Answered step by step

Verified Expert Solution

Question

1 Approved Answer

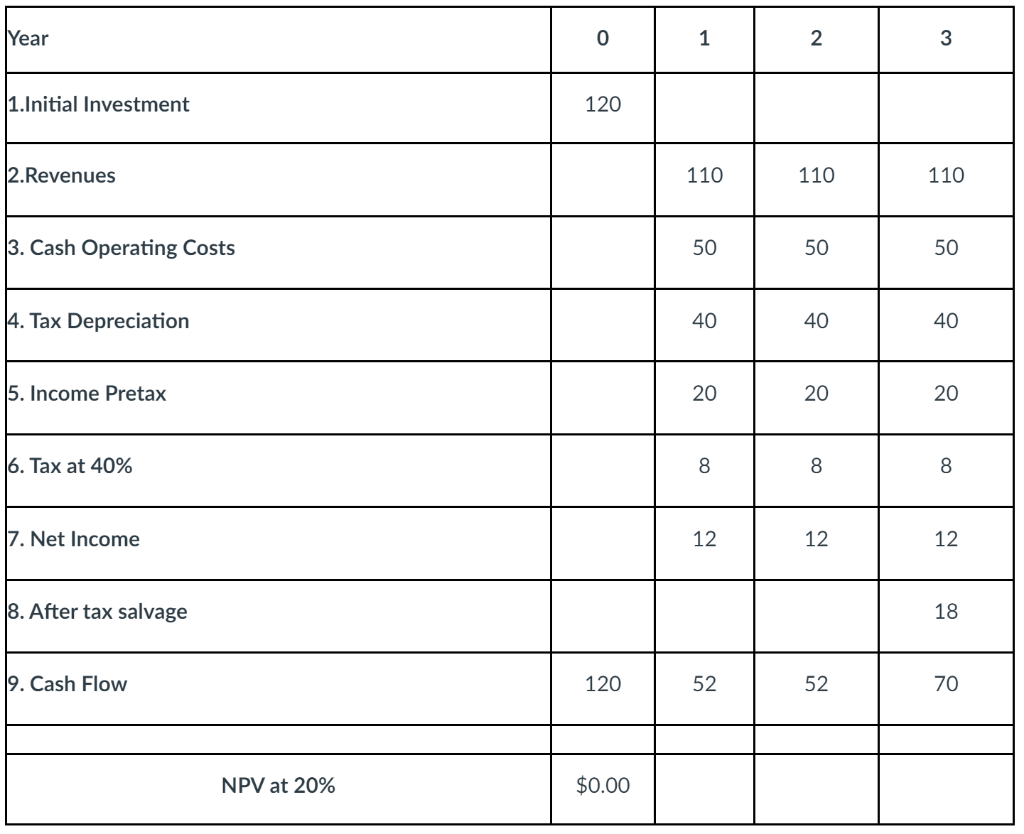

CK22 Ltd operates in a competitive business. Demand is steadily expanding, and new plants are constantly being opened. Expected cash flows from an investment in

CK22 Ltd operates in a competitive business. Demand is steadily expanding, and new plants are constantly being opened. Expected cash flows from an investment in a new plant are as follows:

Suppose that the government now changes tax depreciation to allow a 100% write-off in year 1. Existing plants must continue using the original tax depreciation schedule.

Assumptions:

- Tax depreciation is straight-line over three years.

- Pre-tax salvage value is 30 in year 3 and 60 if the asset is scrapped in year 2.

- Tax on salvage value is 40% of the difference between salvage value and depreciated investment.

- The cost of capital is 20% p.a. compounded annually.

- What is the value of existing one-year and two-year old plants?

- Would it make sense to scrap existing plants when they are two rather than three years old?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started