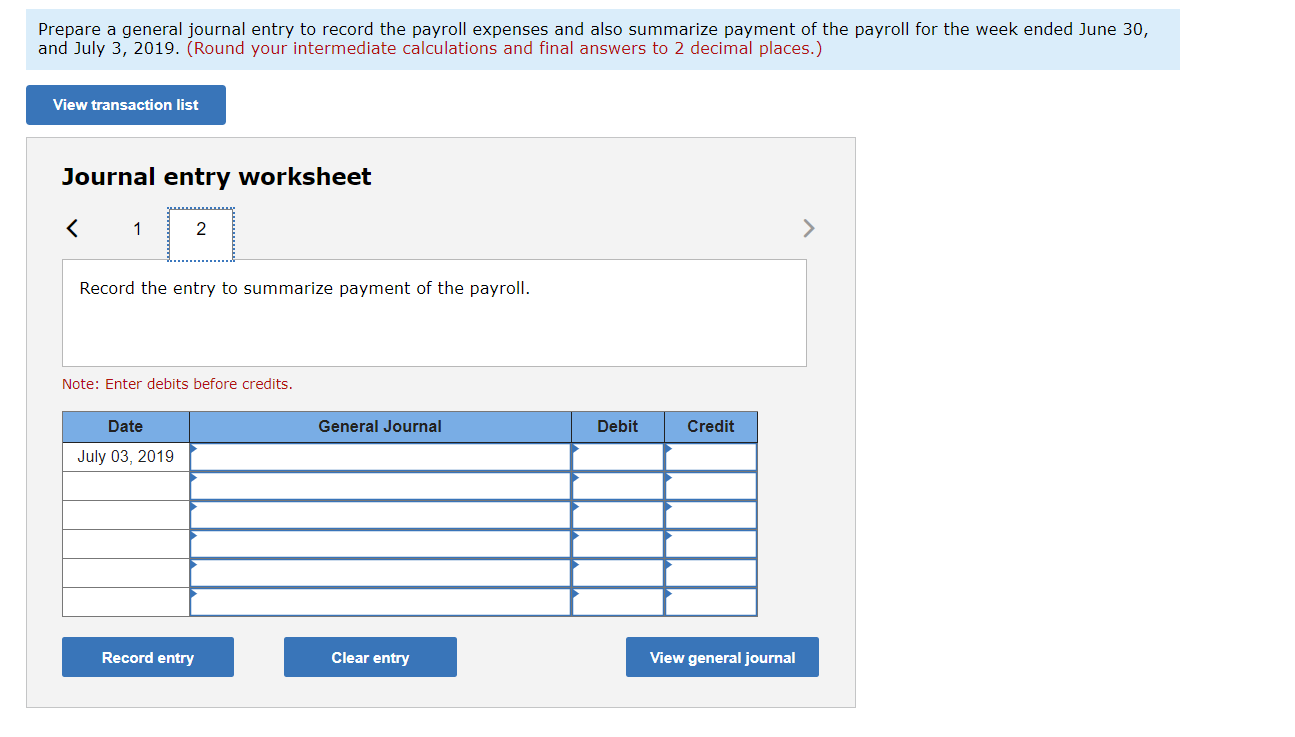

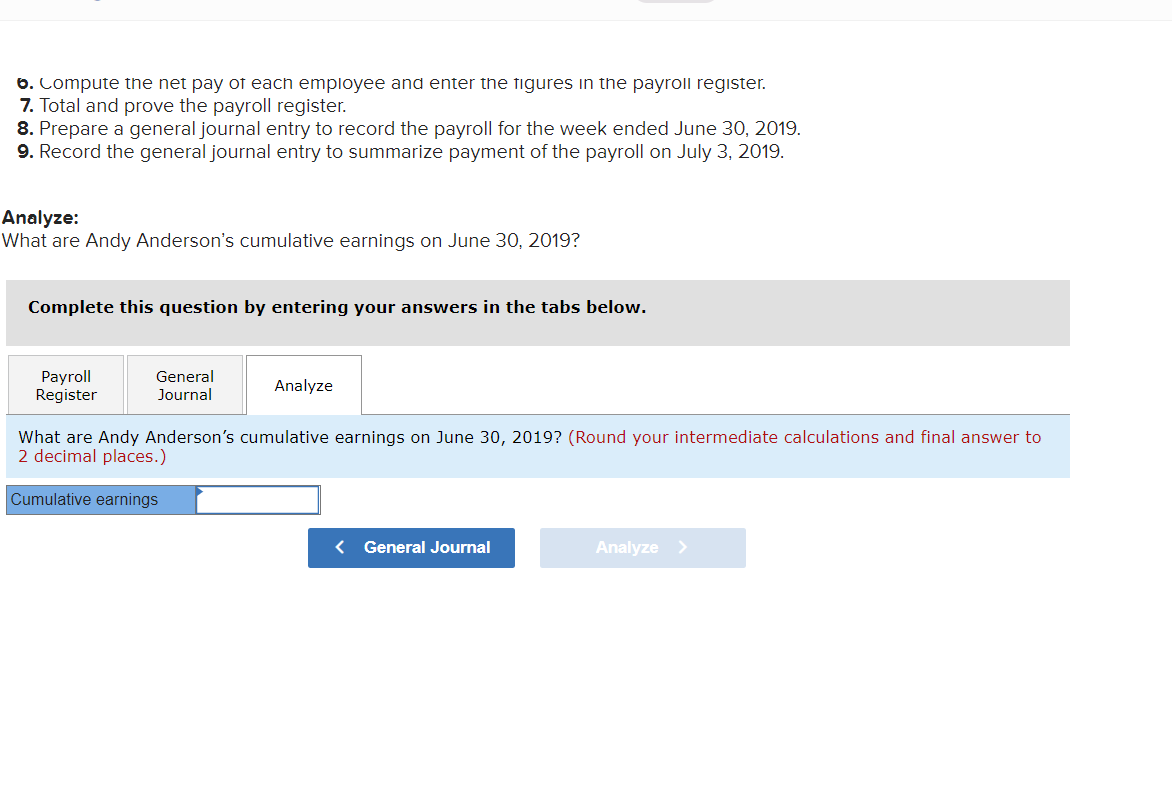

City Place Movie Theaters has four employees and pays them on an hourly basis. During the week beginning June 24 and ending June 30, 2019, these employees worked the hours shown below. Information about hourly rates, marital status, withholding allowances, and cumulative earnings prior to the current pay period also appears below. Consider any hours worked beyond 40 in the week as overtime hours and overtime pay at one and one half times thelt regular hourly rate. Employee Andy Anderson Roma Benson Frank Cortez Winter wise Retuar Hours Worked 42 48 10 51 Hourly Marital Withholding cumulative itate Status Allowances Earni $11.40 M $12,500 10.10 M 16,83 9.90 M 1 15,440 9.40 S 2 14,520 Required: 2. Compute the regular, overtime, and gross earnings for each employee. Enter the figures in the payroll register 3. Compute the amount of social security tax to be withheld from each employee's earnings. Assume a 6.2 percent social security rate on the first $122.700 earned by the employee during the year. Enter the figures in the payroll register. 4. Compute the amount of Medicare tax to be withheld from each employee's earnings. Assume a 1.45 percent Medicare tax rate on all salaries and wages earned by the employee during the year. Enter the figures in the payroll register. 5. Determine the amount of federal income tax to be withheld from each employee's total earnings. Use the tax tables In Elgure: 10.2a & Elgure 10.2b. Enter the figures in the payroll register 6. Compute the net pay of each employee and enter the figures in the payroll register. 7. Total and prove the payroll register 8. Prepare a general Journal entry to record the payroll for the week ended June 30, 2019. 9. Record the general Journal entry to summarize payment of the payroll on July 3, 2019. Payroll Register General Journal Analyze Compute the regular, overtime, gross earnings, social security tax and Medicare tax to be withheld from each employees earnings. Assume a 6.2 percent social carned by the employee during the year. Assume a 1.45 percent Medicare tax rate on all salaries and wages warned by the employee during the year. Determine the be withheld from each employee's total earnings. (Use the table shown in Figure 10.2A Figure 10.213 whichever is applicable). Finally compute the net pay of Payroll register Wook beginning June 24, 2010 Earnings Regular time Overtime Grous amount earnings earnings And ending June 30, 2019 Taxable wages Deductions Social Social Medicare Medicare Security Security Pald: July 3, 2018 Distribution Income tax Net amount Wapes Employee Cumulative earnings Andy Anderson Roma Benson Frank Cortez Winter Wise General Journal > Journal entry worksheet Prepare a general journal entry to record the payroll expenses and also summarize payment of the payroll for the week ended June 30, and July 3, 2019. (Round your intermediate calculations and final answers to 2 decimal places.) View transaction list Journal entry worksheet Record the company's payroll to be paid at a later date. Note: Enter debits before credits. Date General Journal Debit Credit June 30, 2019 Record entry Clear entry View general journal LI