Question

Clancy Company uses activity-based costing to compute product costs for external reports. The company has three activity cost pools and applies overhead using predetermined

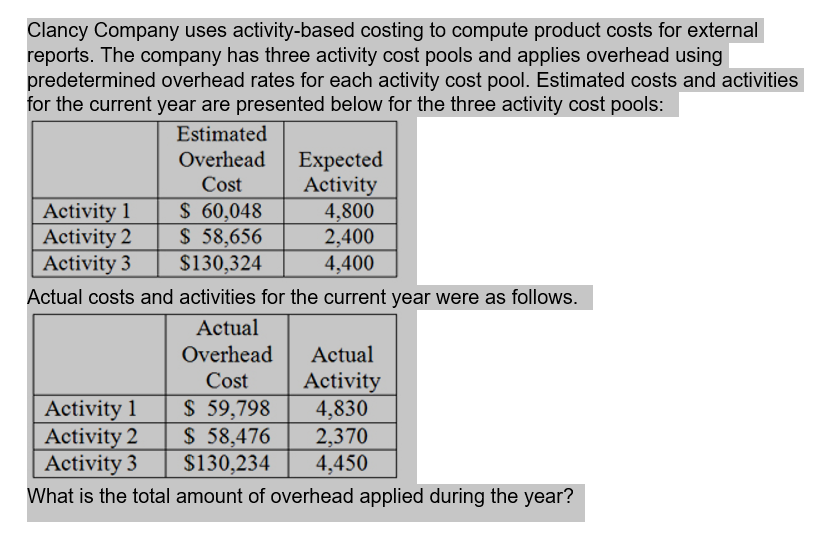

Clancy Company uses activity-based costing to compute product costs for external reports. The company has three activity cost pools and applies overhead using predetermined overhead rates for each activity cost pool. Estimated costs and activities for the current year are presented below for the three activity cost pools: Estimated Overhead Cost Expected Activity Activity 1 $ 60,048 4,800 Activity 2 $ 58,656 2,400 Activity 3 $130,324 4,400 Actual costs and activities for the current year were as follows. Actual Overhead Actual Cost Activity Activity 1 $ 59,798 4,830 Activity 2 $ 58,476 2,370 Activity 3 $130,234 4,450 What is the total amount of overhead applied during the year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management Accounting

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen

6th Edition

0077185536, 978-0077185534

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App