Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sanofi, one of the largest pharmaceutical companies in the world, does not capitalize most of its R&D costs because of regulatory uncertainties surrounding the

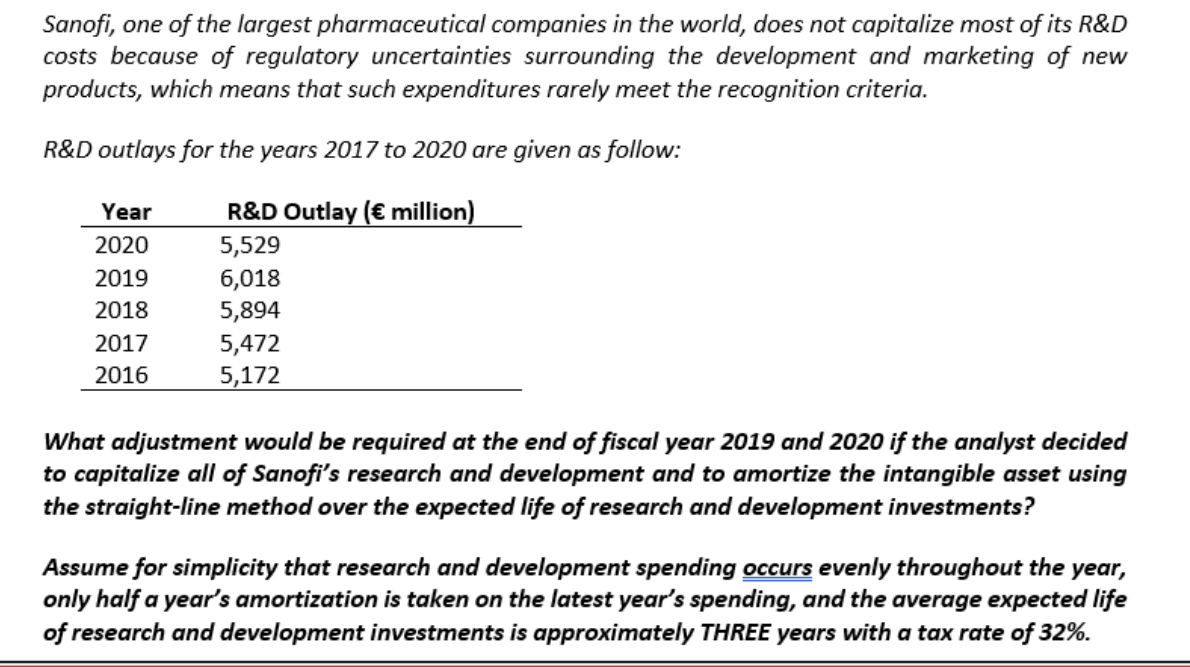

Sanofi, one of the largest pharmaceutical companies in the world, does not capitalize most of its R&D costs because of regulatory uncertainties surrounding the development and marketing of new products, which means that such expenditures rarely meet the recognition criteria. R&D outlays for the years 2017 to 2020 are given as follow: R&D Outlay ( million) Year 2020 5,529 2019 6,018 2018 5,894 2017 2016 5,472 5,172 What adjustment would be required at the end of fiscal year 2019 and 2020 if the analyst decided to capitalize all of Sanofi's research and development and to amortize the intangible asset using the straight-line method over the expected life of research and development investments? Assume for simplicity that research and development spending occurs evenly throughout the year, only half a year's amortization is taken on the latest year's spending, and the average expected life of research and development investments is approximately THREE years with a tax rate of 32%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started